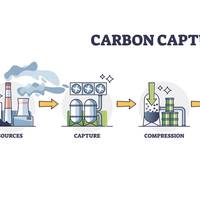

Carbon Capture Chasm Exposed at Climate Summit

Carbon capture and storage has emerged as flashpoint at the UN climate conference in Dubai about how big a role it is destined to play in reaching the target of net zero emissions.It has also prompted an unusual and bad-tempered confrontation between senior officials at the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC).In the run up to the conference, the IEA called on oil and gas producers to let go of "the illusion that implausibly…

Global Container Freight Still Stalled

Global industrial production and containerised freight flows remained in the doldrums at the start of the third quarter, confounding predictions earlier in the year for a strong rebound.Manufacturers and distributors in North America and Europe were struggling to reduce excess inventories after the post-pandemic rotation from goods to services spending.Rising interest rates and a cost-of-living squeeze have also dampened expenditure on expensive long-lived durable items.Global industrial output was up by less than 1% in the second quarter of 2023 from the same period in 2022…

Global Container Freight Stuck in Doldrums

Global trade remained in the doldrums during the second quarter as China’s post-lockdown rebound proved slower than expected and was offset by continued weakness in North America and Europe.Seasonally-adjusted trade volumes were no higher in the three months from February to April 2023 than they had been 17 months earlier in the three months from September to November 2021.Volumes were down in three of the first four months of 2023 compared with a year earlier, according to the Netherlands Bureau of Economic Policy Analysis (“World trade monitor”…

Global Freight Cycle May Have Reached Lowest Point

Global freight volumes show signs of having bottomed out in the first quarter, signalling the industrial cycle may be near its trough, which could provide some support to oil prices later in 2023.Global freight volumes fell 1.1% during the first three months of 2023 compared with a year earlier, according to the Netherlands Bureau of Economic Policy Analysis (“World trade monitor”, CPB, May 25).But volumes were up by 0.2% in March compared with the prior year, after declining 2.5% in February and 1.2% in January…

Global Freight Shows Signs of Bottoming Out

Global freight volumes fell at some of the fastest rates for three decades earlier this year, but at the end of the first quarter showed signs of bottoming out.Volumes were down by -2.1% between December and February compared with the same period a year earlier, according to the Netherlands Bureau of Economic Policy Analysis (“World trade monitor”, CPB, April 25).The rate of decline was in the 8th percentile for all overlapping three-month periods since 1992; volumes have only fallen this fast during the last three recessions in 2020…

Global Freight Slump Deepens At the Start of 2023

Global freight movements continued to dwindle in the first two months of 2023 as manufacturers and distributors struggled to reduce excess inventories and cope with rising interest rates and increased caution among buyers.Container flows fell further in January and February compared with the same months a year earlier, showing the inventory-liquidation cycle was not over yet:Singapore’s seaborne container shipments were down 6% in February compared with a year earlier, one of the steepest falls since the first wave of the pandemic.Japan’s air cargo through Narita airport…

Diesel Consumption to Fall with US Manufacturing Downturn

U.S. manufacturers reported business activity declined for the second month running in December and the sector appears to be on the leading edge of a recession. The slowdown in manufacturing and freight has already dampened consumption of diesel and other distillate fuel oils, and consumption is likely to fall if the manufacturing downturn deepens.The Institute for Supply Management’s manufacturing activity index fell to 48.4 in December (19th percentile for all months since 1980)…

US Container Freight is Shrinking

Container freight volumes at the largest U.S. ports were down 3.8% in September compared with the same month a year earlier, confirming the slackening of merchandise trade and downturn in the business cycle.The ports of New York-New Jersey, Los Angeles, Long Beach, Savannah, Houston, Norfolk, Charleston, Seattle and Oakland account for the overwhelming majority of container ocean freight into and out of the United States.The total volume of loaded containers handled by these nine ports amounted to 2.67 million twenty-foot equivalent units (TEUs) in September 2022…

Fuel Market Calm ahead of IMO Changeover

Fears about a shortage of diesel and other middle distillates stemming from new marine pollution regulations have receded, with distillate premiums falling to some of the lowest levels for two years.From the start of 2020, ocean-going ships will be required to use low-sulphur fuels or employ exhaust gas cleaning systems, known has scrubbers, under pollution control rules approved by the International Maritime Organization (IMO).Fuel traders and shipowners have warned for several…

Diesel Traders See Shortage, but not yet

Gasoil traders expect the middle distillates market to stay well supplied until almost the end of 2019 before swinging into deficit with the introduction of new maritime fuel regulations.Calendar spreads for low-sulphur gasoil delivered to Europe's Amsterdam-Rotterdam-Antwerp hub are currently in contango through until October before shifting to backwardation from November onwards (https://tmsnrt.rs/2WgXabR).In futures markets, contango structures, where future contract prices are higher than front-month prices, are associated with expectations of adequate or rising inventories.

Fund Buying Slows on Crude

Hedge funds added more bullish positions in crude at the start of February but at a much slower pace than before, as optimism about OPEC output cuts was tempered by renewed anxiety about the U.S.-China trade talks.Hedge funds and other money managers increased their net long position in Brent crude futures and options for the eighth time in the last nine weeks but by just 1 million barrels.Fund managers added new short positions (+13 million barrels) for the week ended Feb. 5…

Maritime Rule Change Stirs Fears of Diesel Shortage: Kemp

The International Maritime Organization (IMO) has so far resisted pressure to soften or postpone the implementation of new regulations requiring ships to use bunker fuels with a lower sulphur content from the start of 2020.That has prompted warnings from some analysts that the regulations will squeeze the availability of low-sulphur diesel and jet kerosene required by trucks, trains, aircraft, farmers and industry, resulting in big price increases.The regulations and any associated rise in fuel prices will occur in the run up to the next U.S.

Freight Fuel Market Moves Back Towards Balance: Kemp

The market for freight fuels is moving close to balance, after tightening significantly in 2017 and the first quarter of 2018, contributing to the recent stabilisation in crude oil prices.OECD stocks of middle distillate fuels, including road diesel, marine gasoil and jet fuel, totalled 513 million barrels at the end of June, according to the International Energy Agency (“Oil Market Report”, August 2018).Stocks have fallen compared with the slump years of 2015-2017 (when they…

White House Escalates China Trade Dispute in hopes for Early Solution: Kemp

The United States has adopted an "escalate to negotiate" strategy towards China, threatening a dramatic hike in tariffs to try to force a resumption of trade talks while the U.S. economy remains strong and as elections approach in November.U.S. President Donald Trump has reportedly rejected a plan to levy tariffs of 10 percent on an additional $200 billion of imports from China and ordered aides to prepare a proposal for tariffs at the higher rate of 25 percent.The levies are in addition to the tariffs on $34 billion of imports that have already gone into effect and the $16 billion of tariffs announced but not yet implemented.The administration's approach to China is the same one it has employed in dealing with North Korea…

Sanctions spell the end of OPEC output deal

President Donald Trump’s decision to withdraw from the nuclear agreement with Iran marks the end of the current output agreement between OPEC and its allies.OPEC is likely to insist the current agreement remains in effect, at least for now, but the prospective removal of several hundred thousand barrels per day of Iranian exports from the market will require a major adjustment.Saudi Arabia has already promised to "mitigate" the impact of any potential supply shortages, in conjunction with other suppliers and consumer countries…

Fast-growing Global Trade Boosts Fuel Demand

Freight movements in the United States and around the rest of the world are growing at some of the fastest rates this decade, which should provide a big boost for diesel consumption in 2018. In the United States, the volume of freight moved by road, rail, pipeline, barge and air between September and November was around 6 percent higher than in the same period a year earlier. Freight volumes are growing at some of the fastest rates since 2011, according to the freight transportation services index compiled by the U.S. Bureau of Transportation Statistics (http://tmsnrt.rs/2DB9aLY). Freight movements are being driven by an increase in coal deliveries to power plants, as well as increases in oil and gas drilling. U.S.

Hedging Energy Bets: The Case for a 2018 Oil Bull Run

Hedge funds gamble OPEC will tighten oil market too much. Hedge funds are the most bullish about oil prices in years, expecting further gains even as prices touch multi-year highs and ignoring the risk linked to such a large concentration of positions. A record net long position has been accumulated by hedge funds and other money managers, amounting to 1,183 million barrels in the five biggest futures and options contracts covering crude, gasoline and heating oil. Portfolio managers held a record 1,328 million barrels of long positions in Brent, WTI, U.S. gasoline and U.S. heating oil on Dec.

Global Trade Surge Fuel Oil Markets

Global trade is growing at the fastest rate for six years - which is both a symptom and a cause of the recovery in commodity markets. World trade volumes were up almost 5 percent year-on-year from May to July, according to estimates compiled by government economic planners in the Netherlands. Growth was four times faster than at the same point in 2016 (http://tmsnrt.rs/2y89NxC). Global trade and commodity markets are linked in a circular causal relationship, which is one of the most important in the macroeconomy and a key source of fluctuations in the business cycle. Commodities, from grains to minerals, metals and oil, are the largest item in global trade by tonnage, so the state of commodity markets has a major impact on world trade flows.

Hedge Funds Watch U.S. Refinery Restarts

Hedge funds are betting crude oil stocks will adjust quickly to the aftermath of Hurricanes Harvey and Irma but gasoline and distillate inventories may take more time to normalise. Hedge funds and other money managers increased their combined net long position in the five major petroleum contracts linked to crude, gasoline and heating oil by 46 million barrels in the week to Sept. 5, according to the latest regulatory and exchange data. Fund managers recovered some of their pre-hurricane bullishness after cutting net long positions in the petroleum complex by a total of 116 million barrels over the previous two weeks (http://tmsnrt.rs/2jhR0sX).

US Oil Drillers Cut Rigs for First Week since January

U.S. oil drillers cut rigs this week for the first time since January and the pace of additions slowed this quarter due to declines in crude prices despite an OPEC-led effort to cut production and end a multi-year supply glut. Analysts, however, noted the weekly decline in the rig count was likely just a brief pause in a drilling recovery expected to continue through at least 2019. Drillers cut two oil rigs in the week to June 30, bringing the total rig count down to 756, still more than double the 341 rigs in the same week a year ago…

El Nino Signal is Weakening in the Pacific

The probability of El Nino, a warming of ocean surface temperatures in the eastern and central Pacific, developing this year has been downgraded by U.S. government forecasters as sea surface temperatures and wind speeds in the area remain close to their long-term averages. The Pacific saw a relatively rapid swing in late October from La Nina conditions - characterised as unusually cold temperatures in the equatorial Pacific Ocean - to neutral or even slightly El Nino-leaning conditions by March. Since then, however, the oceanic and atmospheric signals pointing to a possible El Nino have all weakened. The U.S. National Oceanic and Atmospheric Administration (NOAA) last week downgraded the probability of El Nino conditions being present in the fourth quarter of 2017, to just 36 percent.

U.S. Natural Gas Prices Tumble as Coal Surges

U.S. natural gas prices have tumbled by more than 10 percent since late May as hedge funds start to liquidate a near-record bullish position accumulated in the expectation of a tighter market that failed to materialise. Hedge funds and other money managers reduced their combined net long position in the two main futures and options contracts linked to Henry Hub prices by 584 billion cubic feet in the week to May 30. Fund managers reduced their net long position by the largest amount in any one week since November 2016, after raising it by a cumulative 1,721 bcf during the previous 12 weeks. Prior to the selloff, hedge fund managers held a record ratio of 5 long positions for every 1 short position, a warning sign that their position had become overstretched and was at risk from a reversal.

U.S. Freight Recovery Spurs Diesel Demand

U.S. freight movements have started increasing again, which should help boost consumption of distillate fuel oil in 2017 and 2018. The tonnage of freight moved by road, rail, barge, pipeline and air cargo has been increasing year on year since October, after stagnating for much of 2015/16 (http://tmsnrt.rs/2qSDLAJ). Freight movements hit a new record in February, before slipping slightly in March, according to the U.S. Bureau of Transportation Statistics (http://tmsnrt.rs/2rTVx58). Most freight is hauled by equipment that uses diesel engines, or jet turbines in the case of air cargo. Freight is therefore the main driver for consumption of fuels refined from the middle of the crude oil barrel, including distillate fuel oil and jet fuel. The U.S.