Great Lakes Iron Ore Trade Down 5.6%

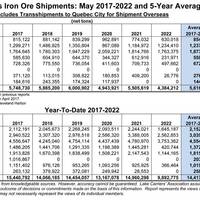

Shipments of iron ore from U.S. ports on the Great Lakes totaled 5.1 million tons in September, a decrease of 5.6% compared to a year ago, the Lake Carriers' Association (LCA) said on Tuesday. Shipments were below the month’s five-year average by 6.5%.Year-to-date the iron ore trade stands at 29.2 million tons, a decrease of nearly 21.8% compared to the same point in 2021, according to latest figures from LCA.Through September iron ore loadings are 20.1% below their five-year average for the first three quarters, LCA.

Lakes Limestone Trade Down 3.7% in September

Shipments of limestone on the Great Lakes totaled 3.5 million tons in September, a decrease of 3.7% compared to a year ago, according to latest figures published by the Lake Carriers' Association (LCA). Limestone cargos were below the month’s five-year average by 2.7%.Loadings from U.S. quarries totaled 2.9 million tons, a decrease of 5.4% from 2021, while shipments from Canadian quarries totaled 675,023 tons, a decrease of 1.3%, LCA said.Year-to-date the limestone trade stands at 21.1 million tons, a near match compared to a year ago, LCA said.

Great Lakes Iron Ore Trade Down in July

Shipments of iron ore on the Great Lakes totaled 5.3 million tons in July, a decrease of 6.8% compared to a year ago, according to trade group the Lake Carriers’ Association (LCA). Shipments were also 6.3% below the month’s 5-year average, LCA said.Year-to-date the iron ore trade stands at 19.1 million tons, a decrease of 27.8% compared to the same point in 2021, LCA said. Iron ore shipments are 25.5% below their 5-year average for the first seven months of the year.

Great Lakes Iron Ore Trade Down 20.4% in May

Shipments of iron ore from U.S. Great Lakes ports totaled 4.4 million tons in May, a decrease of 20.4% compared to a year ago and 21.9% below the month’s five-year average, the Lake Carriers’ Association (LCA) reported.Year-to-date the iron ore trade stands at 9.9 million tons, a decrease of 33.9% compared to the same point in 2021, LCA said. Iron ore shipments were also 31.4 % below their five-year average for five months of the year.

Container Shipping Looks Strong in 2021 - BIMCO

In the full year of 2020, global container shipping volumes fell by 1.2% compared with 2019, much less than feared even before the pandemic was first declared, and much recovered compared with the 6.8% drop recorded in the first six months of the year. Volumes in the second half of the year were up 4.2% from 2019. Much of this growth was concentrated on just a few trade lanes, with congestion and imbalances on these spilling out and causing disruption on other trades.BIMCO expects that 2021 will be even better for container shipping than 2020…

Oil Dips as U.S. Rigs, Refiners Appear to Have Avoided Worst of Storm

Oil prices fell in early trade on Friday as a massive hurricane raced inland past the heart of the U.S. oil industry in Louisiana and Texas, with a storm surge weaker than predicted.U.S. West Texas Intermediate (WTI) crude futures fell 16 cents, or 0.4%, to $42.85 a barrel as of 0014 GMT, adding to overnight losses.Brent crude futures for October, set to expire on Friday, fell 9 cents, or 0.2%, to $45.00 a barrel, while the more active November contract slipped 7 cents to $45.53.Hurricane Laura hit Louisiana early Thursday with 150 mile-per-hour (240 kph) winds…

Great Lakes Iron Ore Trade Down 5.7% in June

Shipments of iron ore on the Great Lakes totaled 5.7 million tons in June, a decrease of 5.7 percent from 2018. Shipments were, however, nearly even with the month’s 5-year average, said a release from Lake Carriers’ Association.Year-to-date the iron ore trade stands at 20.19 million tons, almost matching the previous year’s total of 20.15 million tons.Iron shipments are ahead of their 5-year average for the first half of the year. Loadings have increased more than 840,000 tons.Lake…

Great Lakes Limestone Trade Down 9% in 2016

Shipments of limestone on the Great Lakes totaled 26.3 million tons in 2016, a decrease of 9.3 percent compared to 2015, reported Lake Carriers’ Association (LCA). Loadings in 2016 were also 5.3 percent below the trade’s five-year average. Loadings from U.S. quarries totaled 21.4 million tons, a decrease of nearly 13 percent compared to 2015, according to LCA. Shipments from U.S. quarries also trailed their five-year average by 8.6 percent. Shipments from Canadian quarries totaled 5 million tons…

Great Lakes Limestone Trade Down in November

Shipments of limestone on the Great Lakes totaled 2.5 million tons in November, a decrease of 16.8 percent compared to a year ago, the Lake Carriers’ Association (LCA) reported. November’s loadings were also 15.1 percent below the month’s five-year average. Loadings from U.S. quarries totaled 2.1 million tons, a decrease of 16.2 percent compared to a year ago, while shipments from Canadian quarries totaled 406,000 tons, a decrease of 19.3 percent, LCA said. Year-to-date the Lakes limestone trade stands at 25.3 million tons, a decrease of 8.3 percent compared to a year ago.

GE to Merge Oil & Gas Unit with Baker Hughes

General Electric Co said on Monday it would merge its oil and gas business with Baker Hughes Inc, creating the world's second-largest oilfield services provider as competition heats up to supply more-efficient products and services to the energy industry after several years of low crude prices. The deal to create a company with $32 billion in annual revenue will combine GE's strengths in making equipment long-prized by oil producers with Baker Hughes's expertise in drilling and fracking new wells. Shares of Baker Hughes were down nearly 7 percent, a drop that executives said likely was due to the deal's complicated structure. GE is already the world's largest oilfield equipment maker, supplying blowout preventers, pumps and compressors used in exploration and production.

Great Lakes Iron Ore Trade Down in September

Shipments of iron ore on the Great Lakes and St. Lawrence Seaway totaled 5,258,269 tons in September, a decrease of 5.6 percent compared to a year ago, the Lake Carriers’ Association reported. Shipments trailed the month’s five-year average by even more, 15.3 percent. Shipments from U.S. Great Lakes ports totaled 4,916,787 tons in September, an increase of 60,544 tons, or roughly one load in a 1,000-foot-long U.S.-flag laker. However, loadings at Canadian terminals in the Seaway fell 52 percent to just 341,482 tons.

Great Lakes Limestone Trade Down 18% in July

Shipments of limestone on the Great Lakes totaled 3,348,040 tons in July, a decrease of 18 percent compared to a year ago, according to the Lakes Carriers’ Association (LCA). July’s loadings were also 14 percent below the month’s five-year average. Loadings out of U.S. quarries totaled 2.6 million tons, a decrease of 26 percent compared to a year ago., while shipments from Canadian quarries totaled 760,000 tons, an increase of 35 percent compared to a year ago, LCA said. Year-to-date the Lakes limestone trade stands at 13.1 million tons, a decrease of 6 percent compared to a year ago.

Great Lakes Limestone Trade Down in June

Shipments of limestone on the Great Lakes totaled 3.7 million tons in June, a decrease of 7.8 percent compared to a year ago, and slightly below the month’s five-year average, the Lake Carriers’ Association (LCA) reports. Loadings out of U.S. quarries totaled 2,948,189 tons, a decrease of 10 percent compared to a year ago, while shipments from Canadian quarries totaled 780,907 tons, an increase of 16,770 tons, or roughly one load in a river-class laker, LCA said. Year-to-date the Lakes limestone trade stands at 9.8 million tons, a decrease of 1 percent compared to a year ago, according to LCA.

Great Lakes Iron Ore Trade Down in September

Iron ore shipments on the Great Lakes totaled 5.6 million tons in September, a decrease of 20.6 percent compared to a year ago, the Lake Carriers' Association (LCA) reported. Shipments were down 11 percent from the month’s five-year average. Loadings at U.S. ports in September fell 25.5 percent compared to a year ago, while shipments from Canadian ports rose 42.8 percent. Through September, the Lakes/Seaway ore trade stands at 39.1 million tons, a decrease of 4 percent compared to the same point in 2014.

Ecopetrol Breaks Silence in Risk-on Day for LatAm Markets

A recovery in LatAm debt spreads opened a window for Colombia's Ecopetrol on Tuesday when it printed a US$1.5bn 11-year bond - the state-owned oil company's first debt issue in nine months. Optimism over Greek debt talks spurred risk buying on Tuesday, leaving LatAm debt spreads tightening against a weaker US Treasury market, and also benefiting the oil credit that has received a battering in secondary this year. "We are trading well today and are tighter across most credit spreads," said a New York based trader focused on Latin American credits. Even with Heinz's jumbo US$10bn multi-tranche deal in the US high-grade market, Ecopetrol came on a relatively quiet day in the primary market, leaving the runway open for the Colombian borrower.

Great Lakes Limestone Trade Down in June

Shipments of limestone on the Great Lakes total 7,952,201 tons through June, a decrease of 14.7 percent compared to the same point in 2013. The decrease is even slightly larger when compared to the trade’s long-term average through June: 16.2 percent. Loadings out of U.S. quarries stand at 6.8 million tons through the second quarter, a decrease of 15.7 percent. Shipments from Canadian quarries total 1.1 million tons, a decrease of 8.6 percent. The totals are testimony to the effects of the brutal winter of 2013/2014.

Lakes Iron Ore Trade Down 17% at Midyear

The Lake Carriers' Association reported that iron ore shipments on the Great Lakes total 19.2 million tons through the end of June, a 17 percent decrease from a year ago and the trade’s long-term average. Higher water levels have not been able to offset the interminable delays suffered during the winter of 2013/2014. Shipments from U.S. ports through the second quarter stand at 16.8 million tons, a decrease of nearly 19 percent compared to a year ago. While several cargos in June topped 69…

Great Lakes Coal Trade Down 2.8% in 2013

Shipments of coal on the Great Lakes totaled 24.6 million tons in 2013, a decrease of 2.8 percent compared to 2012. Some of the decrease can be attributed to the early onset of winter in December, which lead to a 17-percent decrease in loadings on Lake Superior. Individual cargos were further reduced toward the end of the month when vessels voluntarily lightened their drafts to ease transits through an ice-clogged stretch of the St. Marys River that connects Lake Superior to the lower Great Lakes. One 1,000-foot-long vessel experienced a 4,474-ton reduction in payload when its first and last cargos of December were compared. For the year, coal loadings at Lake Superior terminals totaled 15 million tons, a decrease of 62,000 tons compared to 2012.

Lakes Stone Trade Down 5.8% in June

Shipments of limestone on the Great Lakes totaled 3.6 million tons in June, a slight increase over May (80,000 tons), but a decrease of 5.8% compared to a year ago. Shipments were also down 7.5% from June’s total in recent years. Shipments from U.S. ports totaled 3.1 million tons, a decrease of 2.8% compared to a year ago, and loadings at Canadian quarries dipped by more than 21%. Year-to-date the Lakes limestone trade stands at 9.3 million tons, a decrease of 6.4% compared to a year ago, and 7.7% below the average for the January-June timeframe in recent years. lcaships.com

Great Lakes Iron Ore Trade Down 9% in August

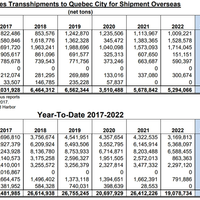

Shipments of iron ore on the Great Lakes totaled 5.8 million tons in August, a decrease of 10% compared to July, and a drop of 9% compared to a year ago. Loadings also trailed the month’s long-term average by 10%. Shipments from U.S. ports totaled 5.1 million tons, a decrease of 6% compared to a year ago. The August total included 447,000 tons shipped to Québec City for loading into oceangoing vessels and delivery overseas. Year-to-date overseas exports from U.S. Great Lakes ports total 1,994,000 tons. Shipments from Canadian ports to Great Lakes destinations totaled 728,000 tons, a decrease of 24% compared to a year ago. Year-to-date, the Lakes iron ore trade stands at 35.4 million tons, a decrease of 8% compared to a year ago.

Great Lakes Coal Trade Down 7.3% in November

Shipments of coal on the Great Lakes totaled 2.7 million tons in November, a decrease of 7.3 percent compared to a year ago, and well below – 35.2 percent – the month’s long-term average. Shipments were also 4.1 percent less than October’s tally of 2.8 million tons. Shipments from Lake Superior ports totaled 1.6 million tons, a decrease of 9.2 percent compared to a year ago. Coal transshipped from Superior, Wisconsin, to Québec City, Québec, for loading into oceangoing colliers totaled 129,000 tons. Exports to Europe from Superior total 1,504,000 tons through November. In 2012, Superior’s overseas exports for the same period totaled 1,252,000 tons. Loadings in Chicago totaled 314,000 tons, a decrease of 11.6 percent compared to a year ago.

Great Lakes Iron Ore Trade Down 5.3% in 2013

Shipments of iron ore on the Great Lakes totaled 58.3 million tons in 2013, a decrease of 5.3 percent from 2012. While the trade had been slightly behind 2012’s pace through November, the gap grew significantly when an early and harsh start to winter limited shipments to 5.1 million tons in December, a decrease of 20 percent compared to a year ago. There were weather-related delays at loadings docks and vessels were either slowed by or beset in heavy ice. Shipments from U.S. Great Lakes ports totaled 51.8 million tons in 2013, a decrease of 3.5 percent compared to a year ago. December loadings were again almost 20 below the level of a year ago.

2013 Great Lakes Iron Ore Trade Down 5.3%

Shipments of iron ore on the Great Lakes totaled 58.3 million tons in 2013, a decrease of 5.3 percent from 2012. While the trade had been slightly behind 2012’s pace through November, the gap grew significantly when an early and harsh start to winter limited shipments to 5.1 million tons in December, a decrease of 20 percent compared to a year ago. There were weather-related delays at loadings docks and vessels were either slowed by or beset in heavy ice. Shipments from U.S. Great Lakes ports totaled 51.8 million tons in 2013, a decrease of 3.5 percent compared to a year ago. December loadings were again almost 20 below the level of a year ago.