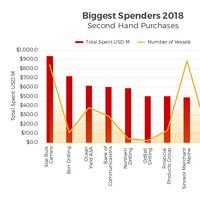

Biggest Spenders of 2018

With less than a week until Christmas and most of our presents bought, we're feeling the pinch. However, that's nothing compared to the amount that some have been spending this year. VesselsValue's Senior Analyst Court Smith gives a rundown on which countries have splashed the most cash on second hand vessel purchases over 2018.USAJP Morgan Global Maritime is the US company who has spent the most on second hand vessels: 308 million USD so far in 2018. However, they have changed their purchasing strategy half way through the year.

US Oil Drillers Add Rigs for 5th Week in a Row

U.S. drillers this week added oil rigs for a fifth consecutive week, Baker Hughes Inc said on Friday, but the oilfield services provider and some analysts cast doubts on a substantial recovery in drilling this year with crude prices heading for their biggest monthly loss in a year. Drillers added three oil rigs in the week to July 29, bringing the total rig count up to 374, compared with 664 a year ago, according to the closely followed Baker Hughes weekly report. U.S. crude futures have slipped below $41 a barrel for the first time since April, pressured by persistently high inventories. The market was on track for a monthly loss of about 15 percent, and is down about 20 percent from highs over $50 in early June when drillers started returning to the well pad.

Baker Hughes Deal Likely to Close in 2016 -Halliburton Exec

Oilfield services company Halliburton's proposed $35 billion acquisition of rival Baker Hughes Inc will likely close in 2016 instead of this year as talks with U.S. regulators continue, a Halliburton executive said on Wednesday. The companies have already agreed to divest $5.2 billion in overlapping businesses to quell concerns the merger would lead to higher prices and less innovation. "Currently we are having substantive discussions with the (Department of Justice)," Christian Garcia, Halliburton's acting chief financial officer told Wells Fargo's Energy Symposium. Garcia said the companies were confident that the deal would be approved. Halliburton is "finalizing negotiations" with buyers for the drilling businesses it first announced it would divest, Garcia said.

Offshore O&G: Weathering the Storm

Vessels are stacked as Gulf oil operators retrench and day rates fall. In the Gulf of Mexico, vessels serving offshore oil-and-gas exploration and production are being stacked or idled as the rig count there declines. Oil companies are retrenching while crude prices remain weak, with smaller operators and the shallow-water sector scaling back the most. As the situation unfolds, MarineNews asked David Barousse, general manager at Fleet Operators, Inc., a marine transportation firm in Morgan City, La., for his take on today’s predicament and what the future holds.

Schlumberger to Take $1 bln Restructuring Charge in Fourth Quarter

Schlumberger Ltd, the world's No.1 oilfield services provider, said it would take a $1 billion charge related to jobs cuts and the writedown of some seismic vessels as it trims its operations in response to slumping oil prices. The company expects a pretax charge of $200 million in the fourth quarter ending December related to the job cuts, it said at Cowen and Company's energy conference on Tuesday. Schlumberger on Tuesday had also said the quarter's results would also include a $800 million charge to write down the value of six vessels and other WesternGeco assets. The company did not say how many or in which of its businesses it would cut jobs.

Schlumberger Cuts Seismic Fleet to Lower Costs

Schlumberger Ltd, the world's No.1 oilfield services provider, said it was reducing the size of its marine seismic fleet to lower costs as it expects customers to cut exploration spending. Schlumberger said it would take a charge of $800 million to write down the value of six vessels and other WesternGeco assets in the fourth quarter ending December. Oil and gas producers, Schlumberger's customers, have scaled back spending plans due to a 40 percent fall in oil prices over the past six months. Analysts expect exploration spending, in particular, to be hit hard as oil and gas producers are unlikely to invest in new fields as long as prices remain low. Schlumberger's fleet of vessels come with seismic equipment that help exploration companies survey potential oilfields.

Schlumberger Mulls Sale of Oilfield Tools Rental Unit

Schlumberger Ltd, the world's largest oilfield services company, is exploring the sale of its oilfield tools rental unit Thomas Tools, which could be valued at more than $600 million, according to people familiar with the matter. An auction is already underway for Thomas Tools, which has annual earnings before interest, tax, depreciation and amortization of around $80 million, the people said this week. Private equity firms keen to buy the unloved divisions of big conglomerates are among those that have shown interest in Thomas Tools, the people said. Boutique investment firm PPHB is advising Schlumberger on the sale process, one of the people added. The sources asked not to be identified because the process is confidential.

Talbert, Toma & Bobillier Join Transocean Board

Transocean Ltd. (NYSE: RIG) (SIX: RIGN) announced that the Board of Directors has named J. Michael Talbert as non-executive Vice Chairman of the Board, Arnaud A.Y. Bobillier as Executive Vice President, Asset and Performance, and Ihab Toma as Executive Vice President, Global Business, effective immediately. As non-executive Vice Chairman, Talbert is expected to succeed Robert E. Rose as Chairman of the Board of Directors when Rose retires at the end of his current director term at the company's 2011 Annual General Meeting of Shareholders. Bobillier will be responsible for the company's Engineering and Technical Support; Asset Management, Performance, Global Supply Chain and IT functions.

Transocean Buys R&B Falcon In $5.3B Stock Deal

Transocean Sedco Forex Inc., already the world's biggest offshore oil-drilling contractor, agreed to buy R&B Falcon Corp. in a $5.3 billion stock deal that will make it the dominant deepwater driller. Under the agreement, approved by the boards of both companies, R&B Falcon stockholders will receive 0.5 shares of newly issued Transocean Sedco shares for each R&B Falcon share. Transocean will also assume approximately $3 billion in R&B Falcon debt, putting a total value on the deal of some $8.3 billion. The combined company would have a market capitalization of about $16.5 billion, almost three times as much as its biggest competitors, and would rank only beneath diversified oilfield services giants Schlumberger Ltd. and Halliburton Co. as a contractor to the global oil and gas industry.

S&P Raises Transocean Offshore Ratings

Standard & Poor's raised its ratings for Transocean Offshore Inc., renamed Transocean Sedco Forex Inc. (See chart page 2, related story page 8) At the same time, Standard & Poor's assigned to the company an 'A-1' short-term corporate credit rating, an 'A-1' rating for its $500 million commercial paper program, and a single-'A' rating for its $400 million term loan maturing December 2004. The company's ratings are removed from CreditWatch with positive implications, where they were placed on July 12, 1999, upon the announcement that un-rated Schlumberger Ltd. would spin off its marine drilling unit and combine it with Transocean. That merger was completed on Dec. 31, 1999. The outlook is stable.

S&P Raises Transocean Offshore Ratings

Standard & Poor’s raised its ratings for Transocean Offshore Inc., renamed Transocean Sedco Forex Inc. (See chart page 2, related story page 8) At the same time, Standard & Poor’s assigned to the company an ‘A-1’ short-term corporate credit rating, an ‘A-1’ rating for its $500 million commercial paper program, and a single-’A’ rating for its $400 million term loan maturing December 2004. The company’s ratings are removed from CreditWatch with positive implications, where they were placed on July 12, 1999, upon the announcement that un-rated Schlumberger Ltd. would spin off its marine drilling unit and combine it with Transocean. That merger was completed on Dec. 31, 1999. The outlook is stable.

Oilfield Stocks Take A Hit As Crude Dips Below $30

Profit-taking hit oilfield service and drilling stocks on Monday as U.S. crude oil prices shed over a dollar to dip below $30 a barrel for the first time since February 28. On Monday afternoon, the Philadelphia Stock Exchange's oilfield service index was off 4.82 points or 4.6 percent at 100.03, while U.S. April crude oil futures were $1.23 lower at $29.68 a barrel. Halliburton Co., the world's biggest oilfield service provider, was off more than five percent at 36-3/8 while Schlumberger Ltd., the industry's No. 2, was down 3-12/16 at 70-9/16. Transocean Sedco Forex Inc., the world's largest offshore drilling company, saw its stock trade 3-5/8 lower at 39-3/8, a loss of more than eight percent on the day.