ABS Launches Maritime Software Firm ABS Wavesight

As digitalization in the maritime sector gains speed, the American Bureau of Shipping (ABS) has launched a new maritime software as a service (SaaS) company called ABS Wavesight, to effectively consolidate all digital products under one roof, offering ship owners a one-stop-shop for it’s A-to-Z digital solutions.In an interview with Maritime Reporter's Greg Trauthwein, Paul Sells, the CEO and the president of the newly formed ABS Wavesight provided the rationale behind the ABS decision to launch the new company.He said: "...ABS has been for over 160 years…

Capital Ship Management Signs On to Deploy ABS' My Digital Fleet

ABS and Capital Ship Management (Capital) signed an agreement to deploy ABS’ digitalization and decarbonization platform in support of Capital’s sustainability strategy.ABS My Digital Fleet is a configurable risk management platform, designed to integrates data to provide AI-driven insights for driving sustainable operations and reducing operational risks. Environmental insights provide visibility into the impact of daily decisions on the vessel’s carbon footprint and allow for…

Capital Ship Management to Secure ABS Decarbonization Notations for Tanker Newbuilds

Capital Ship Management is to secure ABS notations recognizing investment in decarbonization technologies for its newbuild orders for medium range tankers—said to be an industry first.ABS said it developed the notations with Capital’s input during the company's program of new construction projects. The HVSC-Ready notation is for vessels equipped for High Voltage Shore Connection systems to be installed in the future, and the Wind-Assist Ready notation is for vessels equipped for wind-assist equipment to be installed on board.The notations, which can be applied to any vessel type, were developed to support industry decarbonization efforts…

Ammonia Fuel Cells for Deep-Sea Shipping: A Key Piece of the Zero-emissions Puzzle

Interest in ammonia-powered fuel cells for the maritime sector is growing, but stakeholders have been hesitant to commit to investments in large-scale systems. Now the ShipFC project is aiming to secure a place for ammonia in the future of deep-sea shipping.The project will equip the offshore supply vessel Viking Energy, owned and operated by Eidesvik and on contract to energy major Equinor, with a 2-megawatt (MW) ammonia fuel cell, allowing it to operate for at least 3,000 hours annually on clean fuel.

CSMC Uses SKF Equipment

The oceangoing vessel operator Capital Ship Management Corp (CSMC) used SKF equipment to control maintenance costs and avoid breakdowns.SKF’s marine condition monitoring kit is helping a leading ship operator to manage costs and prevent equipment failure across its fleet, said a press release.CSMC has been investigating condition monitoring strategies since 2006, in order to reduce the maintenance costs and minimize the unexpected machinery & equipment breakdown.Together with SKF, Capital came up with an effective strategy by utilizing a new handheld device, launched recently by SKF; the SKF Quick Collect. The company has implemented the solution across a fleet of 30 vessels, with a plan to extend the program for the whole fleet of 56 vessels.

CSMC Takes Delivery of M/T ‘Aitolos’

The Greek oceangoing vessel operator Capital Ship Management Corp. (CSMC) took successful delivery of the newbuilding vessel M/T ‘Aitolos’.The 115,000 dwt, eco-type crude oil tanker is built by Daehan Shipbuilding Co., Ltd, S.Korea, said a press note from the ship management services provider.M/T ‘Aitolos’ is the first of two sister ships to be delivered in 2020.Capital Group currently operates a fleet of 78 vessels including 48 tankers (10 VLCCs, 4 Suezmaxes, 7 Aframaxes, 26 MR/Handy product tankers and 1 small tanker), 5 modern bulk carriers, 18 container carriers and 7 LNG Carriers with a total dwt of 8.5 million tons approx.The fleet under management includes vessels of Nasdaq-listed Capital Product Partners L.P. and NYSE-listed Diamond S Shipping Inc.

Capital Liberty Acquires Two Vessels

Capital Liberty Invest, a joint venture between Greece’s Capital Ship Management, belonging to Evangelos Marinakis, and Germany’s Liberty One, has acquired its first two high specification feeder container vessels.The vessels which will come under the technical management of Liberty Blue in Leer, Germany, said a press release from Capital Ship Management Corp.The first of the two sister ships, ‘Ibrahim Dede’ (1,878 TEU), which was renamed ‘Asterix’, has been successfully taken over on January 21 in the port of Piraeus, Greece and subsequently delivered into charter to one of the world’s leading container operators.The takeover of the second vessel, ‘Cafer Dede’, is expected at the end of the first quarter of 2018.

Capital Ship Management, Liberty One Form JV

Capital Ship Management Corp. and Liberty One have announced the establishment of a joint venture under the name Capital Liberty Invest, taking aim at the German shipping market. The new entity will combine the forces, excellent track record and reputation of Capital and Liberty with the aim to provide commercial and technical ship operating platforms across different shipping segments and sizes in the German shipping market. The Joint Venture will seek growth opportunities in the container segment, ranging from feeder to Post-Panamax vessels, as well as in the crude and product tanker, dry bulk and multi-purpose vessels (MPP) segments. The Joint Venture commenced operations in January 2018 and is based out of the Liberty offices in Leer and headed by Liberty CEO, Dietrich Schulz.

ABS, Capital Ship Management Improve Propulsion Shaft Monitoring

ABS and Capital Ship Management Corp. (“Capital”), a distinguished ship management company, have collaborated to install an advanced condition monitoring system on the propulsion shafting of the Capital managed vessel M/T Agisilaos, a 36,700 dwt, Ice Class 1A IMO II/III Chemical/Product Tanker, built in 2006. The ABS Smart Bearing solution uses non-destructive testing sensors installed on the bearing pedestal and housing to measure and display the force exerted by the main propulsion shafting system onto the bearings, effectively converting the pedestal into a permanently installed weighing machine. “It was a pleasure working with Capital to develop the ABS Smart Bearing concept,” says ABS Chairman, President and CEO Christopher J. Wiernicki.

Jerry Kalogiratos New CEO for Capital Product Partners

Gerasimos (Jerry) Kalogiratos, the Partnership's current Chief Operating Officer and a director of the Partnership, will be appointed as the CEO and CFO effective June 30. Capital Product Partners has announced that Petros Christodoulou, who held the role of CEO and CFO, will leave the company as of the same day. Ioannis Lazaridis, Chairman of the Board of the Partnership, stated: "We thank Petros Christodoulou for his service to the Partnership and we wish him well in his future endeavors. We welcome Jerry Kalogiratos to lead the Partnership to its next phase. The Board and I have worked successfully with Jerry over the past eight years. Jerry has been involved in the day-to-day operations of the Partnership and in all its asset and financing transactions since the Partnership's 2007 IPO.

LNG-fuelled Ultra-Large Container Ships of the Future

Capital Ship Management Corporation is prioritizing a business strategy inspired by, and applying, the key principles and goals of the International Maritime Organization’s (IMO’s) Strategy for Sustainable Maritime Transport Systems. Capital is incorporating key 'imperatives' and 'goals', as defined by IMO in the company’s management systems across its operations. Capital has established a task force to implement specific actions, plans, processes and to develop systems addressing sustainability. Priority has been given to the promotion of a safety culture and environmental stewardship, as well as to the education, training and support of seafarers.

Drydocks World & Dubai Maritime City Participate In Posidonia

Drydocks World & Dubai Maritime City, the international service provider to the shipping, maritime, offshore, oil, gas and energy sectors, announced its participation in Posidonia from June 2-6, 2014, at Metropolitan Expo, Athens, Greece. The exhibition is one of the largest industry shows in Europe.Drydocks World & Maritime World has been a regular participant at the exhibition as it provides an unique access to Greek and international ship owners and buyers. According to His Excellency Khamis Juma Buamim, Chairman of Drydocks World & Maritime World, “We are really pleased to be back once again at Posidonia, an event that takes place every two years in which we participate on a very regular basis.

Latest Global Deep-Sea Shipbuilding Contract Round-Up

Far East shipbuilders scoop the pool of latest big ship newbuilding orders reports Clarkson Hellas in their latest Weekly S+P Bulletin. This week Clarkson Hellas say that Bocimar has announced an order for two firm 206,000 DWT Newcastlemax and one firm 180,000 DWT Capesize at Imabari, with delivery of all three vessels in 2016. Also at Imabari, Wisdom Marine announced an order for two firm 81,000 DWT Kamsarmax. Pricing is understood to be in the region USD 33-Millionper vessel with delivery in 2016.

Vessel Ordering Mania – Why?

The flood of interest in ordering new container vessels is motivated by other factors than supply and demand. The recent surge in new vessel orders at a time of industry-wide overcapacity suggests that market fundamentals are no longer the main driver. Even when the most recently ordered ships are delivered in 2016, Europe and the U.S. are still likely to be climbing out of recession, which means that capacity in the east-west trades will continue to outstrip demand. One of the factors behind the surge in orders is plummeting shipyard prices. Smaller carriers now see an opportunity to gain a competitive edge over the big three at last, and have not been slow to take advantage of it.

Latest Global Shipbuilding Orders

Rizhao Steel (Cara Shipping) are understood by Clarkson Hellas to have contracted two firm 180,000 DWT Capesize at both Dalian and Qingdao Beihai, with an additional two options at the latter. These orders are understood to have been concluded in the middle of this year, with delivery of the first vessel from Beihai lined up for 2015 and the remainder all due in 2016. Following a limited number of new orders so far this year, the VLCC orderbook, which currently stands at around 50 vessels, has seen the addition of two firm plus two option 300,000 DWT crude tankers from Metrostar at HHI. Although pricing remains undisclosed delivery of both firm vessels is planned for the first half of 2016.

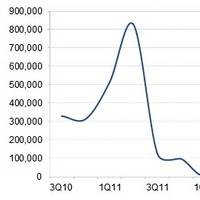

Vessel Ordering Mania – Why?

The flood of interest in ordering new container vessels is motivated by other factors than supply and demand. The recent surge in new vessel orders at a time of industry-wide overcapacity suggests that market fundamentals are no longer the main driver (see figure). Even when the most recently ordered ships are delivered in 2016, Europe and the US are still likely to be climbing out of recession, which means that capacity in the east-west trades will continue to outstrip demand. One of the factors behind the surge in orders is plummeting shipyard prices.