Indian Navy Rescues Crew from US-Owned Ship After Attack Off Yemen

The Indian Navy said on Thursday it had rescued the crew of a U.S.-owned vessel in the Gulf of Aden after an attack by Yemen's Houthi movement as tensions in the region's sea lanes disrupted global trade.Following the attack on the U.S. Genco Picardy late on Wednesday, the U.S. military said its forces had conducted strikes on 14 Houthi missiles that "presented an imminent threat to merchant vessels and U.S. Navy ships in the region".Attacks by the Iran-allied Houthi militia on…

US Lists Houthis as Terrorists, Business Fears Lengthy Red Sea Disruption

The United States on Wednesday returned the Yemen-based Houthi rebels to a list of terrorist groups, while business chiefs warned that disruption to shipping in the Red Sea caused by their attacks could affect supply chains for months.Attacks by the Iran-allied Houthi militia on ships in the region since November have slowed trade between Asia and Europe and alarmed major powers - an escalation of Israel's more than three-month-old war with Palestinian Hamas militants in Gaza.The Houthis say they are acting in solidarity with Palestinians and have threatened to expand attacks to include U.S.

Spot Freight Rates Soar from North Europe to Asia

Spot container freight rates from North Europe to China increased by 45 percent this week, reaching a four-year high. The “World Container Index assessed by Drewry” market reading on the route from Rotterdam to Shanghai jumped to $1,076 per 40ft dry container today, from $740 last week. “Our sources reported that ships are currently full and that carriers have demanded much higher rates – only some prior rate agreements remain in place,” said Philip Damas, head of Drewry’s logistics practice. It is highly unusual for the “backhaul” route from Europe to Asia – where vessels normally have load factors of less than 70 percent - to see such spikes in rate levels and capacity shortages.

Benchmarking Against Peers Upheld Among BCOs

International transport and logistics executives are increasingly benchmarking their companies’ costs and supplier terms in ocean transport contracts, according to data gathered by Drewry Supply Chain Advisors. In the past 6 months, the ocean transport spend under carrier contracts benchmarked by Beneficial Cargo Owners via the Drewry Benchmarking Club global initiative increased by 50%, to $2.2 billion; the number of benchmarked routes rose by 81% and the volume of benchmarked dry container teu jumped by 67%. FMCG companies and retailers are generally ahead of industrial manufacturers when it comes to using benchmarking to negotiate contracts.

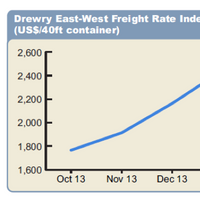

Spot box rates rise above 5-year average - Drewry

Spot container freight rates on the major East-West routes reached a 20-month high this week and have risen above the average of the last 5 years. The latest weekly reading is $1,770/40ft container for the composite index, reflecting increases on individual lanes to $1,785 for the Rotterdam-New York index (up $4 this week), $2,210 for the Shanghai-Rotterdam index (up $257 this week) and $2,106 for the Shanghai-Los Angeles index (up $545 this week). On the back of 1 January GRIs, the World Container Index between Shanghai and Rotterdam rose by 13% to reach $2,210 this week. Drewry expects the volume upsurge on account of an early Chinese New Year to support further increases next week.

Spot Box Rates Rise Above 5-Year Average

Spot container freight rates on the major East-West routes reached a 20-month high this week and have risen above the average of the last 5 years, said a report by Drewry. The latest weekly reading is $1,770/40ft container for the composite index, reflecting increases on individual lanes to $1,785 for the Rotterdam-New York index (up $4 this week), $2,210 for the Shanghai-Rotterdam index (up $257 this week) and $2,106 for the Shanghai-Los Angeles index (up $545 this week). On the back of 1 January GRIs, the World Container Index between Shanghai and Rotterdam rose by 13% to reach $2,210 this week. Drewry expects the volume upsurge on account of an early Chinese New Year to support further increases next week.

Oversupply Remains - Drewry

The withdrawal of Hanjin tonnage has not been enough to rectify the trade’s supply-demand imbalance and headhaul ship utilisation is lower compared to other major East-West markets. Westbound volumes rose by 1.8% in the third quarter and the growth rate for the year to date is now registering 2.9% (see Figure 1). Asian exports shipped to the West Mediterranean (including North Africa) grew by 2.8% between July and September, while traffic to the eastern sector of the trade only expanded by 0.8%. By the end of September, the 12-month rolling average growth factor for westbound flows was touching 3.4% (see Figure 2) which is a distinct improvement on the minus 1.9% recorded a year earlier, and represents the highest point it has reached since March 2015.

44 Hanjin Ships Denied Access to Ports

Some 44 of Hanjin Shipping Co Ltd's ships have been so far denied access to ports while 1 ship has been seized, Reuters reports quoting a company spokeswoman. The 44 ships include instances where port service providers such as lashing firms have denied service, or port authorities are denying entry to ports. Hanjin operates 98 container ships. With South Korea's biggest shipping company filing for bankruptcy protection, the vessels, sailors and cargo of Hanjin Shipping are stuck in limbo, stranded at sea, reports BBC. Ports, fearing they will not get paid, refuse to let them dock or unload. That means the ships are forced to wait for Hanjin, its creditors or partners to find a solution.

Spot Rate Trends on Asia-Europe See Reversal: Drewry

The downwards trend line in Asia-Europe spot freight rates has finally been reversed, as data from World Container Index Shanghai-Europe reveals. Whereas the first four months of 2016 saw 50% or larger reductions in freight rates and record-low spot rate levels, a series of five consecutive monthly rate increases that started in April and continued again on 1 August has resulted in a return to an upwards trend line. “Shippers and cargo owners booking under spot rates enjoyed huge cost reductions while carriers suffered substantial revenue shortfalls in early 2016 on the Asia-Europe route but, as we predicted, this extreme situation did not last,” said Philip Damas, director at Drewry, which jointly owns WCI alongside Cleartrade Exchange.

Which way to Munich?

Drewry Supply Chain Advisors’ whitepaper finds that the traditional gateway ports in North-West Europe no longer hold all of the trump cards. A recently published whitepaper from Drewry’s Supply Chain Advisors looking at the ‘Best Routes’ for containerised imports into South Germany from China found that for some shippers using Mediterranean gateway ports is a viable alternative to the traditional North-West Europe gateways. To establish shippers’ best-route Drewry examined a variety of routes to find the best mix of cost, transit time and the number of service options. Firstly, the whitepaper looked at the number of maritime services from Shanghai to South Germany’s so-called Northern and Southern gates that were available to the market as of March 2016 (see Table).

Survival of the Un-Fittest

Despite historically low rates carriers are unlikely to be killed off as creditors and governments will step in, says Drewry Shipping Consultants Limited. Recent news stories, backed-up by anecdotal stories told to Drewry, report that carriers have quoted zero dollar freight rates to some forwarders on certain lanes out of Asia. Whether these are merely isolated cases or something more widespread is difficult to judge at the present time, but whatever the exact quantum there is no denying the container rates are now close to the historic lows as seen in 2009. The World Container Index’s composite index, an average of spot freight rates on 11 global East-West routes connecting Asia, Europe and the US, reached a record low of $666 per 40-foot container on 24 March.

Container Blood Bath: Freight Rates Hit New Lows

The World Container Index’s composite index, an average of spot freight rates on 11 global East-West routes connecting Asia, Europe and the US, reached a record low of US$701 per 40-foot container on March 10, says Drewry Shipping Consultants. This was the lowest reading since the World Container Index (WCI) starting tracking weekly transatlantic, transpacific and Asia-Europe rates in June 2011. “The World Container Index’s composite index is now 60% lower than the average of the past 5 years and has decreased by 62% in the past year,” said Richard Heath, director of WCI. Jonathan Chappell, an analyst at Evercore ISI in New York says that there’s been an arms race in building bigger and bigger ships and they’re coming at a time the economy is slowing.

Hapag-Lloyd Delays IPO

German container shipping group Hapag-Lloyd AG is postponing its stock market debut by a week after investors shied away from the company following Maersk Line’s modest profit forecast last week, reports Reuters. If demand for the shares remains weak Hapag may lower the offer price, the people familiar with the deal said on Tuesday, adding that cancelling the IPO also remained an option. The company said it would publish a supplement to the IPO prospectus issued on Oct. 14 in due course. Hapag-Lloyd said it was extending the offer period for its initial public offering (IPO) by a week to Nov. 3, with trading now likely to start on Nov. "The order book had been more than one time subscribed.

Container Shipping Capacity Threat for Profitability

The rapid expansion of container shipping capacity this year threatens to reverse the strong profitability ocean carriers showed in the first quarter, Drewry Shipping Consultants Ltd said. Carriers weathered a storm of low rates in the first quarter to deliver some of the best profits in recent times. Will big newbuild deliveries and rising costs mean that was the peak, it asks. The London-based consultants said in a report this week that carriers will add at least 100,000 containers, measured in 20-foot containers, of carrying capacity in June and more than that in each month through the end of the year even as shipping prices on major trade routes are declining.

Global Freight Rates Plunge, Report Finds

Average global freight rates have fallen to a 15-month low, according to Drewry’s new online Container Freight Rate Insight. Drewry’s Global Freight Rate Index fell 12% in April to reach its lowest level since February 2012, when container shipping was still recovering from the last ocean carrier price war. The Index, which is a weighted average of freight rates across the 600 trade routes covered by Drewry’s Container Freight Rate Insight, reached a new low of $2,065 per 40ft and has fallen 18% since the start of the year.

Why Size Matters: Container Ship Economies of Scale

Maersk Line’s first 18,000 teu vessel, the Maersk Mc-Kinney Moller, which was doing the rounds on her maiden voyage in Northern Europe last week, has prompted much speculation on her economies of scale, particularly as HHI has just confirmed that it is negotiating an order for five slightly larger ships with UASC, says Drewry Maritime Research in a new paper. The economies of scale offered by Maersk Line’s 18,000 teu vessels are so great that few can ignore them. Assuming the Triple E’s consume 164 tonnes of fuel a day (excluding diesel)…

Container Freight Rates Gain

A short-lived revival in rates still means rich pickings for shippers coming into the transpacific contracting season, but beware the capacity crunch to come. Shippers should not lose sleep over the recent, short-lived jump in spot rates, but ought instead focus on ways to mitigate the risk of another sudden capacity crunch later in the year, urges Drewry Maritime Research. Freight rates on east-west trades have been in the ascendency of late. Drewry's Hong Kong - Los Angeles container rate benchmark, as published in the Container Freight Rate Insight, leapt 28% in the first week of the year. The benchmark rose $396 to $1,832 per feu and successfully sustained this level into the second week.

WCI Backhaul Routes Listed for Clearing

Major boost for swaps liquidity as WCI backhaul routes are listed for clearing. Introduction of clearing for new Europe-Asia routes will bring significant additional trading potential to container derivatives market. The World Container Index is pleased to announce that two WCI route assessments, covering Los Angeles to Shanghai and Rotterdam to Shanghai will now be cleared by LCH.Clearnet. The addition of clearing, which provides risk management for over-the-counter container freight swap trades, has been made in response to increased demand to manage freight price risk and reflects the growing market acceptance of the WCI. Since launch in September 2011…

Container Index Shows Large Hike in Asia-to-Europe Rates

London - Today’s Shanghai-to-Rotterdam container freight rate assessment from the World Container Index (WCI), a joint venture between Drewry and The Cleartrade Exchange, shows that container freight rates in the westbound Asia-Europe corridor increased by 28 percent this week, adding upwards pricing pressure on shippers only one month after the previous large rate increases. The World Container Index’s Shanghai-Rotterdam container freight rate sub-index went from $2,654 per 40-foot container on March 29 to $3,408 per 40-foot container on April 5, a rise of $754 per feu. Carriers in the key Asia-Europe head haul trade had announced General Rate Increases (GRIs) of about $400 per teu (or $800 per 40-foot container) from April 1.

Guide to Index-Linked Container Contracts Launched

Drewry and the World Container Index have published a White Paper that explains how index-linked contracts work, the first definitive guide on the subject since widespread adoption commenced two years ago. The White Paper, which is FREE to download from Drewry’s web site, examines the causes of recent container freight rate volatility and how index-linked contracts can help mitigate the impacts of such instability. It explains how these new contracting arrangements work with reference to current models in use and summarises the extent of industry adoption thus far. “This White Paper is a must read for any organisation considering the use of index-linked contracts,” said Drewry’s freight rate research manager Martin Dixon.

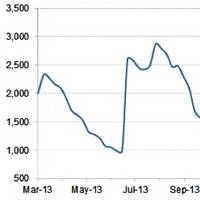

East-West Freight Rates Remain Down After Chinese New Year

Following three consecutive months of price rises, freight rates on the East-West trades declined in February, according to Drewry’s online Container Freight Rate Insight. Rates came under most pressure on the Asia-Europe trade, which weakened following a meteoric rise in the run-up to the Chinese New Year. Drewry’s Asia-Europe Westbound Freight Rate Index dropped 12% in February to $2,992 per 40ft container, while weekly data from the World Container Index assessed by Drewry indicates that the pricing erosion has continued into March.

Global Forwarders Favour Index-Linked Container Contracts

Index-linked contracts between shippers and carriers, and between shippers and forwarders, appear to be increasing for valid reasons, according to the latest edition of Drewry's Container Insight Weekly. According to Freight Investor Services, which specialises in helping contracting parties soften market volatility through hedging, shipper interest in Index-Linked Container Contracts (ILCCs) has increased significantly during the past 12 months. Most of the top 10 global forwarders now have quarterly ILCCs with shipping lines…

Index-Linked Container Contracts Webinar

Drewry & the World Container Index arrange an educational webinar on 5th December 2012 to explain how Index-Linked Container Contracts work . The webinar will examine the causes of recent container freight rate volatility and how index-linked contracts can help mitigate the impacts of such instability. It will explain how these new contracting arrangements work with reference to current models in use and will summarise the extent of industry adoption thus far. Persistent freight rate volatility is forcing container shipping to consider alternative forms of shipper-carrier contracting arrangements that enable the contract rate to vary relative to an external index. “Freight rate volatility will continue to be a feature of container shipping for some time to come,” added Dixon.