MHI Reports $586M Loss on Cruise Ship Builds

Mitsubishi Heavy Industries, Ltd. (MHI) booked an extraordinary loss of approximately 60 billion yen (roughly $586 million USD) on the build of two cruise ships as a loss provision related to the construction work in its consolidated financial results for fiscal year (FY) 2013 (ending March 31, 2014).

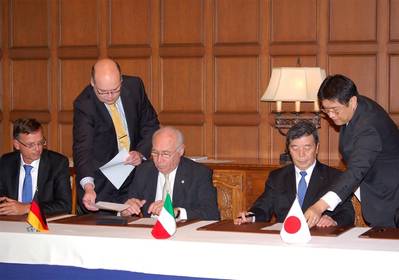

In November 2011, MHI received an order for two large-sized cruise ships for the AIDA Cruises brand, a company that belongs to the COSTA Group, a European subsidiary of Carnival Corporation & plc. The original order was for two ships of 124,500 gross tonnage with capacity to carry approximately 3,300 passengers, for delivery in spring 2015 and spring 2016 from MHI's shipyard in Nagasaki.

Based on its previous experience building cruise ships, the company set up a project to facilitate prompt implementation of measures necessary for the newly ordered ships' construction. Also, the company, because it views the two ships as next-generation energy-efficient cruise vessels that will function as a prototype for the AIDA Cruises brand, accordingly allotted a proportionate amount of time to handling the pre-construction details. Construction of the first of the two vessels got under way in June 2013.

The foregoing initiatives notwithstanding, as work proceeded in the actual construction phase of the project, difficulties involved in the construction of the prototype became evident, MHI said. Moreover, the volume of design work relating to the cruise ships cabins and other areas has been vast and significant design changes have been made, with the combined result of a delay in the design work. The delay has translated not only to increased design costs but also to negative factors in terms of additional material procurement, construction schedule, etc.; and these adverse influences have eroded the originally planned cost structure.

MHI said it won’t change the company's current earnings forecasts for FY2013 announced on February 6, but should it be determined that any revisions are necessary, the company will make announcements as necessary.

mhi-global.com