Hanjin Cutting its Losses

Drewry’s weekly container insight report shows exits from the transatlantic and Asia-Black Sea trades demonstrate how Hanjin is prioritizing financial repair over global coverage.

Drewry said cash-strapped Hanjin Shipping has recently announced to its customers that it will be leaving two unprofitable trade lanes. The South Korean carrier will cease taking slots on the Asia‐Black Sea Express (ABX) service of China Shipping, Yang Ming and Wan Hai, and from April / May will pull out of the transatlantic market, where it operates one 4,367 teu ship (Hanjin Pheonix) on the CKYH Alliance and Evergreen TAE loop (dubbed NTA by Hanjin).

The exit will end nearly a decade of service in the transatlantic for Hanjin, having first entered the trade in early 1995. It is not yet known how its erstwhile partners will cover Hanjin’s departure.

While Hanjin’s involvement in both trades has only been marginal, the move is symptomatic of a carrier that has been forced to curb its ambitions for global port coverage by persistently weak financial performances.

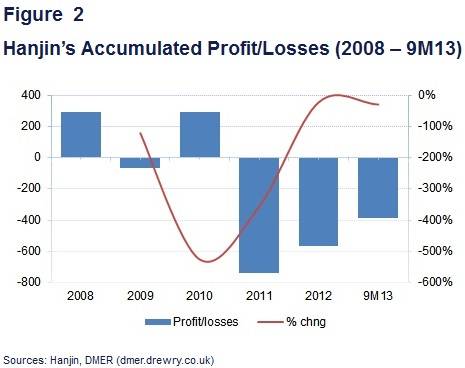

Hanjin’s CEO Kim Young Min recently resigned following a run of four consecutive quarterly losses in the container division totaling $239 million and the news that the company had to borrow KRW 150 billion ($141m) from sister company Korean Air to alleviate “temporary” liquidity problems.

Drewry Maritime Equity Research (DMER) last year identified Hanjin and its South Korean counterpart Hyundai Merchant Marine (HMM) as being particularly vulnerable as they have failed to generate enough cash flow to meet their operational needs and instead relied heavily on short term debt capital from the local markets.

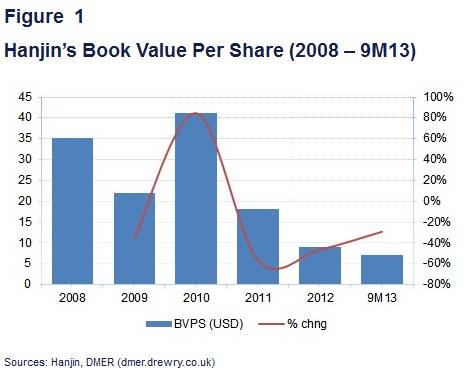

Since 2011 Hanjin has registered net losses every quarter until 3Q13, leading to a massive erosion in its book value and financial health. While its 9M13 net losses stood at KRW 432.8bn (USD 391mn) versus KRW 360.1bn (USD 316mn) in 9M12, its book value per share has declined 84% between 2008 and 9M13.

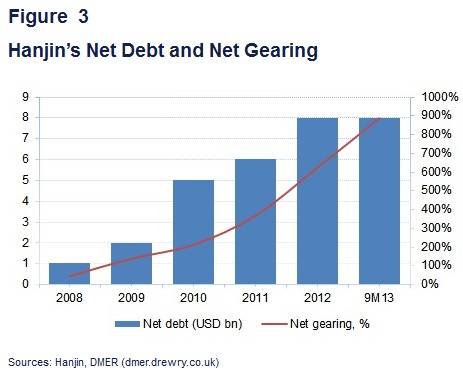

Sustained losses for more than two years accompanied by the burden to meet capital expenditure for fleet restructuring have taken a toll on Hanjin’s balance sheet. While Hanjin’s net debt has swelled from KRW 6.2tr (USD 5.7bn) in 1Q11 to KRW 8.2tr (USD 7.6bn) in 3Q13; its net debt to equity ratio has ballooned from 2.4x to 8.8x during the same period.

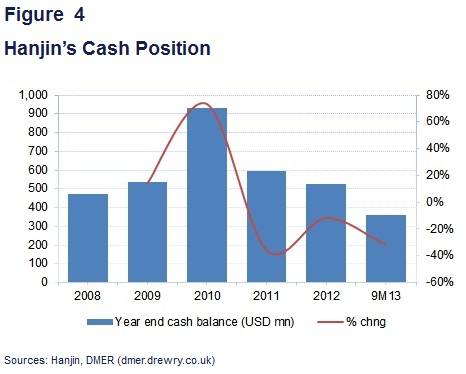

Hanjin’s cash balance, as evident from the chart below, declined from KRW 592bn (USD 470mn) in 2008 to KRW 382bn (USD 356mn) at the end of 9M13.

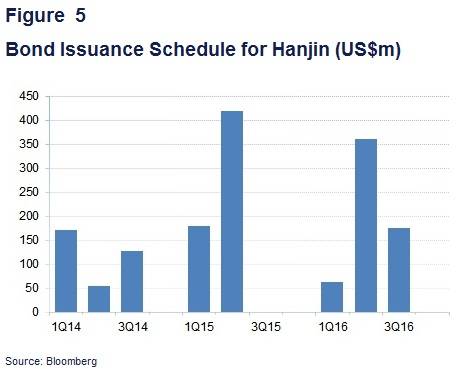

Hanjin plans to raise KRW 1.97tr partly from sale of assets and partly through loans. The amount raised will be used to repay loans. The company aims to repay KRW 1.25tr and KRW 1.08tr of loans in 2014 and 2015 respectively.

Korean Air, which is an affiliate of Hanjin Shipping, had to step in and made a commitment of providing KRW 100bn as financial aid to the group to ease its liquidity pressure which is in addition to KRW 150bn money paid in October. Korean Air is further willing to help Hanjin with a promise to buy KRW 400 bn of new shares that Hanjin plans to sell next year.

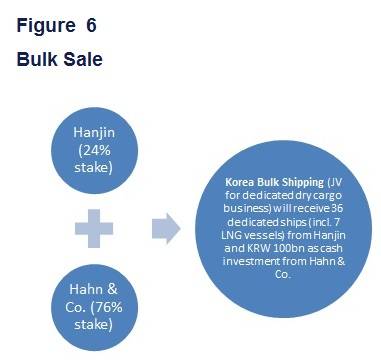

To avoid a liquidity crisis, Hanjin has been disposing of some of its assets including a partial sale of its bulk business through a new joint venture with Hahn & Company. The agreement will secure KRW 300bn of cash for Hanjin as well as transfer debts of KRW 1.4tr to the joint venture, enabling it to reduce its debt and improve balance sheets with this additional liquidity.

DMER believes that, with container shipping still grappling with challenges, Hanjin is likely to continue to post losses even this year, as the industry has yet to show any signs of recovery. In spite of the accelerating efforts to ease cash shortages, DMER remains skeptical about the turnaround prospects of Hanjin as overcapacity is likely to plague the industry for at least another two years, even if there is a gradual recovery.

According to Drewry, other financially troubled carriers will look to follow the example of Hanjin and pair back their networks, with their peripheral trades the first to go. Maintaining global market coverage is now something only the carriers with the deepest pockets can afford.

drewry.co.uk