Performance Shipping Bags Charter for M/T P. Aliki Tanker

Performance Shipping, a shipping company specializing in the ownership of tanker vessels, has entered into a time charter contract with ST Shipping & Transport Pte Ltd., for the 2010-built, 105,304 dwt, LR2 Aframax oil product tanker, the M/T P. Aliki. The gross charter rate will be based on a fixed floor rate of US$45,000 per day for a period of minimum of four months to a maximum of five and a half months at the charterer's option, plus a 50/50 profit share provision above the floor rate. The charter started on June 26, 2023, and is expected to generate approximately a minimum of US$5.5 million to a maximum of US$7.5 million in gross revenue to Performance Shipping…

Performance Shipping Takes Delivery of Secondhand Tanker

Greek shipowner Performance Shipping announced on Thursday that it has taken delivery of a 2013-built LR2 Aframax oil product tanker that it agreed to purchase in November 2022.The 105,408 dwt P. Long Beach (formerly Fos Hamilton) was acquired for $43.75 million, partially financed through a term loan facility with Alpha Bank S.A.Long Beach is equipped with an eco-electronic engine and fitted with a ballast water treatment system (BWTS).The vessel is the fourth vessel delivered to the company during the course of this year, bringing the Performance Shipping’s current fleet to a total of eight Aframax tankers.Andreas Michalopoulos, the Company’s Chief Executive Officer, said, “The delivery of our second LR2 Aframax tanker, the M/T P.

Performance Shipping Buys Secondhand Aframax Tanker

Greek shipowner Performance Shipping on Thursday announced it has signed a memorandum of agreement to purchase a secondhand 105,408 dwt LR2 Aframax oil product tanker for $43.75 million.The vessel, Fos Hamilton, was built by South Korea's Hyundai Heavy Industries in 2013 and is equipped with an eco-electronic engine and ballast water management system (BWMS). It is scheduled to be delivered to the company in mid-December 2022 and will be renamed P. Long Beach.Performance Shipping said it will finance the acquisition with cash proceeds from the previously announced sale its oldest vessel, P. Fos, as well as a new senior secured facility.Andreas Michalopoulos…

Performance Shipping Takes Delivery of Secondhand LR2 Tanker

Greek shipowner Performance Shipping Inc. announced it has taken delivery of its first LR2 Aframax oil product tanker, a 2010-built 105,304 dwt vessel it purchased in August 2022.As previously announced, the P. Aliki—formerly named Alpine Amalia—was acquired for a total purchase price of $36.5 million and financed with $18.25 million cash on hand and $18.25 million from the recently announced term loan facility with Alpha Bank S.A.The vessel will enter into a time charter contract with Trafigura Maritime Logistics Pte Ltd. commencing in mid-November at a daily rate of $45,000 per day for a period of minimum seven months to a maximum of 10 months at the option of the charterer.Andreas Michalopoulos…

Performance Shipping Buys Secondhand Aframax Tanker

Greek tanker owner Performance Shipping on Wednesday announced it has reached a deal to acquire a secondhand Aframax tanker for $36.5 million.The vessel, a 105,304 dwt LR2 Aframax oil product tanker built by South Korea's Hyundai Heavy Industries in 2010, will be renamed P. Alik from Alpine Amalia. The ship is fitted with a ballast water treatment system (BWTS) and exhaust gas cleaning system (EGCS), and its next scheduled special survey and drydock is in 2025.Performance Shipping said it expects to take delivery if the vessel in November 2022. The tanker will be the seventh in the company’s fleet.The company said it intends to finance…

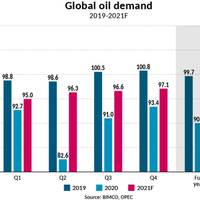

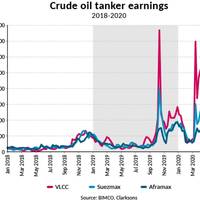

Oil Tanker Market Set to Endure Low Earnings for Another Year -BIMCO

The global oil tanker market faces another year of low earnings as the coronavirus pandemic and vaccine inequalities disrupt demand and producers limit output of crude, a shipping analyst said on Wednesday.The earnings of very large crude carriers (VLCCs) that carry the bulk of crude stand at about $10,000 a day, down from 2020 record highs of more than $240,000, after the pandemic battered demand, creating an oil surplus and a scramble for storage.Despite a patchy recovery in global oil demand and some easing of output cuts…

Profitability Still a Way Off for Tanker Shipping -BIMCO

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

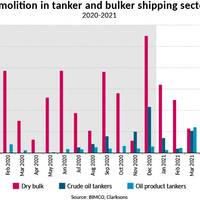

BIMCO: Ship Demolition Prices Spike, Tankers Lead the Way

In the first four months of 2021, the amount of oil product tanker capacity that has been sent for demolition has already reached the total amount of demolished capacity in each of 2019 and 2020 due to unfavourable freight rates. If that pace continues for the rest of the year, an 11-year record is set to be broken.This according to a report out today from BIMCO, which shows that so far this year, 10 crude oil and 38 oil product tankers have left the active trading fleet and the…

HSFO Sales Rebound After Pre-IMO 2020 Correction -BIMCO

In the first quarter of 2021 high-sulpfr fuel oil (HSFO) has been the only bunker fuel to experience year-on-year growth in Singapore, the world's largest bunkering hub. HSFO sales are up 47.2% from Q1 2020, reaching 3.1 million tonnes. This is however still less than a third of high-sulfur fuel sales in Q1 2019, before the IMO 2020 Sulphur Cap came into force.The 1 million tonne increase in HSFO sales exceeded the fall in low-sulfur fuel oil (LSFO) and marine gas oil (MGO) sales, though only marginally, with total bunker sales in Singapore up by 0.8% in Q1.

Tanker Shipping Facing a Tough Year Ahead, Says BIMCO

After a turbulent year, low demand looks set to plague the market in the coming months combined with too many ships fighting for too few cargoes in both the crude oil and oil product segments, says the oil tanker shipping overview and outlook released today by BIMCO.Demand drivers and freight ratesThe realities of the pandemic are setting in for the tanker market. The record-breaking Q2 2020 is a distant memory and, instead, the market faces a slow recovery with low demand, stock…

BIMCO: Tanker Market Hangover Continues

Tanker shipping was in many ways the odd one out of the shipping sectors in 2020; at the start of the pandemic, the market was strong, only to finish off the year in the doldrums, while the other sectors stayed profitable. Even a demand boost in December only managed to lift earnings slightly, raising the question, what will it take for tankers to return to profitability?In the immediate aftermath of the pandemic being declared, tanker shipping appeared immune, but it too has suffered from lockdowns and travel restrictions.

BIMCO on Tanker Shipping; The Worst is Not Over

While the tanker market had a strong run at the outset of the COVID-19 pandemic, according to a report released this morning by BIMCO, tanker shipping will not benefit this year from the usual strong winter seasonal effect. Though the new lockdowns being introduced in many countries are less strict than in the spring, the effect on tanker shipping will be worse, given the supply glut of Q2. The news of an effective vaccine offers some hope of a global oil demand recovery but, however it comes about…

Oil Tanker Transits Through the Suez Canal Drop 27% YOY -BIMCO

The number of oil tankers passing through the Suez Canal in October has declined sharply, down 27% for the month year-on-year amid persisting subdued demand for oil transport since the April crash in oil prices that fueled high demand for oil tankers, according to shipping association BIMCO.A total of 3,708 oil tankers passed through this key chokepoint for global shipping between January 1 and October 31, representing 76 less oil tanker transits (or a 2% decline) compared to the same period last year, BIMCO says.

Fully Loaded Oil Tanker Catches Fire Off Sri Lanka

A fully loaded oil tanker has caught fire off the east coast of Sri Lanka, which has dispatched an aircraft and two navy ships to help in the rescue, a Sri Lankan navy spokesman said on Thursday.The New Diamond, a very large crude carrier (VLCC) chartered by Indian Oil Corp (IOC), was heading to the port of Paradip in India, where the state-run firm operates a 300,000 barrel-per-day refinery.The ship had sailed from the port of Mina Al Ahmadi in Kuwait, carrying Kuwait Export Crude, Refinitiv Eikon ship tracking data showed.The Sri Lankan spokesman, Commander Ranjith Rajapaksa, said the VLCC was ablaze about 20 nautical miles off the east coast.

ReCAAP Issues Alert Over Armed Robberies at Batangas Anchorage

Two recent instances of violent armed robbery against ships berthed/anchored in Batangas, Philippines have prompted the ReCAAP Information Sharing Center (ICS) to alert the maritime community to dangers in the area.The two incidents occurred within an interval of seven days, and in both cases the perpetrators demonstrated violence toward crew with a knife.The first incident occurred on August 14 at about 10 a.m. local time, aboard the chemical/oil product tanker Pacific Sapphire berthed at Bauan, International Port Inc., Batangas.

Ship Orderbook Shrinks to 17-year Low -BIMCO

The total orderbook for dry bulk, container and tanker ships has reached its lowest point in 17 years as COVID-19 has massively slowed contracting (-50%) while deliveries of new vessels have proved more resilient (-2%).The orderbooks for bulk carriers and containerships in particular have fallen sharply. At 63.4 million deadweight tons (DWT), the dry bulk orderbook is at its lowest level since April 2004 and 34.7% smaller than 12 months ago. Similarly, the orderbook for containerships…

Oil Product Tanker S&P Activity Down 45% -BIMCO

Oil product tankers earnings have skyrocketed in the first half of 2020, while the sale and purchase (S&P) activity of the oil product tanker market has slowed to the lowest level since 2016. Data from VesselsValue highlight that in the first five months of 2020, only 2.8 million deadweight tons (DWT) of oil product tankers have shifted hands in the second-hand market, a 45% drop compared to the same period last year.A surprising S&P slowdown?The oil product tanker market has thereby experienced a disconnect in the first half of 2020 with high spot earnings…

Geopolitics Dominate the Oil Tanker Market -BIMCO

Developments in the oil tanker market in the past decade dominated by geopolitics, says shipping association BIMCO.Crude oil and product tanker markets alike have faced high volatility in recent weeks and months, largely due to geopolitics and the constantly evolving situation in the global oil markets. The first major disturbance since the fall in the oil price between the fourth quarter of 2104 and first quarter of 2016 came in the fourth quarter of 2019, after which freight rates have bounced back despite a collapse in demand.In these extraordinary times…

Suez Canal Ship Transits Rise Amid COVID-19

Transits through the Suez Canal, the beating heart of the Egyptian economy, have stayed remarkably resilient to the fallout of the COVID-19 pandemic if judging by total transits of the three commercial shipping sectors which are up 8% year-on-year. This is despite bleak economic growth prospects world-wide following the pandemic, and highlights that shipping remains the backbone of the global economy.It is often said that a picture says more than 1,000 words, but 6,166 ship transits in the Suez Canal can certainly also tell an interesting tale.

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

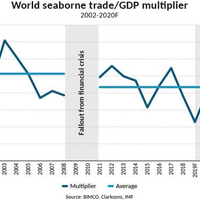

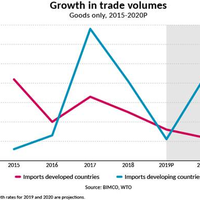

BIMCO: Supply & Demand Trending Off-Balance

One of the most worrying trends that has developed recently - which will affect shipping demand in the years to come - is the falling trade-to-GDP ratio. The falling ratio can be explained by slowing globaliztation as well as increasing protectionist measures being implemented around the world, spear headed by the US. The raised barriers to trade are here to stay as we enter a new decade, with the shipping industry stuck with the consequences.The trade war is the clearest example of these extra barriers to trade…

BIMCO: Tanker Shipping and Macroeconomics Outlook

World growth and trade volumes under pressure, but still positive. A continued slowdown in global growth, as well as a lower trade multiplier will reduce overall demand for shipping for the rest of this year and through 2020.Expectations for global trade growth have also been lowered for 2020; this is now forecast at 2.7%, down from 3%. The WTO cautions that risks to these forecasts are weighted to the downside, with these risks including a potential deepening of trade tensions…

Cable Ship Capsizes near Singapore after Tanker Collision

An undersea cable and pipe-laying ship, the Vanuatu-flagged MV Star Centurion, capsized in the Indonesian waters of the Singapore Straits after a collision with a tanker on Sunday, with no fatalities, authorities said on Monday.The Singapore Straits are one of the world's busiest shipping zones with hundreds of container ships, oil and fuel tankers and dry bulk carriers daily traversing the waters that connect east Asia to Europe, India and Africa.The collision happened just north of Bintan, an Indonesian island in the Riau Islands province that sits opposite the city-state of Singapore."It's already capsized," Samsul Nizar, the head of operations at the Indonesian coast guard base at Tanjung Uban on Bintan…