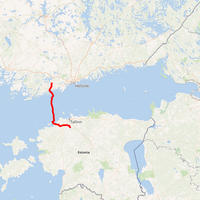

Finland-Estonia Gas Pipeline System to Get Bigger Capacity after Repair

The Balticconnector gas pipeline between Finland and Estonia, which was damaged last month, will get a bigger northbound transmission capacity next year following repairs, Finnish operator Gasgrid said in a statement on Wednesday.The increase will come from an enhancement of the Latvia-Lithuania interconnection, which allows for higher gas volumes to be transported around the Finnish-Baltic region, it added.The pipeline will in the future get a base capacity of 70.5 gigawatt hours of gas per day in the direction from Estonia to Finland…

Partners to Expand Pakistan LNG Inport Terminal

Excelerate Energy announced it has agreed with partner Engro Elengy Terminal Ltd. (EETL) to expand the EETL liquefied natural gas (LNG) import terminal in Port Qasim, Pakistan.Under the heads of agreement (HOA), Excelerate will exchange its existing floating storage and regasification unit (FSRU) Exquisite with a newbuild FSRU, Hull 2477, which is currently under construction at South Korea's Daewoo Shipbuilding and Marine Engineering (DSME) shipyard and due to be delivered in April 2020.

Poland Ends Major Russian LNG Contract

Poland's state gas company PGNiG says it had notified Russia's Gazprom that it will not renew their long-term deal on liquefied natural gas (LNG) supplies when the agreement expires after 2022.In accordance with the provisions of the Yamal Contract, three years prior to its original termination date, i.e. by December 31st, 2019, the parties are required to submit a declaration whether or not they intend to continue their contractual relationship beyond 2022.Gazprom Export, the gas-exporting arm of state-controlled Gazprom, confirmed in a statement to Reuters that it had received the notification from PGNiG.“In line with the Republic of Poland’s aspiration to achieve security of energy supplies and seeking to deliver the PGNiG Group’s current strategy…

W. Africa Crude-Freight costs ease, especially for VLCCs

Freight rates eased further on Friday, especially for the largest oil tankers, promising some recovery for West African oil prices which had touched multi-year lows. VLCC freight costs eased more rapidly than smaller Suezmaxes, making it less advantageous to ship on the latter. Prices for Suezmaxes were estimated around world scale 190-200, with one European buyer estimating further relief to around 150 by the end of next week.Nigeria's NNPC cut its November official selling price for Bonny Light crude to dated Brent plus 58 cents per barrel and for Qua Iboe to plus 63 cents per barrel…

Petrobras Sells TAG, Gets $8.7 bln

Brazilian state-run oil firm Petroleo Brasileiro SA (Petrobras) has concluded the sale of gas pipeline system Transportadora Associada de Gás S.A. (TAG) to a group led by France'sEngie SA and Canada'sCaisse De Depot Et Placement Du Quebec (CDPQ).According to a stock exchange annoucement, Petrobras received a total of 33.5 billion reais ($8.69 billion) from buyers on Thursday for the 90 percent stake it had in TAG.Petrobras will continue to use natural gas transportation services rendered by TAG, through contracts already in force between the two companies, with no impacts on its operations and the delivery of natural gas to its clients.This operation is in line with the company's portfolio optimization and improvement of its capital allocation…

Asian LNG Spot Prices Jump after European Gas Outages

Asian liquefied natural gas (LNG) spot prices jumped this week in reaction to volatile price spikes on European gas markets and ongoing demand from the region's major consumers. Spot prices for January delivery hit $10.50 per mmBtu, 40 cents above last week, with February prices seeing similar levels. In a tumultuous week, European gas prices gyrated wildly following a flurry of major pipeline and production outages coinciding with high demand and freezing weather. The rally began…

Gas Plant Fire Halts US Gulf Coast Platforms

At least two offshore oil platforms halted operations on Tuesday in the U.S. Gulf of Mexico after a fire at a natural gas processing plant in Mississippi shut a crucial pipeline that brings output onshore, several companies said. The fire at Enterprise Products Partners plant in Pascagoula was brought under control, but officials were still forced to close the 225-mile Destin gas pipeline system that can carry 1.2 billion cubic feet per day from offshore fields to Pascagoula. Destin, majority-owned by BP with Enbridge Inc a minority partner, said it was declaring force majeure, a legal clause that allows it to scrap commitments, as a result of the fire.

LNG Import Terminal Opens in Pakistan

On March 28, 2015, officials from Engro Corporation, Excelerate Energy and the Government of Pakistan were present for the inauguration of Pakistan's first LNG import terminal in Port Qasim. Located in a channel of the Indus River east of Karachi, the terminal is a result of a fast-track LNG import solution built to alleviate the energy shortage facing the country, and was brought into service 11 months from the start of construction. Utilizing Excelerate's floating storage and regasification vessel (FSRU), the Exquisite, the facility has the capacity to deliver up to 690 MMcf/d of natural gas directly to Sui Southern Gas Company's natural gas pipeline system. As part of the commissioning process, Exquisite loaded its first LNG cargo in Ras Laffan, Qatar, on March 24, 2015.

Trafigura Seeks Investors for Texas Shale Storage Terminal

Global trader Trafigura AG is seeking potential investors to buy a stake in its oil terminal and storage facility in Corpus Christi, Texas, a once-quiet port that has become a bustling hub for shipping Eagle Ford shale crude. Trafigura, which like other big commodity merchants has in recent years moved to buy key infrastructure assets to support its trading business, bought Texas Dock & Rail in early 2012, just as Eagle Ford production was emerging as the next big U.S. shale play after North Dakota's Bakken. It has since built the facility, once home to a failed steel plant, into a major gateway for shipping rapidly growing U.S. oil production as far as Canada, with two deepwater tanker berths and an expanding suite of logistical assets.

Severe Winter Boosts TransCanada Profit

TransCanada Corp, Canada's No.2 pipeline company and the backer of the Keystone XL pipeline, reported a 14 percent rise in adjusted quarterly profit as an unusually harsh winter in North America boosted demand for its pipelines. Delivery volumes rose 24 percent in the company's Canadian Mainline gas pipeline system and 14 percent in the NGTL system in Western Canada in the first three months of the year. "An unseasonably cold winter resulted in strong demand for our critical pipeline and power infrastructure assets," Chief Executive Officer Russ Girling said in a statement. Girling said the recently completed Keystone Gulf Coast crude pipeline betweenCushing, Oklahoma, and the U.S.

ConocoPhillips Signs Agreement with Freeport LNG

ConocoPhillips announced the signing of an agreement with Freeport LNG Development, L.P. to participate in its proposed liquefied natural gas (LNG) receiving terminal in Quintana, Texas. ConocoPhillips will acquire 1 billion cubic feet (BCF) per day of regasification capacity in the terminal for its use and obtain a 50 percent interest in the general partner managing the venture. ConocoPhillips will be primarily responsible for management of construction and operation of the facility, and provide a significant portion of construction funding. The management of Freeport LNG Development will remain in place and be responsible for all commercial activities and customer interface for the remaining capacity in the facility.

ConocoPhillips Signs Agreement with Freeport LNG

ConocoPhillips announced the signing of an agreement with Freeport LNG Development, L.P. to participate in its proposed liquefied natural gas (LNG) receiving terminal in Quintana, Texas. ConocoPhillips will acquire 1 billion cu. Ft. (BCF) per day of regasification capacity in the terminal for its use and obtain a 50 percent interest in the general partner managing the venture. ConocoPhillips will be primarily responsible for management of construction and operation of the facility, and provide a significant portion of construction funding. The management of Freeport LNG Development will remain in place and be responsible for all commercial activities and customer interface for the remaining capacity in the facility.

ConocoPhillips Finalizes Agreement with Freeport LNG

ConocoPhillips announced the finalization of its transaction with Freeport LNG Development, L.P. to participate in a proposed liquefied natural gas (LNG) receiving terminal in Quintana, Brazoria County, Texas. ConocoPhillips has acquired 1 billion cubic feet (BCF) per day of regasification capacity in the terminal, has obtained a 50 percent interest in the general partner managing the venture and will provide substantial construction funding to the venture. The terminal is designed with storage capacity of nearly 7 BCF and send-out capacity of 1.5 BCF per day. Natural gas will be transported through a 9.4-mile pipeline to Stratton Ridge, Texas, which is a major point of interconnection with the Texas intrastate gas pipeline system.

Contango Announces $383 M in LNG Financing and Update Operations

Contango Oil & Gas Company announced that Freeport LNG Development, L.P. (FLNG), in which Contango holds a 10 percent partnership interest, has closed a $383 million private placement note issuance. The funds from the notes will be used to fund the construction of Phase I of FLNG's liquefied natural gas regasification terminal located near Freeport, Texas. Phase I will have a send-out capacity of 1.75 billion cubic feet per day. Natural gas will be transported through a 9-mile pipeline to Stratton Ridge, Texas, a major point of interconnection with the Texas intrastate gas pipeline system. The terminal's Phase I capacity has been sold to ConocoPhillips and The Dow Chemical Company. Construction is expected to be completed by January 2008.