Veson Nautical

Veson Nautical News

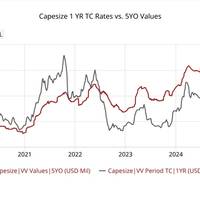

Capesize Values Hit 17-Year High

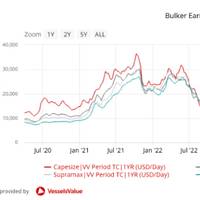

Global trade flows have adjusted to new geopolitical developments last week, with Red Sea diversions maintaining their grip on vessel demand patterns. Against this backdrop, timecharter earnings hit their highest levels since October 2024, with Capesize rates leading the rally while smaller segments lagged behind. The S&P market saw continued interest in modern tonnage as owners position for tightening supply fundamentals.

MSC Leads in Fleet Value

Using data from VesselsValue, a Veson Nautical solution, Rebecca Galanopoulos has analyzed the global container fleet, finding Swiss based MSC currently owns the most expensive fleet with a value of $49.6 billion.This company is also the largest in terms of vessel numbers with a total of 707 vessels, of which 584 are live and 125 on order.The vast majority of this fleet is in the container sector with Panamaxes and Post Panamaxes accounting for around half of this segment.

Global Shipping's Q3 Outlook Centers on Geopolitical Instability (again)

Current global economic and geopolitical landscapes are shaped by several key uncertainties. Tensions between Israel and Iran, particularly regarding the Strait of Hormuz, pose risks to regional stability and energy supply routes. Similarly, Houthi activity in the Red Sea threatens shipping through the Suez Canal. Oil sanctions continue to disrupt global energy markets, while evolving U.S. import tariffs add further complexity to international trade dynamics.

Turbulent First Half of 2025 Echoes Across Global Shipping, Veson Nautical Reports

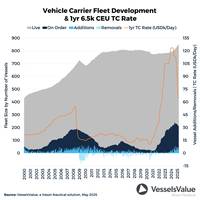

New U.S. tariffs and escalating global trade tensions have reshaped vessel markets in the first half of 2025, curbing investment in some sectors while accelerating strategic orders in others, according to the Half-Year Market Report by Veson Nautical, a provider of maritime freight management solutions and data intelligence.The report states that U.S. trade policy changes hit vehicle carrier markets particularly hard…

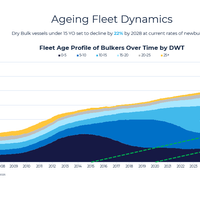

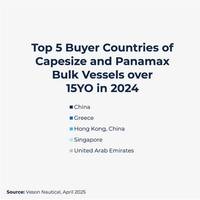

Maturing Dry Bulk Fleet Ill-Equipped for Future

The global dry bulk fleet is facing a sharp contraction in younger, more efficient tonnage, with the supply of vessels under 15 years of age projected to fall by 22% by 2028, according to new analysis shared by Oliver Kirkham, Senior Valuation Analyst at Veson Nautical, a global leader in maritime freight and fleet management solutions.Speaking at the 2025 Marine Money Week in New York, Kirkham told…

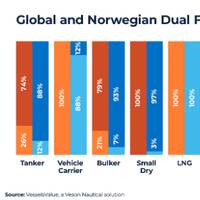

Norway Sets the Bar High With Green Orders

As the shipping world prepares to descend on Oslo for Nor’ Shipping 2025, we take a look at the Norwegian fleet which is currently valued at USD 66.2 bn using VesselsValue data. The following charts highlight the Norwegian fleet breakdown by vessel type, top Norwegian companies, S&P transactions, and the breakdown of dual fuel orders by sector. Thanks to government-backed initiatives such as Enova…

USTR Port Fees Contrasted With Supply Growth Sound the Alarm for Car Carriers in 2026/27

Potential USTR port fees of c.$1 mil per voyage for non-US built car carriers entering the US targeting c.95% of the global fleet from mid-October, combined with this week’s signals from Washington suggesting a sooner-than-expected reopening of the Red Sea, would deal a heavy blow to car carrier demand. Together, these factors comfortably support a scenario of negative car-mile growth through 2026 and 2027.By contrast…

Veson Nautical: US Port Fees May Disrupt Dry Bulk Trade and Vessel Availability

Recent discussions on tariffs have largely overlooked the potential implementation of the Office of the United States Trade Representative (USTR)’s port fees on Chinese-built vessels. This fee, which could reach up to $3.5 million per port call, varies based on the vessel’s origin and the owner’s fleet composition. Given that typical US port calls cost a maximum of $80,000, this fee could significantly impact import and export volumes.According to VesselsValue trade data…

Veson Nautical: Three Impacts of the IMO’s New Fuel Intensity Target on S&P Activity

The International Maritime Organization (IMO) recently hosted the 83rd meeting with the Marine Environmental Protection Committee (MEPC 83), resulting in a new fuel intensity target, which is set to come into force no later than March 2027.This new regulation is similar to the Fuel EU regulation enforced this year, but with global fleet coverage. The major effect of this new IMO GHG regulation will be to enforce a financial penalty for using cheaper…

Bulker S&P Activity Falls Sharply in Q1 2025

Due to market uncertainty, overall sale and purchase levels for Bulkers have fallen year on year, with a decrease of c.58% and just 77 reported this year to date, compared to 182 for the same period last year. Since the US proposed fees to Chinese-built vessels entering US ports in February, sale and purchase levels for Chinese-built Bulkers has fallen by c.58% with just 62 transactions reported since February…

Veson Nautical: Orders For Dry-Bulk Vessels Falldry b by 26% Y-o-Y in Q1

Global economic uncertainty and a cooling of the market has seen newbuild orders for dry-bulk vessels fall by 26% year-on-year according to Hongbeom Park, Head of Korea for global Veson Nautical, a global leader in maritime data and freight management solutions.Speaking at Veson Nautical’s Seoul Forum, Park said uncertainty around the future of fuels, historically high newbuild prices and the price…

South Korea's Orderbook Tops $138 billion

Veson Nautical has used VesselsValue data to confirm that South Korea’s orderbook has now topped $138 billion.The LNG sector is the most valuable, worth $71.3 billion and accounting for around 52% of the total South Korean orderbook value. This sector also has the highest volume of orders with 276 vessels on order.Container ships rank second with a market value of $35.6 billion, equating to a share of about 26% and 184 vessels on order.

Veson Nautical, Cargill Expand Partnership

Veson Nautical and Cargill announced the Strategic Technology Agreement, expanding their partnership to accelerate digital transformation in the maritime sector. The agreement provides Cargill's Ocean Transportation business with a broad range of access to the Veson portfolio, including its data intelligence capabilities and AI-enabled collaborative workflow solution Shipfix. This builds on previous utilization of the Veson IMOS Platform.

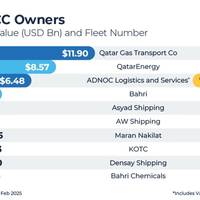

Qatar Gas Tops Regional Shipowner Ranking

Qatar Gas Transport Co is currently the top Gulf Cooperation Council (GCC) company in monetary terms, with a live and on-order fleet value of $11.9 billion, reports Rebecca Galanopoulos of Veson Nautical.Based on VesselsValue data, the fleet consists of 36 live LNG and LPG vessels with a further 30 on order. Qatar Gas also placed the highest value newbuilding order in February 2024 with their investment in 15 large LNG vessels…

New, Old Vessel Speed Disparity Splits Bulker Fleet

The global bulker fleet is facing a significant slowdown, driven by a combination of factors that are not only causing a decline in average speeds but also setting the stage for the emergence of a two-tier market, according to Veson Nautical.A new report: ‘Why is the bulker fleet slowing down? The impact of an aging fleet in the era of efficiency’ says that aging vessels, stricter emissions regulations…

Veson Nautical Opens Dubai Office

Veson Nautical (Veson) opened a new office in Dubai as part of an enhanced commitment to one of the world’s most important shipping hubs.This expansion is aimed at bringing Veson closer to its growing regional client base and reinforcing its role in shaping the future of maritime technology and data solutions in the region.Veson CEO John Veson traveled to Dubai to open the new office, and the occasion…

Chinese Vessel Orders Shoot Beyond $123B, Veson Nautical Finds

Veson Nautical, a provider of maritime commercial management and trading software solutions, has reported that the Chinese newbuilding vessel orderbook has topped $123 billion in 2024, with container ships making around 38% of total vessel orders.Using VesselsValue data, Veson Nautical has summarized the Chinese orderbook by top Chinese ordering companies and insight into the ships currently being built at Chinese yards.Of the top Chinese companies ordering vessels last year…

Ranking & Reporting the World's Top 10 Vessel Owning Nations

In the ever-evolving world of maritime trade, ship ownership is a key indicator of economic influence and global commerce. As we enter 2025, Veson Nautical offers its Top 10 Ship Owning Nations, offering a detailed analysis of fleet values and industry shifts. This year, China has surged to the top, overtaking Japan in total fleet value, while geopolitical events and shifting market dynamics continue…

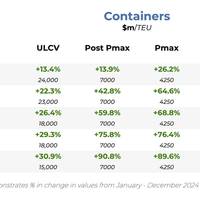

Box Sector bullish after stellar 2024, but risks abound in 2025

The time charter (TC) rates for Post Panamax container vessels rose by 111% year-on-year (y-o-y) in 2024, hitting 73,330 USD/Day, and has led to a huge uptick in newbuild orders and a slowdown in demolitions according to Veson Nautical’s ‘2024 End- Of-Year-Report’.The report states that the bullish market conditions for the container sector are reflected in the TC rates as well as the 76% y-o-y increase in new ship orders which witnessed 321 deals including options…

Spire's Sale of Ship Tracking Arm alarms Users

French maritime data analytics platform Kpler wants to buy ship tracking company Spire Maritime, whose satellite data is a vital resource for oil traders and shipping companies…

- 1

- 2