Australian Government Highlights Nation’s Green Hydrogen Ambition

The Australian government has released its annual State of Hydrogen report, saying it reinforces that Australia has the foundations to become a global leader in green hydrogen.The report illustrates local industry is advancing hydrogen as a chemical feedstock and for export to generate electricity, but there’s an urgent need to speed up priority pilot projects and hydrogen hubs to compete internationally.In 2022, more than 100 Australian green hydrogen projects such as green ammonia and green methanol manufacturing were announced.

Baltic Exchange Launches New Service for Ship Investors

Publisher of maritime market benchmarks, the Baltic Exchange, has launched a new service for shipping investors which provides a snapshot five-year view of the financial prospects of dry bulk carriers.The Baltic Exchange Investor Indices are an easy to use online dashboard displaying data relevant to vessel investment decisions, residual value, health of earnings, spot and five-year timecharter earnings; purchase & recycling values; and running costs. It offers a high level of clarity and transparency for investors in capesize, panamax, supramax and handysize vessel types.

Newbuild Volatility to Alter Future Shipping Cycles -MSI

Independent research and consultancy firm Maritime Strategies International (MSI) has forecast a structural change to future shipping cycles, driven by increased volatility in newbuilding activity. In an article by Dr. Adam Kent, MSI notes that as a consequence of the current glut of excess shipyard capacity, many yards will be well-positioned to take orders and deliver within two years, should freight markets show improvement. “This may mean that we are set to see a something of a structural change in the shipping cycles going forward…

Nordic American Tankers' Declares 2Q Cash dividend

The second quarter 2015 produced better results than the first quarter 2015. So far in the third quarter, we have secured higher average rates than in the two preceding quarters of the year. In 2Q 2015, NAT continued to benefit from both a solid Suezmax tanker market and a top quality fleet (22 vessels in operation in 2Q 2015 and 4 vessels expected to be included later in 2015 and thereafter). Cashflow from operations was $54.5m, compared with $51.0m in 1Q 2015. For all of 2014, cashflow from operations was $77.7m compared with -$11.1m in 2013. For NAT shareholders, the significant liquidity in the stock continues to be an attractive factor for those investors looking to be able to buy and sell shares related to the crude tanker market.

Is NAT Approaching Recovery?

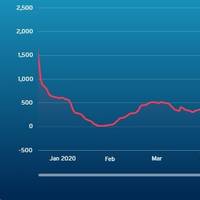

Nordic American Tankers (NAT) published its financial results from 4Q 2013, noting an expected increase in tanker rates that the company expects to play a role in its recovery. In early December 2013 the Suezmax tanker rates increased significantly compared with the average for 2013. A few weeks into 2014 the rates have weakened again. We expect improved results in 1Q 2014. The timecharter results of NAT were slightly lower in 4Q 2013 than in 3Q 2013. Short term rates in the tanker market are very volatile.