Shell Updates 2013 Reults

Royal Dutch Shell plc has updated its expected 2013 results. Fourth quarter 2013 figures, which are expected to be published on January 30, 2014 , are expected to be significantly lower than recent levels of profitability, considering current oil and gas prices and the downstream oil products industry environment.

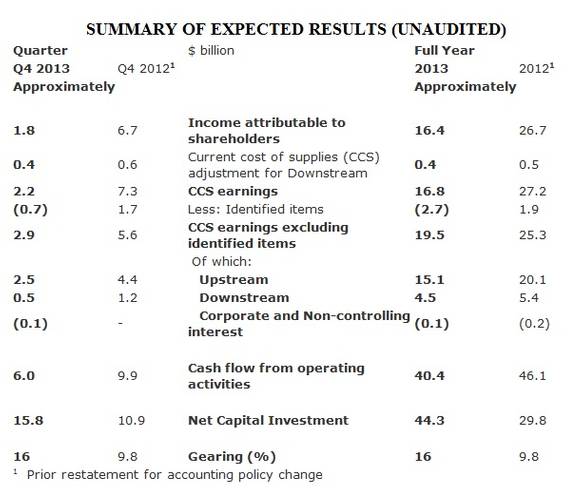

Shell’s fourth quarter 2013 earnings on a current cost of supplies (CCS) basis excluding identified items are expected to be approximately $2.9 billion and were impacted by weak industry conditions in downstream oil products, higher exploration expenses and lower upstream volumes.

Chief Executive Officer Ben van Beurden commented, “Our 2013 performance was not what I expect from Shell. Our focus will be on improving Shell’s financial results, achieving better capital efficiency and on continuing to strengthen our operational performance and project delivery.”

When Shell announces its results on January 30, 2014, fourth quarter 2013 CCS earnings are expected to be approximately $2.2 billion, and full year 2013 CCS earnings are expected to be approximately $16.8 billion.

Fourth quarter 2013 identified items are expected to be a net charge of approximately $0.7 billion, mainly reflecting impairments in Upstream. Full year 2013 identified items are expected to be a net charge of approximately $2.7 billion, also mainly reflecting impairments in Upstream.

Excluding identified items, fourth quarter 2013 CCS earnings are expected to be approximately $2.9 billion, reflecting lower results in each of Upstream, Downstream and Corporate compared with the fourth quarter 2012.

Full year 2013 CCS earnings excluding identified items are expected to be approximately $19.5 billion, reflecting lower results in both Upstream and Downstream compared with the full year 2012.

Compared with the fourth quarter 2012, Upstream earnings excluding identified items were impacted by higher exploration expenses and lower volumes. A high level of maintenance activity during the fourth quarter 2013 affected high value oil and gas production volumes, including gas-to-liquids, as well as LNG sales volumes. Earnings were also impacted by the weakening of the Australian dollar. Upstream Americas continued to incur a loss. The security situation in Nigeria remained challenging.

Compared with the fourth quarter 2012, Downstream CCS earnings excluding identified items were mainly impacted by significantly weaker industry refining conditions, in particular in Asia Pacific and Europe. Marketing and trading contributions were lower. Chemicals earnings increased as a result of improved industry conditions and operating performance.

Cash flow from operating activities for the fourth quarter 2013 is expected to be approximately $6.0 billion. Full year 2013 cash flow from operating activities is expected to be approximately $40.4 billion.

Excluding working capital movements, cash flow from operating activities for the fourth quarter 2013 is expected to be approximately $7.7 billion, and approximately $37.5 billion for the full year 2013.

Net capital investment (see Note 1) for the fourth quarter 2013 is expected to be approximately $15.8 billion. Full year 2013 net capital investment is expected to be approximately $44.3 billion.

Gearing is expected to be approximately 16% at the end of 2013.

Shell’s fourth quarter and full year 2013 results and fourth quarter 2013 dividend are scheduled to be announced on January 30, 2014. Shell’s annual Management Day is scheduled for March 13, 2014 in London, United Kingdom, and will also be webcast on www.shell.com/investor. On March 17, 2014 a Management Day will be held in New York, United States.