Trans Mountain Expects First Ship to Load from Expanded Pipeline in May

The first tanker carrying crude from the expanded Trans Mountain pipeline is expected to load at the Port of Vancouver in the second half of May, the company building the project said on Tuesday.The expanded pipeline, which will carry an extra 600,000 barrels per day of oil from Alberta to Canada's Pacific coast, will begin transporting crude on May 1 with final line fill completed in early May, Trans Mountain Corp said in an email.(Reuters - Reporting by Nia Williams in British Columbia; editing by Jonathan Oatis)

China's Imports of Russian Oil Near Record High

Russia remained China's top oil supplier in March, data showed on Saturday, as refiners snapped up stranded Sokol shipments.China's imports from Russia, including supplies via pipelines and sea-borne shipments, jumped 12.5% on the year to 10.81 million metric tons, or 2.55 million barrels per day (bpd) last month, according to data from the General Administration of Customs.That was quite close to the previous monthly record of 2.56 million bpd in June 2023.Seven Russian tankers under sanctions offloaded Sokol cargoes in Chinese ports in March…

Corpus Christi Crude Oil Exports Up 6.9% in Q1

The port of Corpus Christi, Texas, the top U.S. oil export hub, said it exported 6.40 million barrels per day of crude oil in the first quarter, up 6.9% from the same period a year ago.The U.S. Gulf Coast port handles more than half the nation's oil exports, benefiting from its pipeline ties to South and West Texas shale fields. Its volumes have risen along with shale oil production.Overall, the port has moved nearly 48.9 million metric tons of goods through the Corpus Christi Ship Channel in the first quarter.

US to Reimpose Oil Sanctions on Venezuela

The Biden administration said it would not renew a license set to expire early on Thursday that had broadly eased Venezuela oil sanctions, moving to reimpose punitive measures in response to President Nicolas Maduro’s failure to meet his election commitments.Just hours before the deadline, the U.S. Treasury Department announced on its website that it had issued a replacement license giving companies 45 days to “wind down” their business and transactions in the OPEC country's oil…

Russia's Seaborne Oil Product Exports Fell in March

Russia's seaborne oil product exports fell 4.2% in March from the previous month to 10.178 million metric tons due to unplanned maintenance at refineries and a uel export ban, data from industry sources and Reuters calculations showed.Russia's daily offline primary oil refining capacity has jumped by around a third in March to 4.079 million metric tons from February due to drone attacks, Reuters calculations based on data from industry sources showed.Last month, a fire broke out after a Ukrainian drone attack at the Norsi refinery…

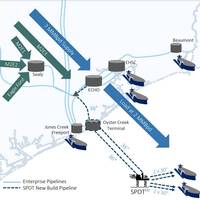

Enterprise Products Gets Port License for Gulf of Mexico Oil Terminal

Enterprise Products Partners said on Tuesday it had received a deepwater port license for its Sea Port Oil Terminal (SPOT) in the Gulf of Mexico from an agency of the U.S. Department of Transportation.The project, located near Freeport, Texas, would become the biggest offshore oil export terminal in the U.S. after completion with a capacity to load two supertankers at a time and export 2 million barrels of crude oil per day."The receipt of the license is the most significant milestone to date in the development and commercialization of SPOT…

Russian Oil Arrives in Cuba After Year-Long Hiatus

Cuban state-run media said at the weekend that 90,000 metric tons of Russian oil had arrived in the cash and fuel-short country to help alleviate power outages and gasoline shortages.In 2022, Russia resumed some oil shipments to the Communist-run Caribbean island after they ceased with the collapse of the Soviet Union.However, according to shipping data no Russian oil left the country for Cuba last year even as Russian media reported in June an agreement was reached between the two governments to supply 1.64 million metric tons of oil and derivatives annually.Jorge Piñón…

Asia Crude Imports Surge as China, India Snap Up Russian Oil

Asia's imports of crude oil are expected to rise to the highest in 10 months as heavyweights China and India lifted arrivals from Russia, but impending maintenance schedules and rising prices mean such levels may not be sustained.The world's top importing region is forecast to see arrivals of 27.48 million barrels per day (bpd) in March, up from 26.70 million bpd in February and January's 27.18 million bpd, according to data compiled by LSEG Oil Research.The bulk of oil arriving in March was arranged before the current increase in prices…

Second Russian Tanker, Hit by Sanctions, Docks in China

Russian tanker Krymsk, hit by sanctions, docked on Wednesday at the Chinese port of Dongying in eastern Shandong province, home of independent refiners, to discharge 700,000 barrels of Russian Sokol crude, LSEG and Kpler shipping data showed.This is the second Russian oil tanker, hit by sanctions, to dock at Chinese ports this month. Last week, tanker Liteyny Prospect discharged its 700,000-barrel Sokol crude cargo at the Chinese port of Huanghua near Cangzhou city in Hebei province.The Dongying port authority declined comment when contacted by Reuters.

Tanker Liteyny Prospect, Hit by Sanctions, Docks in China to Offload Russian Oil

The Russian tanker Liteyny Prospect, hit by sanctions, has docked at the Chinese port of Huanghua to discharge its 700,000-barrel Russian Sokol crude cargo, two sources familiar with the matter said, clearing part of a backlog of cargoes disrupted by sanctions on Moscow's oil trade.The tanker is one of six ships carrying Sokol crude, which India has not been able to import due to payment issues. The six ships had been sailing to China but five of them are floating at sea early this week, shipping data showed, following fresh U.S.

Iran to Unload Crude from Seized Tanker Advantage Sweet

Iran will unload about $50 million worth of crude from a Marshall Islands-flagged tanker seized last year, the semi-official Fars news agency reported on Wednesday, in a tit-for-tat action against the United States.Advantage Sweet is a Suezmax crude tanker that had been chartered by U.S. firm Chevron and was seized in April 2023 by Iran's army following an alleged collision with an Iranian boat.The unloading of the cargo follows a Tehran court order in favor of Iranian patients of Epidermolysis Bullosa (EB)…

US Gulf Coast Fuel Oil Imports Hit Five-year Low

Imports of fuel oil bound for the U.S. Gulf Coast fell to a five-year low last month as refiners ran more cheap, heavy Canadian crude and geopolitical tensions in the Middle East pressured fuel oil flows.Fuel oil deliveries to the Gulf Coast dwindled in February to just 318,000 barrels per day (bpd), a 20% drop from the prior month and marking their lowest level since February 2019, data from tanker tracking firm, Kpler showed.Heavy fuel oil feedstocks like high sulfur fuel oil…

Venezuela Oil Exports Rising, but Shipping Delays Persist

Venezuela's oil exports slightly increased in February to some 670,000 barrels per day (bpd), but ongoing shipping delays worsened a bottleneck of tankers waiting to load, according to documents and vessel monitoring data.State-run oil firm PDVSA's customers have rushed to send tankers to Venezuela in recent months to pick up crude and fuel before the United States potentially reimposes oil sanctions.Restrictions could resume on April 18 when an existing license expires, the U.S.

Barge Fuel Exports Help Russia Negotiate Tanker Shortage

Russia exported more than 700,000 metric tons of oil products from the Black Sea port of Novorossiisk in 2023 using small river barges because of a lack of bigger tankers owing to EU sanctions and price cap limitations, market sources said and LSEG data showed.Some ship owners have avoided Russian ports since the EU embargo and price cap on Russian refined oil products went into effect in February last year, forcing shippers to turn to a so-called shadow fleet of ageing tankers.The shadow fleet has supported the flow of Russian barrels…

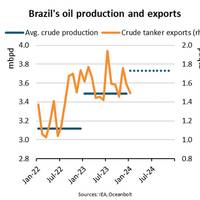

Oil Production, Chinese Buying Buoys Brazil Crude Exports 19%

“The reshaping of global crude tanker markets continued in 2023. In 2022, sanctions shifted Russia’s exports from Europe to Asia while OPEC production cuts in 2023 increased the Americas’ share of exports. Brazil’s oil production increased by 12% year-on-year in 2023 while crude tanker exports rose 19%,” said Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the International Energy Agency (IEA), Brazil’s oil production reached 3.49 million barrels per day (mbpd) in 2023, up from 3.12 mbpd the year before.

Exxon, Enbridge Sued by Competitor

Exxon and Canada-based crude pipeline operator Enbridge were sued in Illinois federal court on Tuesday over claims they barred a competitor from building a terminal to ship oil by barge from the Chicago area to refineries in the Midwest and Gulf of Mexico.The antitrust lawsuit from energy infrastructure developer Ducere seeks more than $11 million in damages for work the Illinois company said it already paid for on the project and for lost future profits.Exxon, Enbridge and their…

Russian Oil Flows Through Red Sea Face Lower Risks

Tankers carrying Russian oil have continued sailing through the Red Sea largely uninterrupted by Houthi attacks on shipping and face lower risks than competitors, according to shipping executives, analysts and flows data.Russia has become more dependent on trade through the Suez Canal and the Red Sea since it invaded Ukraine, which led to Europe imposing sanctions on Russian imports and forced Moscow to export most of its crude to China and India. Before the war, Russia exported…

Chevron Reroutes Kazakh Oil to Asia Around Africa

Chevron is sending cargoes of Kazakhstan's CPC Blend oil to Asia around Africa's Cape of Good Hope rather than via the Red Sea to avoid the risk of attacks by Yemen’s Houthis, according to three industry sources and LSEG ship-tracking data.The Iranian-aligned Houthis have stepped up attacks on shipping despite U.S.-led air strikes on the group's positions in Yemen, leading more vessels to avoid using the Red Sea and the Suez Canal - the shortest sea route between Europe and Asia.CPC Blend crude is loaded at the Russian Black Sea terminal of Yuzhnaya Ozereevka, near Novorossisk.

Russian Oil Facilities Hit by Drone Attacks, Fires

Russia energy infrastructure has been hit by drone attacks and fires in the past month, adding to uncertainty in global oil and gas markets already rocked by the conflict in the Middle East.Russia and Ukraine have targeted each other's energy infrastructure in strikes designed to disrupt supply lines and logistics and to demoralise their opponent as they try to get the edge in a nearly two-year-old war that shows no sign of ending.Following are recent major incidents at Russian oil facilities in the past month:* A Russian appointed official said on Jan.

Russia Eases Harsh Weather Restrictions to Boost Oil Exports

Russian ports are operating during more severe storms and easing restrictions for non ice-class vessels during winter, traders said and regulations showed, in an attempt to boost exports following disruptions from Western sanctions and harsh weather.Following the European Union oil embargo, Russia has to rely mostly on seaborne loadings, rather than westbound pipeline supplies via the Druzhba pipeline.Traders and analysts said the easing of restrictions carried technical and ecological risks, but could help Russia's revenues that are heavily reliant on oil.Russian pipeline monopoly Transneft,

Oil Loadings Resume from Russia's Port of Novorossiisk After Storm

Oil loadings from Russia's Black Sea port of Novorossiisk have resumed after being suspended due to a storm on Dec. 27, two sources familiar with the matter told Reuters on Thursday.The port will likely be able to ship all the crude volumes scheduled for December, as the weather has improved, the sources added.Oil loadings from Russia's Black Sea port of Novorossiisk were suspended on Wednesday.

Russia Oil Price Cap Coalition Toughens Shipping Rules

The U.S.-led coalition imposing a price cap on seaborne Russian oil announced changes on Wednesday to its compliance regime the Treasury Department said will make it harder for Russian exporters to bypass the cap.The Treasury also imposed fresh sanctions on a ship manager owned by the Russian government and three oil traders involved in Russian oil trade.The Group of Seven (G7) industrialized countries last year imposed a price cap of $60 per barrel on Russian oil shipments in…

Record Output, Tax Dodge Pushes Up Crude Exports from US Gulf Coast

Oil is flooding out of Texas in the final weeks of 2023, as traders find outlets abroad for record U.S. production and dodge a hefty year-end tax bill on their inventories.U.S. crude exports, nearly all of which leave from the U.S. Gulf coast, averaged about 4 million barrels per day (bpd) so far this year, according to U.S. government data, about 500,000 more than last year's record as oil production climbed to 13.2 million barrels per day.U.S. West Texas Intermediate crude's wider discount to the global benchmark Brent , currently at about $4.50 per barrel, is making U.S.