Are We Looking at the Next Dry Bulk Super Cycle? Is It Even a Cycle?

Throughout the first half of the year, talk of a new dry bulk super cycle has been on many lips as commodity prices have soared to multi-year highs. Freight rates and ship values have also risen but although they exceed prices seen during most of the 2010s, they are still far below super cycle levels.

“Commodity prices have staged a comeback and are hovering around or above 2007 and 2008 levels. This has fuelled talk of a commodity super cycle. However, while dry bulk freight rates and ship values are currently high compared to the past 10 years, they are very far from earnings seen during 2007-2008 and there is little to suggest that they are heading that way,” says Peter Sand, BIMCO’s Chief Shipping Analyst.

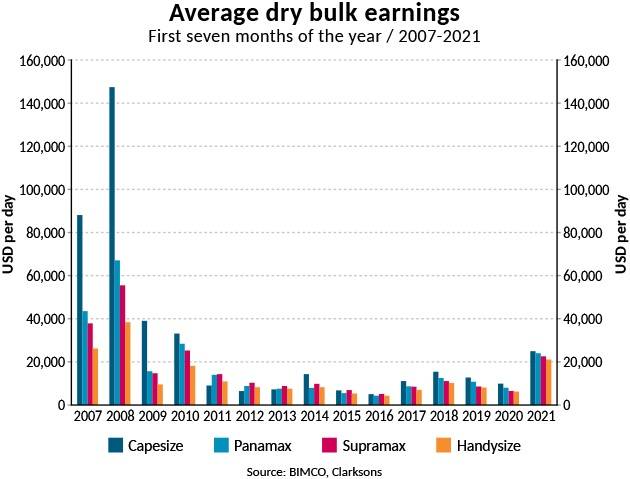

Freight rates are high. But not super cycle high

Compared to the past 20 years, freight rates have been high during the first seven months of 2021, with all ship sizes averaging earnings that exceed USD 20,000 per day. However, compared to the first seven months of 2007 and 2008, the current rates are still far below.

In the first seven months of this year Capesize rates have average USD 24,970 per day. In the same period of 2008, Capesize rates averaged USD 147,475 per day. As a share of what they earned back in 2008, Handysize rates come closest, but are still far below with average earnings so far this year at 55% of rates recorded in the first seven months of 2008. Panamax and Supramax earnings stand at 36% and 41% respectively.

Higher valuation, higher volume? Not quite so fast

Higher commodity prices are not the key to a super cycle in dry bulk shipping. In fact, no super cycle without the volumes. Although volumes have grown in the first half of this year, the growth hasn’t been enough to justify talk of a super cycle.

Shipped iron ore volumes have grown 4.2% in the first half of this year compared to 2020, reaching 771.0m tonnes. This is the highest first half of the year on record, beating the previous record set in 2018 by 0.3%. However, this does not provide enough evidence of demand running wild. Instead, it seems like the higher prices are driven by restraints in increasing the supply of iron ore, with exporting miners unable to adjust their volumes at the same pace as demand increases.

For comparison in 2007 and 2008, Chinese iron ore imports grew year-on-year by 18% and 16% respectively.

Similarly, the volume of shipped coal has grown modestly from last year, up 3.6%, but remains below the first six months of 2019. To justify talk of a super cycle, much higher volume growth is needed here too.

“The start of the year has brought some much-appreciated relief to owners’ and operators’ bottom lines following years of lower earnings in the dry bulk industry. Although volumes have risen, it hasn’t been enough to fully justify the much stronger start to 2021 compared with recent years. Other factors include congestion at ports due to Covid-19 restrictions as well as disruptions arising from trade tensions,” says Sand.

“Additionally, the higher commodity prices mean that despite the rise in the absolute cost of shipping, it's share of the total cost hasn’t suddenly spiked. You may be more inclined to accept a USD 5 to 10 per tonne increase on a spot rate if the value of your cargo has increased by USD 100 per tonne,” Sand adds.

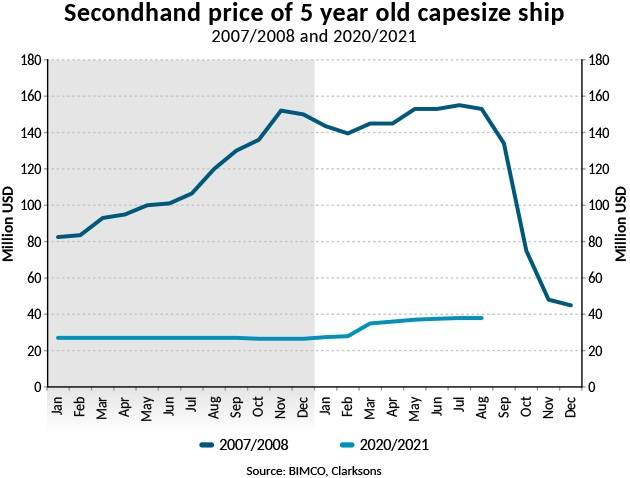

Ship values also far from super cycle levels

The value of dry bulk ships is also far below the last super cycle levels. A comparison of the value of a 5-year-old Capesize ship today with August 2008 shows how big the difference is. In August 2008, the ship could be traded for around USD 153 million. Today it could yield just USD 38 million. Although well below 2008 levels, this is still the highest level since December 2014. The price for a newbuilt Capesize ship is USD 39.5 million lower today (USD 59.5 million) than it was in August 2008.

Commodity prices in line with the last super cycle

High commodity prices have offered the strongest evidence of a super cycle, driven by massive fiscal stimulus packages, and fuelling a recovery in demand as global economies claw their way back from the challenges of the COVID-19 pandemic. Iron ore, the biggest commodity for dry bulk shipping in terms of volume, stood at an average spot price of USD 214.4 per tonne in June. This exceeded the strongest month before the Great Financial Crisis when the iron ore price peaked at USD 200.0 in March 2008.

Rather than putting pressure on margins, the higher iron ore price is absorbed by higher steel prices which are up by USD 305 in China since the start of 2020, currently at USD 856 per 20mm steel plate.

“Adding to the talk of a super cycle, many higher value but lower volume type of goods that are not transported by bulk carriers, have enjoyed large price increases. This has helped fuel the talk of the super cycle in the global economy, without having any impact on dry bulk shipping,” says Sand.

Not super, but is it even a cycle?

As usual in the shipping market, movements in the freight and asset markets spark talk of the latest turn in the cycle, with a low predestined to be followed by a high, and on the flipside, a high fading into a low. For many, the cycle is seen as a given and the key to high profits is getting the timing right.

But just how certain is this cycle? Is it a cycle? Depending on your definition of a cycle, the answer may vary. Are the ups and downs just a given in dry bulk shipping? Or are the fluctuations the result of too little or too many ship orders?

“There are certainly many views about the cyclical nature of dry bulk shipping but what is clear is that owners should be enjoying the current freight rates after the many years of poor earnings. At the same time however, they should acknowledge that this is unlikely to be the start of a super cycle like the one we saw in 2007/2008,” says Sand.

“After the stimulus-induced rise in demand for goods such as iron ore, and a return in demand for coal, one of the questions looming in the horizon is what will happen to demand for these commodities as the demand for lower CO2 emissions becomes more and more pressing.”

(BIMCO)