The main exporters of thermal coal for coal-fired power plants to the U.K. have experienced a heavy decline in seaborne cargo volumes in 2016. This comes as a result of the U.K. starting a concerning trend for the dry bulk shipping industry, by close to doubling its Carbon Price Floor (CPF), says the Baltic and International Maritime Council (BIMCO).

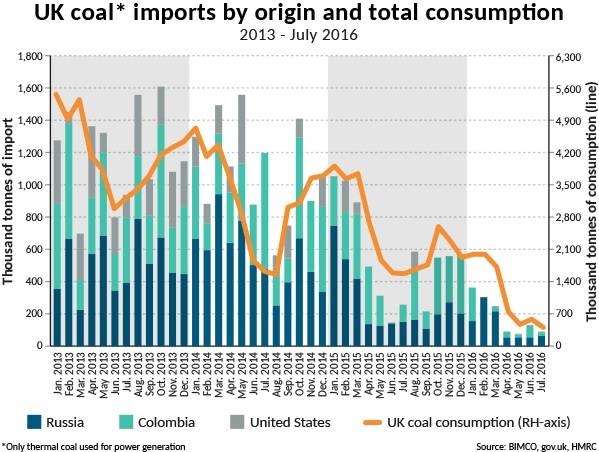

Russia, Colombia and the U.S. have been the top coal exporters to the U.K. for the previous three years. The long hauls from the U.S. and Colombia have historically been strong routes for the dry bulk industry, as they have provided a lot of tonnage miles. Since the U.K. increased their CPF to £18 per metric ton of CO2, the exports from the three main exporters during the first seven months have declined 69 percent compared to last year and the U.K. total import of coal for coal-fired power plants is down 64 percent for the same period.

Peter Sand, Chief Shipping Analyst at BIMCO, commented, “This is one of the most significant effects, which has impacted the demand side of the global dry bulk shipping industry in 2016. It reflects something bigger lurking beneath the surface of the coal industry and in transportation of this commodity.

“The declining trend in coal consumption in the U.K. is affecting the dry bulk industry negatively and this story will not be the only one,” Sand said.

U.K, carbon price floor increases coal price by 138 percent

When the CPF first came into effect in April 2013, it was based on the carbon price support (CPS) price per metric ton of CO2 on top of the EU emission trading system (ETS) rate per metric ton of CO2. At that time the CPS was £0.819 per Gigajoule (GJ). The introduction of this led to closures of several coal plants from 2012-2014 in the UK, with a total capacity of 8.4 Gigawatt (GW), enough to generate electricity for an estimated 6.7 million homes (Total: 25 million homes).

From the beginning of 2016 the CPS was increased to £1.568 per GJ equalling to around £18 per metric ton of CO2, operating on top of the EU ETS at €5 per metric ton of CO2. In September 2016 this was equivalent to a tax around £63.90 on a metric ton coal worth £46.38 (CIF ARA). This increase led to a further closure of 8.2 GW in 2015 and 2016.

The CPF will double again in 2020 to £30 per metric ton of CO2 and by 2030 it will be £70 per metric ton of CO2.

Sand added, “Implementing a tax which increased the total price of coal by 138 percent, caused an immediate reaction from the U.K. coal-fired power plants. The dry bulk industry is hugely affected by this, due to a large reduction in long haul thermal coal imports.”

The capacity taken out as a result of closures has put the UK into a position where their domestically produced supply of electricity will struggle to meet peaks in demand. In the case of domestically produced electricity falling short of demand, the U.K. will need to rely on importing electricity from other European countries.

Depending on the other European countries energy mix, their electricity exports will be a surplus of renewable fossil fuel - or nuclear energy. If the electricity generated comes from fossil fuel it may offset the declining U.K. coal imports somewhat and the change in demand for the dry bulk shipping industry will be less severe.

Price floor does the trading scheme's job

While the effect of the U.K. carbon price floor to coal imports is undeniable, the European Union emission trading scheme (ETS) has not limited coal imports to the same extent. The development of the European ETS rate per metric ton of CO2 from €30 in 2008 to the current €5, has not incentivized others to reduce coal consumption on a large scale. The decrease of the EU ETS rate is primarily due to an oversupply in allowances.

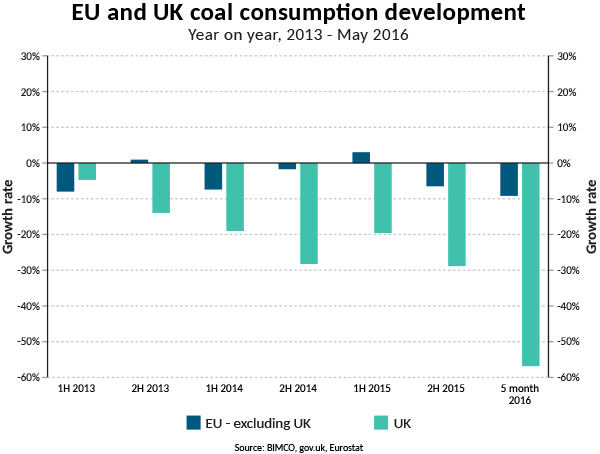

U.K. coal consumption has been falling for four years, while the development in EU coal consumption has been more stable. The increase of the CPF level in 2016, caused a decline of 56.7 percent year-on-year for the first five months of 2016. A total of 6,839 thousand metric tons was consumed in the first five months, compared to 15,800 thousand metric tons in the year before.

“It will be a setback for the dry bulk shipping industry if the CPF becomes a standardized scheme and is adopted by other nations as well as on a supranational level. It will, if introduced at the same level as in the U.K., cause a similar development and closure of coal-fired power plants,” Sand said.

“France, importing the fourth largest share of coal for European countries (8 percent) in 2016, has already imposed a CPF on €30 per metric ton of CO2 planned to be introduced in January 2017.”