No improvement in the market and no change in the behaviour of South Korean yards, says fifth Commission report on world shipbuilding

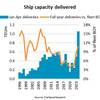

The world shipbuilding market continues to face serious difficulties, while certain South Korean yards are still pricing ships below cost, notes the European Commission's latest (fifth) report on world shipbuilding, adopted today. World ship prices are still being depressed by excess supply, due to past expansion of yards mainly in Korea. New orders did reach an historic high in 2000, bringing a brief price recovery, but then sank substantially in 2001, taking prices with them, in the wake of US recession and the effects of the September 11 terrorist attacks on demand for sea trade and cruises respectively. Declining orders for container ships and cruise ships cut the market shares of both Korea and the EU, which are particularly strong in these segments.

The fifth report confirms its predecessors' findings that this world market suffers from a serious imbalance of supply and demand, leading to very low prices offered mainly by Korean yards in most market segments. In some cases, the resulting losses have been offset by financial restructuring which, in the view of the Commission, is not in line with the relevant World Trade Organisation (WTO) rules.

The only increase in absolute order volume last year was in the (niche) market for liquified natural gas carriers (LNG). Korean yards took 79% of new LNG carrier orders in 2001, even though they have no patents on the requisite key technologies. Market analysis suggests they gained their LNG market share (now 65% of the world order book), through very low offer prices and their ability to supply large numbers of vessels at an early delivery date.

Detailed cost investigations by the Commission show that some Korean yards are still pricing ships below cost, and that most managed to show a profit for 2001, thanks to high sales volumes, advance payments, and one-off measures to improve their financial position.

South Korean yards remain a major player in the world market, despite a small decline in their market share of new orders (from 36% in 2000 down to 30% in 2001). The Commission will continue its market monitoring and cost investigations and report its findings to the Council as required by Article 12 of Regulation (EC) N° 1540/98.

Sponsored Content

GLO Marine: Acting as a Vessel Upgrade Department in the hybridization of the MV Mygan.

Avid Controls Pledges Lifetime Support for MV3000 Line

Subscribe for

Maritime Reporter E-News

Maritime Reporter E-News is the maritime industry's largest circulation and most authoritative ENews Service, delivered to your Email five times per week