US Appeals Court Scraps Sempra's Port Arthur LNG Emissions Permit

A U.S. court has removed an emissions permit for Sempra's Port Arthur LNG export terminal in Texas, potentially halting construction of the facility.In its decision, the U.S. Court of Appeals for the Fifth Circuit on Tuesday found that the Texas Commission on Environmental Quality (TCEQ) failed to impose the same emissions limits on the Port Arthur plant as on other projects, including the Rio Grande LNG project which is now under construction.The approximately 13.5 million-metric…

U.S. Navy Shipbuilders & Disaggregated, Dispersed Production

With a lame-duck CNO, a divided Congress and the impending launch of the next Presidential election cycle, America’s naval market is locked into something of a fragile and fearful autopilot, cruising inexorably towards whatever excitement 2024 might bring.Materially, don’t expect much change: The demand for naval platforms will continue to outstrip available funding, meaning there will be little movement or growth in America’s major shipbuilding programs of record. The procurement outlines are already set.

Sempra Reaches FID on Port Arthur LNG Plant's Phase 1

U.S. power and gas utility Sempra Energy said on Monday the first phase of its proposed Port Arthur liquefied natural gas (LNG) export terminal received the financial greenlight to move ahead with investment firm KKR & Co agreeing to a minority stake in the project.Though KKR's investment was not disclosed, an infrastructure fund managed by it will buy a 25% to 49% indirect, non-controlling interest in the project. Sempra Infrastructure Partners, the 70%-owned unit of Sempra, would target 20% to 30% of indirect ownership interest in the project…

NAT Adds Two Suezmax Newbuilds

Nordic American Tankers said it has added two suezmax tankers to its fleet. The newbuilds, NAT's first delivered since 2018, both have long term contracts.The 157,094 dwt Nordic Harrier was delivered on May 13 from Samsung shipyard in South Korea. The second vessel, to be named Nordic Hunter, is 156,800 dwt and will be delivered from Samsung within the next few days, NAT said. The ships were ordered in 2020.Both tankers have six-year contracts with Oman's ASYAD Shipping Company. The time charters will generate an aggregate revenue of more than $100 million, New York-listed NAT said when it announced the deals in February.The newbuilds are fully financed via Ocean Yield, a company controlled by Kohlberg Kravis Roberts (KKR), which is headquartered in the U.S.

KKR to Buy Norway's Ocean Yield for $829M

U.S.

NAVTOR Acquires Tres Solutions

NAVTOR continues to evolve its eNavigation solutions with the acquisition announced today of Tres Solutions, a 5-year-old Houston-based tech start up that specializes maritime software and analytics, a natural fit for NAVTOR as it pushes to expand its role in the global fleet’s vessel analytics and performance optimization. Financial specifics of the acquisition were not made available.“We (explored) the market and we ended up with Tres Solutions, the very best in the market,” said Tor Svanes…

Quark Expeditions Holds Keel-Laying Ceremony

Quark Expeditions, a leader in polar adventures, held the keel-laying ceremony for its pioneering new ship Ultramarine on August 2, officially kicking off the next stage in the ship’s construction: the build of its hull and superstructure.Held at Brodosplit, the largest shipyard in Croatia, the event was attended by a mix of senior staff from Brodosplit, its parent company DIV Group, Quark Expeditions, its parent company Travelopia, and private equity investors KKR. Speeches were given by Joerg Metzner…

Adnoc Signs USD4bln Pipeline Deal

Abu Dhabi State-Owned Oil Company Adnoc has sealed a $4 billion midstream pipeline infrastructure deal with BlackRock, the world's largest asset manager, and private equity firm KKR & Co.The Middle East national oil company said that the transaction includes the creation of Adnoc Oil Pipelines, which will lease Adnoc's interest in 18 pipelines and give rights to transport crude and condensates from Adnoc's onshore and offshore concessions over 23 years.BlackRock and KKR will form a consortium to hold a 40% stake in Adnoc Oil Pipelines, while Adnoc Infrastructure, a fully-owned Adnoc subsidiary, will retain the remaining 60%. Adnoc estimated its proceeds at about $4 billion. Sovereignty over the pipelines and management of pipeline operations remain with Adnoc.

DFDS to Buy U.N. Ro-Ro in $1.2 Bln Deal

Danish shipping and logistics company DFDS has agreed to buy Turkish freight shipping operator U.N. Ro-Ro from Turkish private equity firms Actera Group and Esas Holdings for 950 million euros ($1.17 billion) on a debt-free basis. It marks a change of course for the Turkish company, which had planned an initial public offering for up to 57.7 percent of the company, a draft prospectus showed last month. U.N. Ro-Ro operates five freight shipping routes between Turkey, Italy and France. DFDS said U.N.

Chembulk Tankers Issues USD 200mln Bond

Chembulk Tankers announced that one of its wholly owned subsidiaries, Chembulk Holding LLC, has priced USD 200 million in senior secured bonds which will carry a coupon of 8.00% and be due in February 2023. The net proceeds from the bond offering will be used for refinancing of existing bank debt and general corporate purposes. In addition, this bond offering contains a tap issuance feature, where Chembulk can expand the issue amount at a future date to a maximum of USD 250 million, subject to standard issuance tests. DNB Markets acted as bookrunner in connection with the placement of the new bond issue, and KKR Capital Markets acted as financial advisor. An application will be made for the bonds to be listed on Oslo Børs.

Crystal Nordic Sold to Essberger Tankers

Nordic Tankers and Embarcadero Maritime (a joint venture between Borealis Maritime and KKR) have signed and closed an agreement to sell the jointly held company Crystal Nordic to John T. Essberger in Hamburg, a leading owner and operator of chemical tankers in Europe. Crystal Nordic was established following the combination of Nordic Tankers’ inter-European stainless steel chemical tanker business with Crystal Pool in 2015. The parties have agreed not to disclose any financial information. Crystal Nordic is a Danish headquartered chemical tanker operator, owning 14 ships between 4,000 and 12,000 DWT, serving customers primarily in Northern Europe.

Harris Pye Sold to Joulon Group

The Harris Pye Engineering Group, global specialists in the provision of repairs, upgrades and conversions to the marine, offshore oil and gas, and associated onshore industrial sectors, has been acquired by the Joulon Group. Joulon was created in partnership with KKR, the global investment firm to acquire well established companies globally. The investment in Joulon comes from multiple funds managed or advised by KKR. Harris Pye has been acquired to primarily add capability in the Project Management Platform for the Joulon Group and will also have an impact in the majority of the Joulon platforms. “We are really excited to have Harris Pye as part of Joulon Group. “This is very much a win:win situation,” explained Mark Prendergast, Harris Pye’s Chief Executive.

Bilden Joins HII Board of Directors

Philip M. Bilden has been elected to Huntington Ingalls Industries’ (HII) board of directors, effective November 7. Bilden retired last year as a co-founding member of the private equity firm HarbourVest Partners. He began his career in Boston in 1991 and relocated to Hong Kong in 1996 to establish the firm’s Asian subsidiary. Throughout his 25-year tenure at HarbourVest Partners, Bilden served in senior leadership roles in the firm’s global management, including the firm’s six-person executive committee responsible for governance.

NordLB Drops Plans to Sell Shipping Loans to KKR

German lender NordLB has abandoned efforts to sell a 1.3 billion euro ($1.5 billion) portfolio of shipping loans to KKR, Handelsblatt reported on Monday, citing a spokesman for NordLB. NordLB had said in April it hoped to complete a deal by the end of June. Neither NordLB nor KKR were immediately available for comment. (Reporting by Maria Sheahan)

Colonial, Shippers to Face off over Pipeline Congestion

Executives from Colonial Pipeline, which runs the main fuel artery for the U.S. Atlantic Coast, will be questioned by customers and regulators on Wednesday after worsening congestion spawned secondary markets for space on the system, driving up costs for wholesale diesel and gasoline buyers. Refiners, retailers and trading houses have jockeyed to move barrels in an increasingly competitive race for space on the line since a 300,000 barrel per day expansion between 2011 and 2013 failed to ease traffic as shippers increased on the 2.5 million bpd system. Customers including Costco Wholesale Corp complain that so-called line space trading adds business costs, prompting a rare hearing at the Federal Energy Regulatory Commission. "We have very sophisticated customers.

Pillarstone Italy Invests to Relaunch Premuda

Pillarstone Italy said on Friday it had finalized the acquisition of 100 percent of Italy's Premuda and would invest 50 million euros ($53.5 million) to support the relaunch of the troubled shipping company. Pillarstone Italy is a platform set up by U.S. private equity firm KKR to restructure ailing companies. The shipping industry is in an eight-year downturn due to slowing international trade. Pillarstone also said Popolare Emilia Romagna had joined rivals Intesa Sanpaolo, UniCredit and Carige in transferring to the platform credits towards Premuda. (Reporting by Valentina Za)

KKR Unit Takes on Italian Shipping Company Debt From Banks

Pillarstone Italy, owned by U.S private equity firm KKR, will take on the bulk of the debt owed by Italy's Premuda to a group of banks, in a first move that could make Pillarstone one of the main shareholders of the shipping company. Under the deal, Banca Carige, UniCredit and Intesa Sanpaolo will transfer around 250 million euros ($281 million) in loans to Pillarstone, making it the main creditor of Premuda, a spokesman for the KKR unit said on Friday. "Pillarstone will enter talks with other creditor banks to reach a final deal aimed at restructuring the whole debt," Premuda said, referring to its total net debt of 320 million euros at the end of 2015. It added that a part of the debt held by the KKR unit could be converted into shares.

Commerzbank Sells 18 Ships for $254.5mln

KKR & Co LP's Embarcadero Maritime unit will pay $254.5 million to buy 18 dry bulk and container ships from Commerzbank AG's Hanseatic Ship Asset Management GmbH, the companies said on Thursday. U.S. private equity firm KKR and London-based independent ship operator Borealis Maritime formed the Embarcadero Maritime joint venture in 2013 to invest in distressed shipping assets as several fleets struggled with overcapacity. The acquisition increases Borealis' fleet to 61 vessels, carrying containers, chemicals, and liquefied petroleum gas. To date, the joint venture has deployed more than $600 million to acquire assets. This acquisition includes 13 mid-size container vessels and 5 mid-size dry bulk vessels which Commerzbank took over from borrowers who defaulted on their loans.

Warning Sign: High-Yield Bonds Drive Energy Sector Growth

Energy companies have become a larger presence in the US high-yield bond market this year, relying on debt to fund capex as they expand exploration and production activity, but months of heavy issuance and weaker oil prices are taking their toll. Some recent bond deals have struggled to get across the line, only to end up still getting punished in secondary. Apollo's US$1.1bn LBO bond for Jupiter Resources, for example, has traded as low as 89 - even after coming to market last month with a five-point discount. "A lot of high-yield energy companies, particularly those developing shale plays, are spending more money than they are taking in," Patrick Faul, head of research at Calvert Investments, told IFR.

NordLB to Shed Shipping Loans to KKR

German state-owned lender NordLB and KKR Credit said they had reached an agreement by which KKR Credit will acquire a $1.5 billion portfolio of shipping loans from NordLB jointly with an unspecified sovereign wealth fund. The portfolio of performing and non-performing loans will include up to 100 ships and will form the seed mandate for a portfolio management company that the buyers plan to set up. NordLB is one of several German banks seeking to cut its ship loan exposure as the container and dry bulk shipping industries struggle with their worst downturn due to a glut of ships, a faltering global economy and weaker consumer demand.

Investors to Acquire $1.5 bln Shipping Portfolio from NORD/LB

NORD/LB Norddeutsche Landesbank and KKR Credit have reached an agreement by which, subject to completion of certain conditions precedents, KKR Credit, together with a sovereign wealth fund (the “Investors”), will acquire a portfolio of performing and non-performing shipping loans originated by NORD/LB. The initial portfolio with a total volume of about USD 1.5 billion will include up to 100 ships and would form the seed mandate for a shipping portfolio management company that the Investors will create simultaneously with the closing of this sale. This company is designed to be open for use by third party banks for their portfolio management.

German Banks Count Cost of Global Shipping Crisis

German banks are struggling to recoup tens of billions of dollars of loans as a global shipping industry slump hits them hard. The lenders - among the biggest backers of shipowners over the past 20 years - are behind up to a quarter of the world's $400 billion of outstanding shipping loans, three shipping financiers told Reuters. This would make them collectively more exposed than banks from any other single country in terms of outstanding debt to the sector. These institutions…

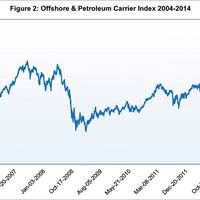

Energy Sector Volatility Affects Middle Market M&A Activity

Market volatility for the petroleum sector provides a backdrop to an evolving Merger & Acquisitions environment for the Offshore Sector. In the 3Q edition of Maritime Professional, this series of articles examined the overall evolution of maritime and offshore M&A activity since 2010, tracing the flow of deals in the post-financial crisis era. In this edition, we take a closer look at relevant U.S. offshore energy industry deal flow and market movements as they relate to oil prices over time, and highlight some recent middle market transactions.