Carbon Capture Chasm Exposed at Climate Summit

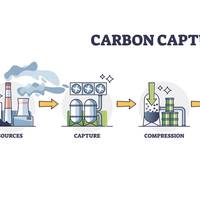

Carbon capture and storage has emerged as flashpoint at the UN climate conference in Dubai about how big a role it is destined to play in reaching the target of net zero emissions.It has also prompted an unusual and bad-tempered confrontation between senior officials at the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC).In the run up to the conference, the IEA called on oil and gas producers to let go of "the illusion that implausibly…

Perenco, SNH to Increase Utilization of Golar's Hilli Episeyo FLNG

Oil and gas company Perenco and Cameroon's national oil firm SNH have agreed with Golar LNG to increase the utilization of the FLNG Hilli Episeyo - Africa's first FLNG in operation and the world’s first converted FLNG. The Hilli Episeyo FLNG vessel moored offshore Cameroon and producing from SNH and Perenco's offshore gas fields, started producing in March 2018. The initial agreement was for the use of two of the four liquefaction trains and provided Perenco and SNH the option to increase liquefaction production.Back on March 31…

Vantage Drilling Sinks Into the Red

Texas-based offshore drilling contractor Vantage Drilling International reported a net loss of $52.2 million for the three months ended December 31, 2018 as compared to a net loss of $36.6 million for the three months ended December 31, 2017.For the year ended December 31, 2018, Vantage reported a net loss of $141.5 million or as compared to a net loss of $149.8 million for the year ended December 31, 2017.Vantage, a Cayman Islands exempted company, issued $350 million of new senior secured notes using proceeds to repay its first and second lien debt and to acquire the Soehanah jackup for $85.0, including transaction costs.Ihab Toma, CEO, Said: "We refinanced two tranches of debt thereby extending maturities to 2023.

Global FPSO Market to Exceed USD 115 bln by 2024.

Global FPSO Market is anticipated to witness growth of 19% and exceed USD 115 billion by 2024. Rising demand of hydrocarbons and increase drilling activities for exploration and production will drive the industry growth.Increase in the conversion of vessel to FPSO to augment the productivity and minimize the capital expenditure may complement the business growth, said a report from Global Market Insights.Converted FPSO market is witnessed to grow over 18%. Comparison with new built, converted FPSO requires low capital cost that drives the business growth.Reduced project execution timeline will increase the redeployed FPSO market share with a valuation over USD 700 million in 2015 followed by the expansion rate of over 22% by 2024.

Vantage Gets Extension of Contract for the Emerald Driller

Vantage Drilling International announced that it has been notified that its drilling services contract for the Emerald Driller will be extended for two years, beginning in May 2018. Ihab Toma, the Company’s Chief Executive Officer, commented, “We are very pleased that we will continue to work with one of our esteemed clients and keep our rigs working in this challenging environment. Vantage Drilling International, a Cayman Islands exempted company, is an offshore drilling contractor, with a fleet of three ultra-deepwater drillships, four premium jackup drilling rigs and one standard jack-up drilling rig. Vantage's primary business is to contract drilling units…

Op/Ed: Shipping's Energy Challenge

There is no more economically and environmentally efficient way of transporting the world’s goods than by sea. Compared to air or road freight, based on per ton of cargo shipped, shipping’s carbon footprint is small. Yet with the 60,000 or so ships that transport 80 percent of the world’s goods emitting about 1.12bn tons of CO2 each year, almost 4.5 percent of all global greenhouse gas emissions, it is unequivocal that we need a viable way of reducing our environment impact. As other sectors reduce their carbon footprint shipping’s is likely to increase as an overall percentage.

Ian C. Strachan Elected Transocean Chairman

The Board of Directors of the company elected Ian C. Strachan to serve as Chairman of the Board effective May 18, 2013. Mr. Strachan replaces J. Michael Talbert who was not re-elected at the company's annual general meeting held on May 17, 2013. Mr. Strachan has served as director of the company since December 1999. Most recently, he served as chairman of the Finance Committee of the company as well as serving on the Corporate Governance Committee of the company. The Board believes that Mr. Strachan has relevant senior management experience in the energy sector and other business sectors, including Chief Executive Officer and chairman positions in international companies. Mr. Strachan formerly served as chairman of Instinet Group Incorporated.

Major milestone: First Gas Flows From Offshore Into The Pearl GTL Plant In Qatar

Qatar Petroleum and Shell today announced the first flow of dedicated offshore gas into the Pearl GTL plant located in Ras Laffan Industrial City in the State of Qatar. Shell, which is the operator of the Pearl GTL plant developed under a Production and Sharing Agreement with QP, has opened natural gas wells offshore allowing the first sour gas to flow through a subsea pipeline into the giant GTL plant onshore. Sections of the Pearl GTL plant will be started up progressively over the coming months.

Update: BOEMRE Response to Natural Gas Leak in GOM

The Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) is continuing to oversee Apache Corp.’s source control efforts for a natural gas leak near East Cameron Block 278 Platform B. The platform is located approximately 93 miles offshore Louisiana, south of Lake Charles, in about 173 feet of water. The platform, which has not been in production for nearly a decade, is currently used to process natural gas and condensate from other facilities. With BOEMRE’s approval and after several safety system evaluations, Apache personnel re-boarded the platform January 19 and began work to kill the leaking well. BOEMRE engineers reviewed and approved the well control procedures to be used from the platform.

UPDATE: BOEMRE Response to Natural Gas Leak in GOM

The Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) is continuing to oversee Apache Corp.’s source control efforts for a natural gas leak near East Cameron Block 278 Platform B. The platform is located approximately 93 miles offshore Louisiana, south of Lake Charles, in about 173 feet of water. The platform, which has not been in production for nearly a decade, is currently used to process natural gas and condensate from other facilities. With BOEMRE’s approval and after several safety system evaluations, Apache personnel have re-boarded the platform and begun work to kill the leaking well. BOEMRE engineers reviewed and approved the well control procedures to be used from the platform.

Update: BOEMRE Response to Natural Gas Leak in GOM

The Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) is continuing to oversee Apache Corp.’s source control efforts for a natural gas leak near East Cameron Block 278 Platform B. The platform is located approximately 93 miles offshore Louisiana, south of Lake Charles, in about 173 feet of water. The platform, which has not been in production for nearly a decade, is currently used to process natural gas and condensate from other facilities. With BOEMRE’s approval and after a safety evaluation, Apache personnel have re-boarded the platform and are preparing equipment to begin work to contain the source of the gas leak. BOEMRE engineers are completing final reviews of source control procedures.

BOEMRE Continues to Respond Leak in GOM

The Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) is continuing to oversee Apache Corp.’s source control efforts for a natural gas leak near East Cameron Block 278 Platform B. The platform is located approximately 93 miles offshore Louisiana, south of Lake Charles, in about 173 feet of water. The platform, which has not been in production for nearly a decade, is currently used to process natural gas and condensate from other facilities. Under the oversight of BOEMRE, Apache Corp has deployed a remotely operated vehicle (ROV) to evaluate the safety issues associated with re-boarding the platform. If the platform can be re-boarded safely, source control measures can be taken using equipment on the facility.

BOEMRE Responds to Report of Natural Gas Leak

The Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) is responding to a report that Apache Corp. has experienced a potential natural gas leak at East Cameron Block 278 Platform B, a natural gas production platform approximately 93 miles offshore Louisiana, south of Lake Charles, in about 173 feet of water. The platform, which has not been in production for nearly a decade, is currently used to process natural gas and condensate from other facilities. According to its report, at approximately 10 a.m., January 16, Apache was in the process of permanently plugging its associated non-producing natural gas wells when workers spotted what appeared to be natural gas bubbling to the surface near the platform.

Modernizing the Fleet

The recent oil price fluctuations may have wreaked havoc with many offshore service companies; but Seacor Smit managed to pull through, relatively unscathed. With a strong balance sheet and a modernized fleet, Seacor Smit, a leading offshore service and supply company, managed to ride out the recent oil price fluctuation with minimal damages. Charles Fabrikant, chairman, president and CEO, points to the company's adherence to a policy of acquiring modern vessels, while pruning those less marketable, or more expensive to operate. The core of the program is replacing vessels serving primary markets - like deepwater - and shifting older assets to less demanding services. In the course of a year, Seacor disposed of 34 vessels, generating $144 million in cash.

Natural Gas Boom Causes Soft Offshore Rig Demand

Demand for offshore rigs in the U.S. Gulf of Mexico has softened after a natural gas drilling boom in the first half of 2001, but forces that could support a recovery may already be at work, analysts said on Monday. Drilling has slowed down in the waters off the Texas and Louisiana coasts in response to a steep drop in U.S. natural gas prices from record highs of around $10 per thousand cubic feet at the end of last year to levels of around $3 in recent weeks. The number of rigs working in the U.S. Gulf fell to 165 last week from 168 the previous week, bringing the utilization rate for the U.S. Gulf drilling fleet down to 77.8 percent from 90.5 percent in late April, according to Offshore Data Services.