CMA CGM Records Mixed Q3 Results

The Board of Directors of CMA CGM Group, the world’s third largest container shipping group, met under the chairmanship of Jacques R. Saadé, Chairman and Chief Executive Officer, to review the financial statements for the third quarter 2013.

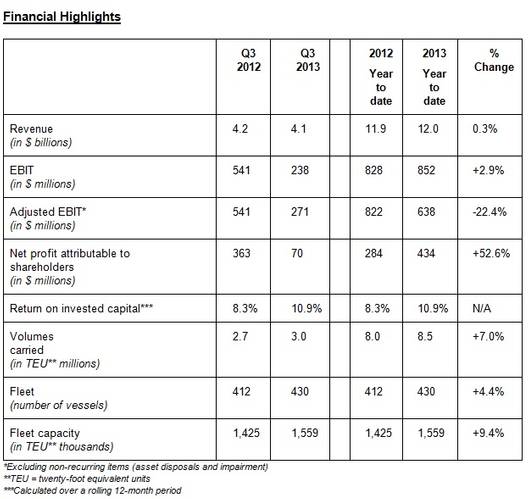

During the period, consolidated revenue amounted to $4.1 billion, up 1.4% over the second quarter and down 2.1% year-on-year. Volumes carried rose by 11% year-on-year to 3 million twenty-foot equivalent units (TEUs), a new historical record for the Group. The average revenue per TEU declined by 11.8% year on year, when Asia-Northern Europe market rates, as measured by the SCFI, contracted by more than 45% over the quarter.

This performance in terms of volumes and price resistance illustrates CMA CGM’s resilience in a market that remains extremely volatile. The group is evidencing the benefits derived from its size and global presence, which are enabling it to diversify its activities by geography, customer category and service solution, particularly in its onshore operations.

During the third quarter, CMA CGM reported

- $238 million in consolidated EBIT, versus $541 million in the third-quarter 2012. Excluding non-recurring items, core EBIT stood at $271 million for the period.

- A 6.6% EBIT margin before non-recurring items, one of the highest in the industry.

- $70 million in consolidated net profit for the period, bringing the total to $434 million for the first nine months of the year.

Business in the third quarter contributed to maintaining consolidated cash and cash equivalents at nearly $1.1 billion. Net debt amounted to $3.7 billion as of September 30, for a gearing ratio of 0.77.

Significant events during the quarter

As part of their future P3 operational alliance, CMA CGM, Maersk Line and MSC Mediterranean Shipping Company SA finalized their operating agreements on the Asia-Europe, Transatlantic and Transpacific trades. As announced, subject to the approval by the various regulatory authorities, these services will be deployed in second-quarter 2014.

CMA CGM has signed a strategic contract with SAP to implement a new information system dedicated to container shipping that will be deployed starting late 2015. This investment will enable the Group to improve its operating performance.

Outlook for 2013

To further strengthen the Group’s liquidity position, an additional $200 million securitization program was set up in October 2013.

Lastly, Moody’s has upgraded the Group’s rating to B2 with a stable outlook.

Given the usual year-end seasonal variations and currently prevailing freight rates, performance in the final three months of the year will likely see a decline compared with the third quarter 2013.