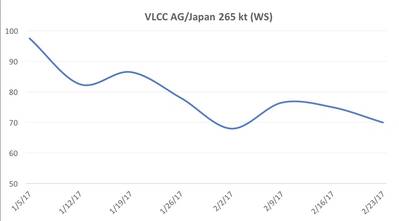

VLCC rates on the AG/Japan route tumbled by nearly w10 points within a day to w60 on Tuesday, after news of S-Oil placing Australis on subs for an AG/Onsan run at w54.75, loading March 13-15 basis 274kt, broke. Charterers went for the jugular, with at least four older vessels fixed within the range of w55-w58 for an AG/East voyage. We believe that VLCC rates will remain depressed in the short term due to the upcoming refinery turnaround season in Asia, diminishing floating storage inventories that will free up more tonnage as well as OPEC production cuts.

Heavy refinery maintenance in Asia

Upcoming Asian refinery maintenance over the next two months is unusually heavy and is expected to lower March cargo flows out of the AG, weighing on VLCC rates. At least 2 mmb/d of refining capacity in the East of Suez is expected to be offline in March, more than double that of last year. China’s state-owned refiners account for around 50 percent of overall shut capacity in Asia in March, which will reduce AG-loading cargo volumes as they form the core of Saudi Aramco’s client base.

Falling floating storage inventories

The unwinding of storage plays has begun as floating storage becomes less economically viable due to the flattening Brent futures curve. According to Reuters, 12.1 mmb of crude (equivalent of six VLCCs) were released from floating storage in Malaysia, Singapore and Indonesia. The influx of tonnage will further push down freight rates. Moreover, some of the vessels previously chartered for floating storage are older units which are typically available at discounted rates.

OPEC production cuts

The overall impact of OPEC’s production cuts (~1.2 mmb/d) is evident from the fall in VLCC fixtures from the AG. The number of fixtures is estimated to have dropped by 9 percent m-o-m to 145 in February. According to OPEC, compliance reached over 90 percent in January with Saudi Arabia shouldering the bulk of agreed cuts.

The Author

Rachel Yew is a Singapore based commodity and freight research analyst at Ocean Freight Exchange.