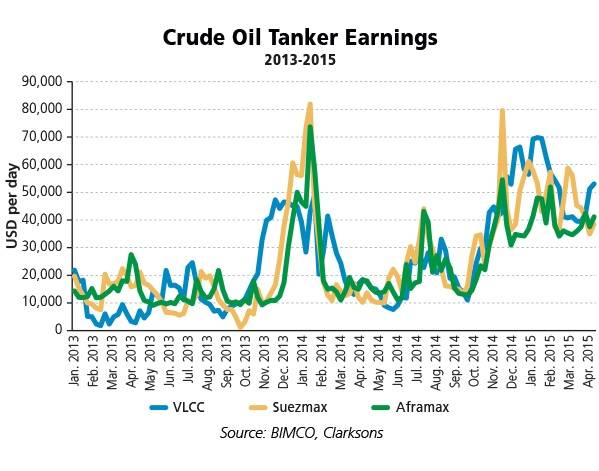

Tanker earnings for crude oil tankers have climbed to new strong levels in the first quarter of 2015, with averages not seen since 2008, the Baltic and International Maritime Council (BIMCO) reported.

The demand for crude oil tankers remains high even though the winter months are far behind us. Following the winter peak season of 2013/14, crude oil tanker earnings collapsed and remained low during spring, before rebounding over the summer. In the winter peak of 2014/15, this has not been the case. The market appears to have kept the momentum going, keeping the crude oil tanker earnings at a high level.

The average earnings for VLCCs were around $51,000 per day in the first three months of 2015. That is 76% higher as compared to the first quarter of 2014, where it was around $29,000 per day. For Suezmaxes, earnings were at the same level, around $50,000 per day in 2015 as compared to around 31,000 in 2014. As regards to the Aframaxes the difference between the two years was a bit smaller however still noticeable with around $40,000 per day in Q1 2015 up from around 29,000 last year.

Chief Shipping Analyst at BIMCO, Peter Sand, said, “The strong winter market for crude oil tankers was in line with our expectations. But on top of that is this extended run of strong earnings that proves the window of opportunity is still open as a result of very advantageous fleet growth levels for all crude oil tanker segments.”

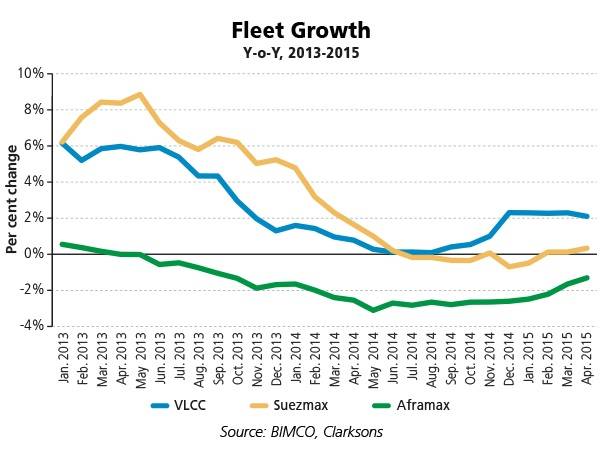

Although the steady demand for oil has played its part in this year’s high rates, there is another more substantial factor in play. When we look at the fleet development from the previous years, it is clear that the fleet growth for the three crude segments has been low. For VLCCs, the average monthly fleet growth in 2014 was only 0.8% on a year-on-year basis. For Suezmaxes the number was 1%. In comparison the year-on-year numbers for 2013 where 4.6% for VLCCs and 6.8% for Suezmaxes.

For Aframaxes the numbers were even better. A decrease of 0.6% in 2013 compared to 2012 followed by another drop of 2.6% in 2014. A reduction of the fleet has shifted the supply and demand curves and it is safe to say it has contributed to keeping the earnings at the level we see today.

“BIMCO expects crude oil tanker supply growth at 2.2% in 2015. This is a three-year high. Fortunately, it’s still a level that should see healthy earnings for crude oil tankers throughout 2015, all other things being equal,” Sand added.