Star Bulk 1Q Results

Star Bulk Carriers Corp. (Nasdaq: SBLK), a global shipping company focusing on transportation of dry bulk cargoes, announced its unaudited financial and operating results for the three month period ended March 31, 2009.

First Quarter 2009 Highlights

• For the first quarter of 2009, net income was $22.5 million versus net income of $16.7 million for the first quarter of 2008, an increase of approximately 34%.

• For the first quarter of 2009, total revenue was $45.1 million versus total revenue of $41.7 million for the first quarter of 2008, an increase of approximately 8%.

• Earnings per share, basic and diluted for the first quarter of 2009 were $0.37 based on a weighted average of 60,390,219 shares outstanding, basic and diluted.

• Earnings per share, basic and diluted for the first quarter of 2009 were $0.16, excluding non- cash items.

• EBITDA for the first quarter of 2009 was $40.8 million. Adjusted EBITDA for the same period excluding all the above was $27.8 million.

Akis Tsirigakis, President and CEO of Star Bulk said, "We are pleased to report our sixth consecutive profitable quarter. We are also satisfied that with the consistent implementation of our strategy we have achieved, what we believe is the most balanced business model within our peer group, in terms of balance sheet strength, debt level, contract coverage, first-year growth and revenue per dollar invested while steering clear of newbuilding orders. With a current cash position in excess of $73 million, coupled with the Shelf Registration we filed earlier in 2009 for up to $250 million and our relatively modest debt level, we are well positioned to take advantage of opportunities.

Since the beginning of the year, we have been able to further enhance the revenue visibility of our fleet by entering into new or amended employment agreements for ten of our vessels as well as into index-based profit sharing arrangements for three of our vessels enabling us to share into the potential market upside. As of today, we have secured over $425 million in contracted revenue with 100% of our fleet operating days for 2009 contracted, 71% for 2010 and 42% for 2011.

Finally, I would like to mention that we have closed all of our FFA positions which in the past we utilized as a hedge given that presently all of our vessels are under time charter contract."

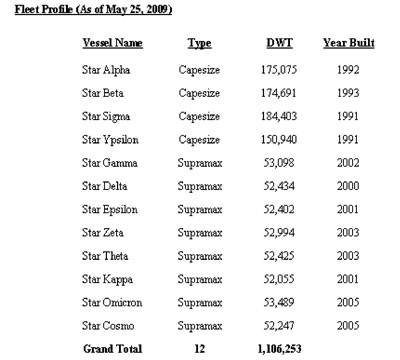

George Syllantavos, Chief Financial Offer of Star Bulk said, "As of March 31, 2009, our senior debt stands at $284.5 million; the remaining principal debt repayments in 2009 are about $35 million and for 2010, $59 million. With 100% of our fleet locked in on long term contracts for the remainder of 2009 we expect our cash position to grow further enhancing our solid balance sheet. We generate in excess of $9,000 per vessel per day over the daily breakeven of $23,350 which translates into an average of $108,000 per day for our fleet of twelve vessels indicative of our strong cash flow generation and profitability.

We recently announced that we have commenced in-house technical management of our fleet which will improve our cost structure going forward and aligns the company's financial, commercial and operational matters under our management."

For the quarter ended March 31, 2009, total revenues amounted to $45.1 million versus $41.7 million for the quarter ended March 31, 2008 mainly due to the operation of a larger fleet offset by lower charter rates achieved for some of our vessels. Operating income amounted to $25.2 million for the quarter ended March 31, 2009 compared to operating income of $17.7 million for the quarter ended March 31, 2008. Net Income for the first quarter of 2009 amounted to $22.5 million representing $0.37 earnings per share calculated on 60,390,219 weighted average number of shares. Net Income for the first quarter of 2008 amounting to $16.7 million represents $0.37 earnings per share calculated on 45,189,990 weighted average number of shares, basic and $0.34 earnings per share calculated on 49,827,425 weighted average number of shares, diluted .

The first quarter of 2009 net income figure includes the following non-cash items:

• Amortization of fair value of below/above market acquired time charters of $6.4 million, or $0.11 per basic and diluted share, attributable to the amortization of the fair value of time charters attached to vessels acquired, which are amortized over the remaining period of the time charter into revenue.

• A gain of $10.9 million or $0.18 per basic and diluted share associated with the gain on the time charter agreement termination which mainly relates to the unamortized fair value of below market acquired time charter on a vessel early redelivery date.

• Expenses of $1.5 million, or $0.02 per basic and diluted share relating to the amortization of stock based compensation recognized in connection with the 1,385,000 restricted shares (vested and unvested) issued to directors and employees.

• An unrealized loss of $2.8 million or $0.05 per basic and diluted share associated with the mark-to-market valuation of the Company's Forward Freight Agreements.

The first quarter of 2008 net income figure includes the following non-cash items:

• Amortization of fair value of below/above market acquired time charters of $17.9 million, or $0.40 and $0.36 per basic and diluted share, respectively, attributable to the amortization of the fair value of time charters attached to vessels acquired, which are amortized over the remaining period of the time charter into revenue.

• Expenses of $1.4 million, or $0.03 per basic and diluted share relating to the amortization of stock based compensation recognized in connection with the 165,000 restricted shares (vested and unvested) issued to directors and employees.

• Vessel impairment loss of $4.1 million, or $0.09 per basic and $0.08 per diluted share, in connection with the sale of the vessel Star Iota.

EBITDA for the first quarter of 2009 was $40.8 million as compared to $26.6 million for the quarter ended March 31, 2008. Adjusted EBITDA for the first quarter of 2009 and 2008 excluding all the above items was $27.8 million and $10.1 million respectively. A reconciliation of EBITDA and adjusted EBITDA to net cash provided by cash flows from operating activities is set forth below.

An average of 12 and 8.1 vessels were owned and operated during the first quarter of 2009 and 2008, respectively, earning an average Time Charter Equivalent, or TCE rate of $35,158 per day and $35,767 per day, respectively. We refer you to the information under the heading "Summary of Selected Data" later in this release for further information regarding our calculation of TCE rate.

Total expenses increased to $31.1 million for the three month period ended March 31, 2009 compared to $24.0 million for the three-month period ended March 31, 2008 due to higher vessel operating and voyage expenses and depreciation related to the operation of a larger fleet. Vessel operating expenses were $6.7 million for the first quarter of 2009 compared to $4.6 million for the same period last year. The increase in vessel operating expenses was due to the operation of a larger fleet, higher crewing and insurance expenses.

Depreciation expenses increased approximately 76% to $15.7 million for the first quarter of 2009 from $8.9 million for the first quarter of 2008 mainly due to the growth of our fleet. General and administrative expenses amounted to $2.9 million for the quarter ended March 31, 2009 and $2.8 million for the quarter ended March 31, 2008, respectively. Therefore, on per vessel and per day basis, general and administrative expenses decreased by approximately 31%. This decrease is mainly due to the increase in the number of vessels during the three month period ended March 31, 2009.

Net cash provided by operating activities for the three months ended March 31, 2009 and 2008, was $24.6 million and $16.8 million, respectively. Net cash provided by operating activities for the three month period ended March 31, 2009 was primarily a result of recorded net income of $22.5 million, adjusted for depreciation of $15.7 million and fair value of derivatives of $2.8 million, offset by amortization of fair value of below/above market acquired time charter agreements of $6.4 million and non- cash gain on time charter agreement termination of $10.9 million. Net cash provided by operating activities for the three months ended March 31, 2008 was primarily a result of recorded net income of $16.7 million, adjusted for depreciation and the vessel impairment loss related to the sell of vessel Star Iota of $12.9 million offset by the amortization of fair value of below/above market acquired time charter agreements of $17.9 million.

Net cash used in investing activities for the three months ended March 31, 2009 and 2008, was $20.0million and $143.0 million, respectively. For the three month period ended March 31, 2009, there was no actual cash used in investing activities due to the lack of acquisitions and/or sales of vessels during the period, although, there was an increase in restricted cash of $20.0 million related to waivers obtained for the existing loan agreements. For the three months ended March 31, 2008 the cash used in investing activities related mainly to the payment of the cash consideration of $115.7 million due to the delivery of the remaining five vessels of our initial fleet, the payment of $17.3 million representing the 10% of the purchase price of the vessels Star Omicron and Star Sigma and $10.0 million related to the increase in restricted cash.

Net cash used in financing activities for the three months ended March 31, 2009 was $10.1 million as compared to $146.9 million of net cash provided by financing activities for the three months ended March 31, 2008. For the three months ended March 31, 2009, net cash used in financing activities consisted of the payments of loan installments amounting to $12.0 million offset by cash provided from our Director's dividend reinvestment of $1.9 million. For the quarter ended March 31, 2008, net cash provided by financing activities consisted of the drawdown of $120.0 million related to our loan facilities and the proceeds from exercise of warrants of $32.8 million mainly offset by the payment of cash dividends of $4.6 million.