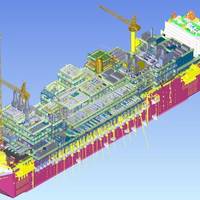

MODEC Confirms Its First FPSO Order in Guyana

Japan's MODEC said Monday it would proceed with engineering, procurement, and construction on the Uaru FPSO vessel following a final investment decision on the Uaru offshore oil project by ExxonMobil in Guyana last month.The Uaru FPSO is named ‘Errea Wittu’, which means ‘abundance,’ and will be the fifth offshore FPSO in Guyana and the first to be supplied by MODEC. The first four, two of which are now in production in the Stabroek block off Guyana, were/will be delivered by SBM Offshore.Apart from supplying the Errea Wittu FPSO…

Offshore Energy: Are Decommissioning Costs set to Spiral?

As offshore market activity recovers and continues to increase through the next decade, as we expect it to, oilfield service (OFS) capacity is expected to tighten.As offshore market activity recovers and continues to increase through the next decade, as NorthStone Advisors expect it to, oilfield service (OFS) capacity is expected to tighten. In NorthStone Advisors’ view, this will create a period of increased scarcity and cost inflation, presenting significant cost and schedule risk to decommissioning programs.Many eyes are on the UK…

Southeast Asia Bullish on OFS Market

Offshore project sanctions in Southeast Asia could lift greenfield investments in the oilfield services market by nearly 70 percent in 2020, said Rystad Energy.According to Norwegian energy research firm, the growth will be driven by a handful of new mega-projects across Malaysia, Myanmar and Vietnam, according to the latest tally of project commitments in Southeast Asia by the Norwegian energy research and consulting firm.New final investment decisions (FIDs) in 2021 are expected to sound the starting gun for big contract awards in Vietnam, Indonesia and even politically-troubled Brunei.“We anticipate that operators will aim to place most of the associated contracts within their domestic markets…

OFS Sector Expected to Take a Hit

Lower oil prices will push the global oilfield services (OFS) sector into a recession in 2020 after three successive years of growth, according to Rystad Energy.In a new sector outlook update, Audun Martinsen, head of oilfield services research at Rystad Energy, forecasts a 4% decline in global oilfield service revenue if oil prices stay flat next year.“Lower oil prices call for negative growth in the service market in 2020,” says Martinsen. “For suppliers, this means that a three-year growth story will come to an end regardless of which market segment you look at.”The service market will likely achieve a 2% growth in 2019, to $647 billion.

Oil, Gas Jobs Moves from Shale to Offshore

With offshore market gaining momentum the main driver of employment is shifting from shale to offshore.According to new analysis by energy research firm Rystad Energy, increased activity in onshore shale basins such as the Permian in the US held employment in the oilfield service industry steady from 2016 to 2017.However, the offshore industry has now taken the lead, gradually increasing the overall headcount of the top 50 oilfield service companies from 2017 to 2018, the report said.“This is a clear effect of the increase in offshore sanctioning. We expect offshore commitments to nearly double from 2018 to 2020, and sustain high levels of spending over the next five years…

Oil and Gas Projects to Triple in 2019

A surge in final investment decisions (FIDs) this year on new petroleum projects worldwide could see sanctioned volumes of oil and gas – excluding shale and tight oil and gas prospects – nearly triple compared to last year’s tally.The collective volumes could swell past 46 billion barrels of oil equivalent (boe), according to research conducted by Rystad Energy.“We expect global FID volumes in 2019 to triple over last year, and 2019’s megaproject awards could lead to billions of subcontracting dollars in coming years,” said Rystad Energy upstream research analyst Readul Islam.He added: “The only supply segment likely to shrink this year is the oil sands, whereas deepwater, offshore shelf and other conventional onshore developments are all poised to show substantial growth.

Onshore Spending on the Cusp of Recovery?

DW’s recently released quarterly World Oilfield Services Market Forecast (OFS) and World Oilfield Equipment Market Forecast (OFE) continue to suggest 2016 will see the start of a barren period for the offshore OFS and OFE sectors. In line with previous editions of the report, a significant drop in project sanctioning, coupled with low rig dayrates, will see annual OFS expenditure average $49 billion (bn) over 2016-2020, while OFE expenditure will decline from $69bn to $43bn over the same period. Growth in offshore drilling seen since 2010 has been sharply halted – offshore well spuds saw an 8% reduction last year and a further 9% is anticipated for 2016.

DW: Local Content Key in Foreign Offshore Deals

In many of the key deepwater markets, estimated to be worth $72bn by 2018, E&P and OFS companies alike are exposed to challenging local content requirements, remarks Douglas-Westwood in their 'DW Monday'. Local content agreements are typically are motivated by a desire to stimulate industrial development, and promote technology transfer. A typical local content agreement stipulates that E&P companies must procure a minimum percentage of equipment and services from local contractors. Recent examples can be seen in countries such as Brazil (Petrobras new-build FPSO units to use domestically-built hulls), Angola (BP partnering with Sonangol) and Nigeria (Total utilising a 90% local work force for the AKPO FPSO).

Pushing the HPHT Envelope

With demand for hydrocarbons increasing and costs rising, the E&P industry is also facing numerous technical challenges including the development of High Pressure – High Temperature (HPHT) reserves. HP / Extreme HP typically refers to borehole pressures between 10,000 psi and 20,000 psi whereas HT / Extreme HT refers to borehole temperatures between 300 degrees Fahrenheit and 400 degrees Fahrenheit. Pressures and temperatures outside these ranges are referred to as “Ultra-HPHT”, which represents the absolute limits of current technology. While the HPHT term is widely used, it should be noted that pressure and temperature do not always correlate: in Thailand many wells have extremely high temperatures without correspondingly high associated pressures.

Drilling Deep: Pushing the HPHT Envelope

With demand for hydrocarbons increasing and costs rising, the E&P industry is also facing numerous technical challenges including the development of High Pressure – High Temperature (HPHT) reserves, explains energy forecasters, marine market researchers & renewables analysts Douglas-Westwood in 'DW Monday'. HP / Extreme HP typically refers to borehole pressures between 10,000 psi and 20,000 psi whereas HT / Extreme HT refers to borehole temperatures between 300 degrees Fahrenheit and 400 degrees Fahrenheit. Pressures and temperatures outside these ranges are referred to as “Ultra-HPHT”, which represents the absolute limits of current technology.

Westwood: N. Sea Future is "Bright"

“Despite a long-term decline in oil & gas production in the North Sea, its services and support industry has a bright future,” said John Westwood, Chairman of energy business advisors Douglas-Westwood, in Aberdeen this week. Addressing a major event organized by the Norwegian British Chamber of Commerce on opportunities and challenges for the industry in the North Sea area, Westwood noted that the North Sea is a major world-class basin that for the past 40 years has delivered huge economic benefits to Norway and The UK. “However, oil & gas production is in decline,” he said.

Offshore Lockout to Shut Norwegian Oil Fields

The Norwegian Oil Industry Association (OLF) announced that a lockout will be imposed from 24.00 on Monday 28 June on all members of two unions covered by the offshore pay agreements. This move against the Federation of Oil Workers Trade Unions (OFS) and the Norwegian Association for Supervisors follows a deadlock in the strike which they initiated on 18 June. According to the OLF, a stoppage will lead to an almost complete shutdown of oil and gas production on the NCS. Statoil-operated fields stand to suffer a daily loss of some 1.4 million barrels of oil and condensate and roughly 150 million cubic metres of gas. The group itself will be losing roughly 585,000 barrels of oil and condensate and some 60 million cubic metres of gas per day from its own or partner-operated fields.

Norwegian Offshore Strike Implications for Smedvig

The Norwegian Shipowners Association and the Federation of Offshore Workers Unions (OFS) have not succeeded in reaching agreement at arbitration on the annual settlement. This means that the OFS has called out on strike its members on four rigs. As from July 9, the strike will be extended by one more rig. For the time being none of Smedvig's mobile units are affected by the strike. However, if the strike is extended, Smedvig's rigs and/or the Company's activities on fixed platforms in the Norwegian sector may be affected.

Second Norwegian Offshore Lockout Coming

lockout affecting workers on 94 offshore service vessels and shuttle tankers on the Norwegian continental shelf. encompassing members that so far have remained outside the current dispute. week. says Managing Director Marianne Lie. considerably more than a billion kroner, and has reached a dead lock. company competitiveness," underlines Ms Lie. accepted. shelf will have to close down oil production operations. laid off," Ms Lie concludes. Association. nature in a working group. demands. employers' representatives. than 20 different shipping companies. installations on the Norwegian shelf. include 350 OFS members, currently not involved in the ongoing dispute. on the permanent platforms will therefore be affected by the dispute. Norsk Offshore Catering. affected. the dispute.