Crude Oil Tanker Earnings Drop 68% in Nine Days -BIMCO

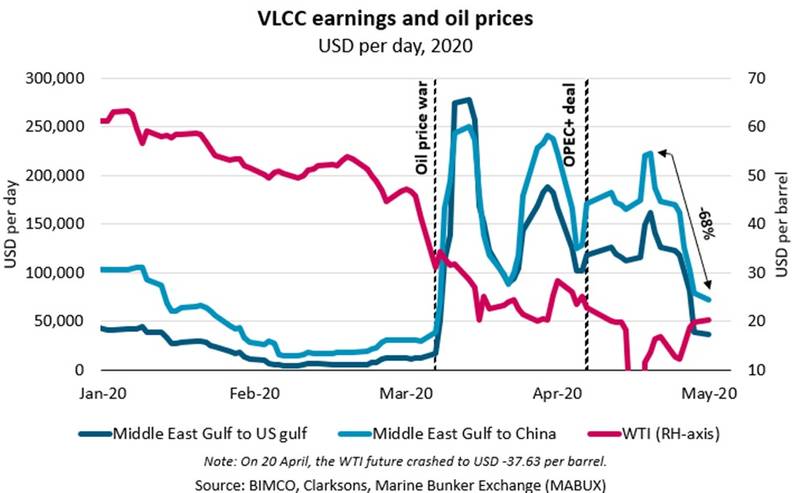

Crude oil tanker earnings have come down sharply in recent weeks with very large crude carrier (VLCC) earnings from the Middle East Gulf to China dropping 68% in just nine days (from $222,591 per day on April 22 to $71,885 per day on May 4), according to BIMCO. In the same period, daily VLCC earnings from the Middle East Gulf to the U.S. Gulf have plunged nearly 80% (from $162,433 per day to $36,249).

The window of extraordinary earnings closed at the end of April with the OPEC+ oil production cuts of 9.7 million barrels per day (bpd) on May 1, reducing the flood of oil in the market. The tanker market is now challenged by a collapse in oil demand as a result of the coronavirus outbreak.

The oil supply and demand shocks of 2020

The oil tanker market has enjoyed a paradise of profitability, but very much on borrowed time since the outbreak of the oil price war. As the oil supply shock abates, the effect of the unprecedented oil demand shock, estimated to be a drop of 23.1 million bpd in the second quarter (source: IEA), will set in.

Perhaps, second only to a coronavirus vaccine, oil storage has been the most sought-after item in recent months. This has been reflected in the skyrocketing crude oil tanker time-charter rates brought about by oil suppliers and traders seeking to charter ships for floating storage.

The uptick in floating storage in 2020, temporarily removing capacity from the market, is not expected to provide a silver lining that can offset the faltering demand and overcapacity. One can only hope that the strong earnings have fortified the cash reserves of oil tanker companies for the treacherous months that lie ahead.