Hapag-Lloyd Secures 'Green Financing' for LNG-powered Newbuilds

German shipping company Hapag-Lloyd has joined the shift to green financing, securing funds for six liquefied natural gas (LNG) powered, 23,500 TEU containerships it ordered in December 2020.The firm said it concluded two transactions according to the Green Loan Principles of the Loan Market Association (LMA), as verified by independent secondary party DNV GL, as the shipping industry increasingly turns toward financing linked to measurable sustainability targets."Our first green financings are a major milestone for us…

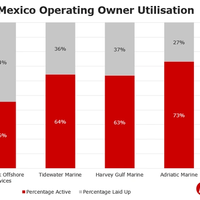

BY THE NUMBERS: the OSV Markets

US Offshore Support Vessel Analysis 2018 and 2019. The US GOM Offshore Support Vessel (OSV) market is suffering, utilization remains poor, and many owners are still squeezed financially. However, a poor market forces people to adapt and for those willing to take risks, the upside can be extremely large.US Owners 2018 vs. 2019: Within the US GOM, 2018 saw a period of strategic thinking and tactical business decisions. Tidewater Marine completed their merger with GulfMark Offshore to create the world’s largest OSV player.

BP’s LNG Carrier Fleet is Growing

BP said it will take delivery of six new, state-of-the-art liquefied natural gas (LNG) tankers in 2018 and 2019 to support its expanding global LNG portfolio. BP’s finance partners KMarin and ICBC Leasing are investing more than $1 billion in the tankers. The vessels will join BP’s exixting fleet to help service a 20-year liquefaction contract with the Freeport LNG facility in Texas, as well as other international LNG projects in BP’s global portfolio. “These vessels will significantly increase BP’s ability to safely transport LNG to anywhere in the world, directly supporting BP’s global natural gas strategy,” said BP Shipping CEO Susan Dio. The new ships are designed to be about 25 percent more fuel efficient than their predecessors, BP said.

Windea Leibniz Delivered to Bernhard Schulte

The newly built wind farm service vessel Windea Leibniz was delivered from Ulstein Verft to Bernhard Schulte Offshore and ICBC Leasing on February 28, and named March 2 at a ceremony in Ulsteinvik, Norway. Beginning in April, the vessel will work at the Sandbank wind farm in the German Bight for Siemens Wind Power Service to help ensure energy production from the site’s 72 wind turbines. Windea Leibniz is the second wind farm service vessel in a series for Hamburg based shipping company Bernhard Schulte and the Beijing based financial company ICBC Leasing…

Windea La Cour Goes to Work

Two years on from the launch of the Ulstein Group’s X-STERN design at the ONS 2014 maritime exhibition in Stavanger, the first vessel to feature the innovative hull line has entered service at the Gemini offshore wind farm. The newly built Windea La Cour incorporates the X-STERN: a pointed stern instead of a conventional transom stern, offering increased comfort and flexibility due to reduced vibrations and slamming, according to Ulstein. These are key assets for the Norwegian-designed and -built vessel…

Yangzijiang Bags Orders for Six VLOCs

China’s biggest private shipbuilder Yangzijiang Shipbuilding Holdings Ltd has won orders for six dry bulk carriers worth a combined US$510 million. The 400,000 DWT very large ore carriers (VLOCs) are the largest dry bulk carriers ever awarded to the group, the shipbuilder announced on Wednesday (April 13). The six vessels will also be the largest VLOCs that Yangzijiang will be building till date. The VLOCs are scheduled for delivery from 2018 to 2019. The orders were placed by ICBC Leasing, "marking a rare case where a state-owned ship owner in China places orders with a private shipyard", the company added. ICBC Leasing is a wholly owned subsidiary of ICBC, China’s biggest state-owned bank.

Chinese Shippers Order for 30 Valemax Vessels

The Chinese shipping companies - Chinese shipping majors Cosco Group, China Merchants Group and ICBC Financial Leasing Co- ordered 30 Valemaxes worth a combined $2.5 billion for delivery starting from 2018, deployed on Brazil-China trade routes, reports WSJ. The vessels will bosst the trade between China and Brazil and also will invest billions of dollars into delaying shipbuilding industry in the country. The vessel will be employed on Brazil-China trade routes, boosting the import of Vale iron ore in China. Sources said the three state-controlled shipping companies ordered 10 ships each from four local yards—Shanghai Waigaoqiao Shipbuilding, Beihai Shipbuilding, CIC Jiangsu and Yangzijiang Shipbuilding—with deliveries scheduled to begin in 2018.

Jaccar Inks Gas Carrier Financing Deal with ICBC leasing

JACCAR Holdings informed that Mr. Li Keqiang – Prime Minister of the People’s Republic of China - during his recent state visit to France signed Memorandam of Understanding with Mr. Manuel Valls, Prime Minister of France , for a 900 M$ financing of gas carriers with ICBC leasing. Jacques de Chateauvieux, as Chairman and CEO of Cana Tera and JACCAR Holdings declared “we are extremely honored to benefit from the trust of ICBC Leasing for the second time following the BOURBON sale and bare boat charter for 10 years of 46 offshore vessels completed last year. This will strengthen our ability to engineer and contract innovative vessels in China whilst benefitting from local financing as well”.

Bourbon Plans Transformation Project

Bourbon is rolling out a transformation plan for its future growth. As part of its “Transforming for Beyond” project, Bourbon has decided to sell vessels worth $2.5 billion from its fleet and retain the vessels on bareboat charter for a period of 10 years. The terms of a first phase of the financial aspect of “Transforming for Beyond” was signed off on April 9th with the Chinese company ICBC Financial Leasing for up to 51 supply vessels either in operation (24) or under construction (27 with delivery within 14 months) for a total of up to $1.5 billion. The transaction will be closed within two months of its signing following completion of each party procedures. -right of first refusal in the event of ICBC Financial Leasing selling vessels during lease period.