UAE Emerges as Hub for Companies Helping Venezuela Avoid US Oil Sanctions

In June, the United States imposed sanctions on half a dozen oil tankers managed by established shipping firms. It was a major escalation of American attempts to choke off Venezuela’s oil trade.Within weeks, a little-known company based in the United Arab Emirates took over management of several tankers that had been shipping Venezuelan oil. The vessels got new names. And then they resumed transporting Venezuelan crude.The company, Muhit Maritime FZE, is one of three UAE-based entities identified by Reuters that have shipped Venezuelan crude and fuel during the second half of this year. Their role emerges from an examination of internal shipping documents from Venezuela’s state oil company as well as third-party shipping and vessel tracking data.

Iran Uses Disguised Tanker to Export Venezuelan Oil

A tanker chartered by the National Iranian Oil Company (NIOC) is loading Venezuelan crude for export, documents from state-run PDVSA show, providing evidence of the two countries’ latest tactics to expand their trade in defiance of U.S. sanctions.Venezuela and Iran have deepened their cooperation this year as Venezuela has exchanged gold and other commodities for Iranian food, condensate and fuel.Names of scrapped vessels are being used by several PDVSA (Petroleos de Venezuela, S.A.) customers, including NIOC, to disguise the routes and identities of the tankers they use.A very large crude carrier (VLCC), identified in PDVSA’s loading documents as the Ndros…

Phantom Buyers in Russia, Advice from Iran Help Venezuela Skirt Sanctions

On Aug. 21, a tanker called the Otoman docked at the Jose oil terminal on Venezuela’s coast in the Caribbean to load 1.82 million barrels of heavy crude, according to the state oil company’s internal documents.Yet no tanker with that name is registered in major global shipping databases.Muddying the situation further, the unique identifier for the Otoman listed in the documents - a number used by the International Maritime Organization to identify ships - was assigned to another tanker called the Rubyni, according to the databases.The Rubyni was broken up two years ago, they record. Satellite images provided by TankerTrackers.com, an independent vessel tracking service…

A Killing at Sea Implicates the Armed Forces in Lawless Venezuela

Around midnight on February 23, Eulalio Bravo, a marine electrician, was dozing in his rack aboard the San Ramon, an oil tanker anchored off the coast of Venezuela.Suddenly, he heard footsteps pounding along the passageway outside. His captain, Jaime Herrera, cried for help."Be still!" an unfamiliar voice ordered.A gun fired.By the time Bravo and eight other shipmates emerged to see what had happened, the captain lay dead, a gunshot in the back of his head. Herrera's stateroom had been pillaged, drawers flung open, his bunk overturned. The killers were gone, as were thousands of dollars the captain kept under lock and key, according to crew members interviewed by Reuters.The murder…

How China Got Venezuelan Oil Despite US Sanctions

Last year, China replaced the United States as the No. 1 importer of oil from Venezuela, yet another front in the heated rivalry between Washington and Beijing.The United States had imposed sanctions on Venezuela’s state-owned oil company as part of a bid to topple that country’s socialist president, Nicolas Maduro. U.S. refineries stopped buying Venezuelan crude. Caracas’ ally China, long a major customer, suddenly found itself the top purchaser. Through the first six months of 2019, it imported an average of 350,000 barrels per day of crude from Venezuela.But in August, Washington tightened its sanctions on Venezuela, warning that any foreign entity that continued to do business with the South American country’s government could find itself subject to sanctions.

Soldier-run PDVSA and AWOL Oil Output

Last July 6, Major General Manuel Quevedo joined his wife, a Catholic priest and a gathering of oil workers in prayer in a conference room at the headquarters of Petroleos de Venezuela SA, or PDVSA.The career military officer, who for the past year has been boss at the troubled state-owned oil company, was at no ordinary mass. The gathering, rather, was a ceremony at which he and other senior oil ministry officials asked God to boost oil output."This place of peace and spirituality…

PDVSA Readies Armada of Fuel Imports

About a dozen tankers are sailing to Venezuela or waiting offshore to discharge cargoes after state-run oil company PDVSA ramped up tenders to buy gasoline and other fuels to offset its weak refining output, according to traders and Thomson Reuters data. Petroleos de Venezuela SA (PDVSA) recently awarded BP , Castleton Commodities, Rosneft and CT Energia contracts to buy more than 15 cargoes of gasoline blend stock, diesel, vacuum gasoil, catalytic naphtha and cutter stock for delivery from April through May. The total volume expected for the coming weeks surpasses 4 million barrels, according to traders and tender documents circulated by PDVSA. Venezuela can produce up to 1.3 million barrels per day (bpd) of fuels at its refineries.

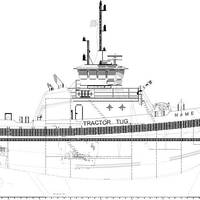

PDVSA Orders 10 ASD Tugs from Damen

Signaling a major commitment to tug fleet renewal, Petroleos de Venezuela SA (PDVSA) has placed a 10-vessel order with Damen Shipyards Group, as part of the state-owned operator’s strategic shift from chartered in to owned tonnage. The new tugs, which are expected to enhance operating efficiencies while reduce running costs, will provide mooring and maneuvering support to tankers in Venezuelan ports and harbors. Following a global tender, the contract calls for Dutch shipbuilding group Damen to supply ten ASD 2810 type Azimuthing Stern Drive tugs, each with a 60 metric ton bollard pull rating.

Petrobras Secures Loan for RUpdate: efinery

Petroleo Brasileiro SA borrowed 4 billion reais ($1.8 billion) in a 17-year loan from Banco Bradesco SA to help pay for work on the Abreu e Lima refinery in northeastern Brazil, a source with direct knowledge of the deal said on Tuesday. Petrobras, as Brazil's state-controlled oil producer is known, will pay annual interest of 9.5 percent plus Brazil's TR minimum savings remuneration rate, said the source, who declined to be identified because terms of the deal are subject to banking secrecy laws in Brazil. The TR yielded 0.3 percent in the 12 months through the end of February, according to the BM&FBovespa exchange. The Abreu e Lima Refinery, or RNEST, outside of Recife is expected to cost $20 billion by the time it reaches full operating capacity of 235,000 barrels a day in mid-2015.

Petrobras Secures $1.8b Loan for Refinery

Petroleo Brasileiro SA borrowed 4 billion reais ($1.8 billion) in a 17-year loan from Banco Bradesco SA to help pay for work on the Abreu e Lima refinery in northeastern Brazil, a source with direct knowledge of the deal said on Tuesday. Petrobras, as Brazil's state-controlled oil producer is known, will pay annual interest of 9.5 percent plus Brazil's TR minimum savings remuneration rate, said the source, who declined to be identified because terms of the deal are subject to banking secrecy laws in Brazil. The TR yielded 0.3 percent in the 12 months through the end of February, according to the BM&FBovespa exchange. The Abreu e Lima Refinery, or RNEST, outside of Recife is expected to cost $20 billion by the time it reaches full operating capacity of 235,000 barrels a day in mid-2015.

Wison Begins Building New Fabrication Yard

Wison Offshore & Marine Ltd. (Wison Offshore & Marine) announced today the commencement of the construction of key modularized components for the Petroleos De Venezuela, S.A.(PDVSA) RPLC refinery project at Wison Offshore & Marine’s Zhoushan Fabrication Yard (The Zhoushan Yard). This project marks the first construction project at Wison Offshore & Marine’s Zhoushan yard, and the official operational launch of the first phase of the yard. The yard is located on Xiushan Island in Zhoushan, Zhejiang province and covers an area of 1.5 million square meters with a coastline of 2,300 meters. Construction on the second phase of the yard is ongoing, and is scheduled to be fully complete and operational in 2015.

Wison Announces Venezuela Contract

Wison Offshore & Marine Ltd., a subsidiary of the Wison Group, announced has the award of a contract to supply key modularized components for a major refinery project in Venezuela. The project, known as the Venezuela Puerto La Cruz Refinery Deep Conversion Project, was awarded to Wison Offshore & Marine by Hyundai‐Wison, a consortium of Hyundai Engineering & Construction Co., Ltd. (HDEC), Hyundai Engineering Co., Ltd. (HEC) and Wison Engineering Ltd. (Wison Engineering), following a competitive bid. Procurement and Construction contractor for the project under an Prime Contract with the refinery owner, Petroleos De Venezuela, S.A. (PDVSA).

$23m Contracts Awarded to Great Lakes Shipyard

Caribbean Tugz, LLC, an affiliate of SEACOR Holdings, Inc., Fort Lauderdale, Florida has awarded Great Lakes Shipyard, Cleveland, Ohio vessel construction contracts to simultaneously build two new state-of-the-art 50-ton bollard pull ASD tugboats to be used for ship docking and escort operations at the Hovensa Oil Refinery in St. Croix, U.S. Virgin Islands. The contracts’ total price of the new tugs is $23 million. Design and construction are to start immediately, and the tugs are scheduled for completion in early 2013.

Tidewater Reports Q4 Results

Tidewater Inc. (NYSE:TDW) announced today fourth quarter net earnings for the period ended March 31, 2011, of $12.0 million, or $0.23 per share, on revenues of $254.0 million. For fiscal year ended March 31, 2011, net earnings were $105.6 million, or $2.05 per share, on revenues of $1,055.4 million. For fiscal year ended March 31, 2010, net earnings were $259.5 million, or $5.02 per share, on revenues of $1,168.6 million. • a $6.3 million ($6.3 million after-tax, or $0.12 per…

Venezuela Orders Crude Tankers from Itochu

According to a report from the Oil & Gas Journal, Itochu Corp. has won an order to supply four Aframax tankers to a subsidiary of Venezuela’s Petroleos de Venezuela SA (PDVSA) and has commissioned Sumitomo Heavy Industries to build the vessels. The ships will have a capacity of 104,300 dwt each and are scheduled for delivery in 2012. (Source: Oil & Gas Journal)

Tidewater Q4 Results

Tidewater Inc. (NYSE:TDW) announced fourth quarter net earnings for the period ended March 31, 2010, of $56.9 million, or $1.10 per share, on revenues of $260.0 million. For the same quarter last year, net earnings were $109.7 million, or $2.13 per share, on revenues of $341.6 million. For fiscal year ended March 31, 2010, net earnings were $259.5 million, or $5.02 per share, on revenues of $1,168.6 million. For the fiscal year ended March 31, 2009, net earnings were $406.9 million, or $7.89 per share, on revenues of $1,390.8 million. • a $5.4 million ($3.5 million after-tax, or $0.07 per common share) reduction of the previously recorded “Provision for Venezuelan operations…

Tidewater Reports Q2 Results for 2010

Tidewater Inc. (NYSE:TDW) announced its second quarter net earnings for the period ended September 30, 2009, of $98.2m, or $1.90 per common share, on revenues of $295.5m. Included in net earnings for the September 30, 2009 quarter is a $34.3m, or $0.66 per common share, tax benefit resulting from a favorable resolution of tax litigation. For the same quarter last year, net earnings were $95.4m, or $1.85 per common share, on revenues of $346.8m. The immediately preceding quarter ended June 30, 2009, had net earnings of $44.5m, or $0.86 per common share, on revenues of $ 326.6m. Included in net earnings for the June 30, 2009 quarter was a non-cash charge totaling $48.6m ($47.7m after tax, or $0.93 per common share) related to the company’s Venezuelan operations.

Tidewater Reports Q1 2010 Results

Tidewater Inc. (NYSE:TDW) announced first quarter net earnings for the period ended June 30, 2009, of $44.5m, or $0.86 per share, on revenues of $326.6m. Included in net earnings for the June 2009 quarter is a non-cash charge totaling $48.6m ($47.7m after-tax, or $0.93 per common share) related to the company’s Venezuelan operations. As a result of the seizure of 11 vessels and certain other assets during the June quarter in Venezuela pursuant to a May 2009 Venezuelan law and the continued nonpayment of outstanding receivables from Petroleos de Venezuela, S.A. (PDVSA) and an affiliate of PDVSA, the company recorded a $3.8m charge equal to the net book value of the assets seized and a $44.8m provision to fully reserve accounts receivable due from PDVSA-related entities.

Phoenix Energy Nav Joins Aframax Pool

PDV Marina, S.A. (PDVM), the marine transportation subsidiary of Petroleos de Venezuela, S.A. (PDVSA), the Venezuelan state oil company, and Overseas Shipholding Group, Inc. announced that Phoenix Energy Navigation SA (Phoenix) has joined the Aframax International Pool. Phoenix has contributed two double-hulled Aframax tankers to the pool (the Phoenix Alpha and the Phoenix Beta both built in 2003), expanding the number of vessels in the Pool to 34, including committed newbuildings.

Industry Leaders Elected To ABS Membership

Twenty-four prominent shipping industry executives have been elected as new Members of ABS bringing the classification society's worldwide membership to 817. The members, each eminent in their maritime field of endeavor, provide broad governance and oversight of ABS. Members are drawn from various sectors of the marine, offshore and related industries worldwide. Timothy J. Lawrence R. James J. John R. RADM. Robert C. Vittorio Portunato, Managing Director, Portunato & C.S.R.L. John F. Reinhart, CEO, Maersk Line. William J. H. W.

PDV Marina to Buy Tankers from Iran

Venezuela's state oil company will reportedly buy four oil tankers from Iran, according to an AP report. Petroleos de Venezuela SA said in a statement that its shipping subsidiary, PDV Marina, had signed a contract to buy the tankers from the Iran Marine Industrial Company. It did not disclose the price. PDV Marina president Asdrubal Chavez, who is a cousin of Venezuela president Hugo Chavez, reportedly said the deal is among various projects involving the two governments, and is also part of Venezuela's larger plan to expand PDV Marina's current fleet of 21 oil tankers. (Source: AP)

Venezuela, Brazil to Build Oil Tankers

According to reports, Venezuela's state oil company has signed a deal with Brazilian companies, Eisa and Maua Jurong to build ten oil tankers in Venezuela. The joint venture will produce at least eight Panamax tankers, the largest type of vessel capable of navigating the locks of the Panama canal, Petroleos de Venezuela SA, or PDVSA, said in a statement. PDVSA plans to increase its total fleet to 42 ships by 2012, the statement said. Last month, PDVSA announced it had signed a deal with the Brazilian company Andrade Gutierrez to build a dry dock in eastern Venezuela for the construction of oil tankers. Source: AP

Petroleos de Venezuela Orders 18 Tankers

Petroleos de Venezuela SA said it will buy 18 oil tankers from China for $1.3b as South America's largest oil firm seeks to boost exports to Asia. Orders for the tankers were placed with China State Shipbuilding Corp., and China Shipbuilding Industry Corp. A timetable wasn't provided for deliveries. (Source: Toronto Star)