Crude oil prices bolted higher early last week as traders returned from a long holiday weekend to indications that exporting countries may extend the supply cuts which have helped double petroleum prices this year.

Crude oil for delivery in February closed 46 cents higher at $26.33 a barrel on the New York Mercantile Exchange, but still failed to lift shares of companies such as Exxon Mobil Corp. and Chevron Corp. in stock market trading.

Indeed, the Standard & Poor's index of international oil companies dropped 30.77 points, or more than three percent, to 950.48, while the broader S&P 500 lost 1.24 points, or 0.09 percent, to 1,457.10.

In a quiet U.S. oil futures market following the holiday weekend - London's International Petroleum Exchange was closed - traders were greeted with indications from Iran's oil minister that current production cuts could be extended past their scheduled expiration this spring.

Iran's Bijan Zanganeh said Monday that the Organization of Petroleum Exporting Countries would probably agree to extend their supply cuts for another three to six months at their March meeting.

Iran's statements follows last week's comments by Mexican Energy Minister Luis Tellez that non-OPEC Mexico - which has been a key component to producers' newly found cooperation - may be ready to team with other major exporters to extend the cutback packages through next year.

"I believe there is the will in all the countries who are in agreement to continue, if necessary, with a policy of supply management through the whole of 2000," Tellez said last week.

Freezing weather also gave a boost Monday to heating oil futures, which gained 1.24 cents to 69.75 cents a gallon.

Featured videos

Taking the First Step Toward Autonomy

Send in the Drones (to deep, dark, confined maritime spaces)

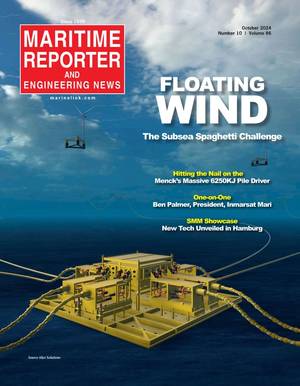

October 2024

Read the Magazine

Read the Magazine

Read the Magazine

Read the Magazine

This issue sponsored by:

Svendborg Brakes' Yaw Brake Solution Transforms Wind Turbine Maintenance

Subscribe for

Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week