LNG carrier freight rates have come under severe pressure due to rising fleet supply and stabilizing LNG demand, as Japan prepares to restart its nuclear power plants. Despite the general market belief that new LNG supply from Australian projects will provide ample employment to the growing fleet, there are immediate challenges on freight rates. This is due to 49 million tonnes per annum (mtpa) of Australian LNG cargo supply expected to hit the market over the next two years, according to the newly launched LNG Forecaster report published by global shipping consultancy Drewry.

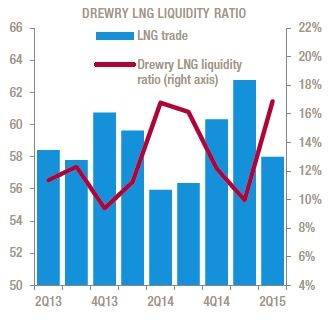

There are already signs of weakness in LNG demand as 17 percent of global liquefaction capacity remained unutilized during the second quarter 2015. The LNG fleet continues to rise, with 30 more vessels expected to be delivered this year and a further 41 next year. Nonetheless, the majority are yet to secure dedicated employment; at present, around 30-40 vessels are sitting idle.

“With Asian demand stabilizing, contractual supply from Australian projects will substantially reduce the dependency of Asian buyers on the spot market,” said Shresth Sharma, Drewry’s lead LNG shipping analyst. Furthermore, the impact on LNG shipping demand will be muted given Australia’s relative proximity to Asia compared to other key sources of LNG supply such as the Middle East. This will serve to further diminish the overall employment prospects for the LNG fleet in the short term.

Approximately 75 percent of new LNG shipping capacity serving this trade has been contracted by Asian buyers, principally the big three importers of Japan, South Korea and China.