US Regains Crown as World's Largest LNG Exporter

The U.S. regained its crown as the world's largest exporter of liquefied natural gas (LNG) in the first six months of this year, according to the U.S. Energy Information Agency (EIA).US exports of the superchilled gas, particularly to Europe, have jumped in the last year as buyers looked for alternatives to Russian gas imports and to fill Europe's storage inventories, the EIA said.An average 11.6 billion cubic feet per day (bcf/d) of the superchilled gas was exported through June, up 4% from the same period a year-earlier, the U.S. Department of Energy (DOE) said.The increase in U.S.

U.S. Natural Gas Production Sets New Record

According to the U.S. Energy Information Agency (EIA), US natural gas production registered an increase by 10.0 billion cubic feet per day in 2018, noting an 11% rise in comparison to 2017.The development reported was the largest annual increase in production on record, establishing a record high for a second year in a row, it said in a press release.U.S. natural gas production measured as gross withdrawals averaged 101.3 Bcf/d in 2018, the highest volume on record, according to EIA’s Monthly Crude Oil, Lease Condensate, and Natural Gas Production Report.U.S. natural gas production measured as marketed production and dry natural gas production also reached record highs at 89.6 Bcf/d and 83.4 Bcf/d, respectively.U.S.

Oil Majors Push Offshore Players for 30% Cuts

30%That’s the minimum level of capital expenditure cuts facing owners and operators of offshore rigs, vessels and various support services, as they scramble to keep equipment working and their heads above water during one of the worst oil downturns in 30 years. From a high of $108 per barrel in June of last year, prices plummeted roughly 60% as supply surpassed weakening demand, crashing in November to around $44 a barrel. The pricing collapse caught all sectors of the industry and financial markets by surprise, pulling down with it market valuations, quarterly earnings and day rates.

BIMCO: Key Indicators for Shipping Demand

New data on three of the key indicators followed by BIMCO’s shipping market analyst sheds light on near-term and future market developments. The news follow up on BIMCO market reports and comments to commercial developments for the three main shipping segments. 1. China’s industrial production (IP) grew by 9% in July over the same period last year, according to the National Bureau of Statistics in China. This is a minor decrease from 9.2% in June, which was a three-month-high.

Suez Canal: Better Service to the Shipping Industry

According to the U.S. Energy Information Agency, one of the world’s oil transit choke-points is the Suez Canal, the Panama Canal being another. However, the recently announced Suez Canal expansion plans are more likely to cater for containership transits, in strong competition with the expanding Panama Canal, rather than respond to the demand from oil tanker transits. On Tuesday, August 5, 2014, the Egyptian President Abdel Fattah el-Sisi unveiled the project, which is bound to be a multiyear, multibillion dollar one.

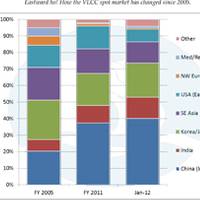

The Changing Face of the VLCC Market

With so much discussion of the poor freight rates available to VLCC owners hiring their ships out for voyages from the Middle East to major consumers east and west, it is informative to see how much the spot market for VLCCs has changed in just a few years. Since 2005, there has been a 25% reduction in reported AG/West spot VLCC voyages from 291 in 2005 to 216 in 2011. Just 11 AG/West fixtures were recorded in January 2012; if annualised the total would be 180, only 62% of the number recorded in just seven years earlier.