Ship Recycling: Prices Continue to Fall

Prices continue to struggle across the major ship recycling markets, reports cash buyer GMS.

Bangladesh further declined after depreciating currencies and sustained credit struggles, while Turkey suffered similarly with declining steel plate prices, the Lira, and its vessel prices.

The supply of tonnage seems to have increased slightly over the last couple of weeks, particularly from the Chinese market. This has left owners and cash buyers chasing various recycling destinations amidst weakening prices.

As forecasted a few weeks ago, Pakistan seems finally to be ready to re-enter the market and has overtaken an extremely lackluster Indian market. In India, offers of below $500/LDT have been made, with little success for all parties involved.

Vessels entering the recycling market have mostly been bulk carriers, especially older Panamax and Handymax units built in the 1990s.

Post budget in Bangladesh has certainly been more difficult to get Central Bank approval on fresh lines of credit, but things seem to have eased up a little this week as local buyers are emerging once again, just as the tonnage flow is also increasing.

The Turkish market is suffering as import and local steel prices, the currency and vessel prices have all dropped. Prices have even come in below $300/MT.

Overall, it will take time to absorb many of the unsold vessels, and therefore, sentiments and demand may remain muted for some time – at least until the monsoons start to subside.

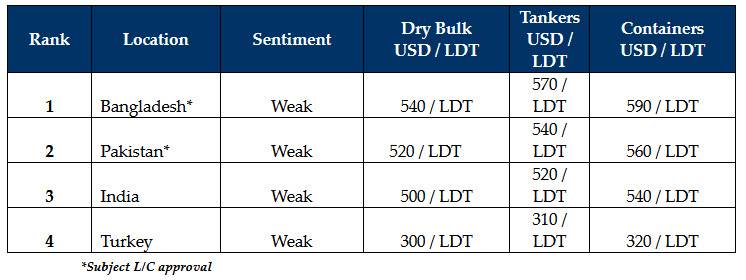

For week 29 of 2023, GMS demo rankings / pricing for the week are: