KOTUG Takes Full Ownership of Its Bahamas Towage JV with SEACOR

KOTUG International, a marine services and towage provider based in the Netherlands, announced on Thursday it has concluded its acquisition of Kotug Seabulk Maritime (KSM), taking full ownership of the Caribbean marine towage business.KOTUG said it has acquired the interest of its joint venture partner, Fort Lauderdale, Fla.-based SEACOR Holdings via its Seabulk subsidiary KS Maritime Holdings, owner of the 50% share in KSM.Founded in 2017, KSM acts as the exclusive provider of maritime terminal support services for Buckeye Partners’ Bahamas Hub…

Tanker Involved in US Seizure of Iran Oil Cargo Changes Name

An oil tanker confiscated by the United States for carrying Iranian oil and diverted to the U.S. Gulf Coast, was headed to the Bahamas on Wednesday under a new name, ship tracking data showed.The tanker Suez Rajan was the subject of attention this year for carrying more than 980,000 barrels of contraband Iranian crude oil, which was confiscated by the U.S. in a sanctions enforcement operation.It was unable to unload the Iranian crude for nearly two and half months over fears of secondary sanctions on vessels used to unload it. It was renamed the St Nikolas after unloading the cargoes.The vessel fully unloaded the Iranian crude this month and the Suez Rajan Ltd company pleaded guilty in April.

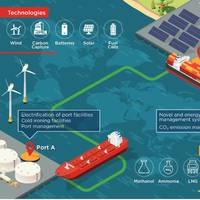

'Hydrogen Hubs' to the Fore

The path to decarbonization is defined by partnership and fueled by government funding. This month we examine the players, partnerships, and evolution of Hydrogen Hubs in the Gulf of Mexico.The Green Shipping Challenge, organized by the United States and Norway at COP 27 held in late 2022, brought about dozens of announcements on maritime decarbonization. Among these was a joint statement from the Blue Sky Maritime Coalition (BSMC) – a consortium of North American shipowners and…

Oil Companies Work Around Jones Act to Supply US Fuel Markets

U.S. oil companies are working around a century-old shipping law to supply fuel to the U.S. East Coast, according to data from Refinitiv and oil trading sources, as high demand for gasoline and global disruptions in fuel markets sent prices higher.Traders are increasingly sending unfinished gasoline components from the Gulf Coast to Buckeye Partners LP’s terminal in the Bahamas, also known as Borco, where they are blended into finished gasoline to be sent to the U.S. East Coast. The uncommon trade is a sign of heavy demand for products up and down the coast, home of some of the nation's largest consumer markets.The trade represents a legal workaround to the Jones Act, which requires goods moved between U.S. ports to be carried by ships built domestically and staffed by U.S.

Army Corps Awards Contract for Corpus Christi Channel Improvement

The U.S. Army Corps of Engineers (USACE) on Friday awarded a $139 million construction contract to Great Lakes Dredge & Dock Company, LLC. (GLDD), to complete the third phase of the landmark Port of Corpus Christi Ship Channel Improvement Project (CIP). The four-phase infrastructure project will increase the Corpus Christi Ship Channel depth from -47 feet Mean Lower Low Water (MLLW) to -54 feet MLLW and widen it to 530 feet, with an additional 400 feet of barge shelves.Phase 3 will extend west of the La Quinta Junction through the Chemical Turning Basin in the Port’s Inner Harbor.

Callan Marine’s New Dredge General MacArthur Enters Service

Callan Marine's new Jones Act cutterhead suction dredge (CSD) General MacArthur and its accompanying idler barge have entered service in Texas, heading to work on several projects before transiting to Corpus Christi for the second phase of the deepening and widening project.The newest and largest dredger in Callen Marine's fleet, the General MacArthur represents the next generation of dredging technology and crew comfort, said Maxie McGuire, President of Callan Marine.“The General MacArthur is a complete game-changer for the dredging industry,” McGuire said.

Callan Marine Wins Corpus Christi Dredging Work

The U.S. Army Corps of Engineers (USACE) awarded a $97.9 million dredging contract on Wednesday to Callan Marine, Ltd., to complete the second phase of the four phase Corpus Christi Ship Channel Improvement Project. The project increases the channel depth from -47 feet Mean Lower Low Water (MLLW) to -54 feet MLLW, and widens the channel to 530 feet with an additional 400 feet of barge shelves.The newest and largest dredger in the Callen Marine fleet, the General MacArthur, is…

IFM, Vitol and VIP Take Joint Ownership of Vitol Tank Terminals International

Vitol Investment Partnership(VIP), an investment vehicle sponsored and managed by Vitol, and IFM Investors, a global provider of investment services to institutional investors, have agreed to acquire Buckeye Partners LP’s 50% equity interest in Vitol Tank Terminals International (VTTI), a leading global independent provider of energy storage.On completion, VTTI will be owned 50% by IFM and 50% by Vitol and VIP. It will continue to be managed by an independent management team led by Rob Nijst, CEO.The transaction is subject to certain conditions precedent and is expected to close by year end.Rob Nijst, CEO VTTI says: “It has been a pleasure working with Buckeye over the last two years and we wish Buckeye the very best in its future endeavours.

Buckeye Partners JV Announces Marine Terminal in Texas

Buckeye Partners announced the formation of a joint venture with Phillips 66 Partners and Andeavor to develop a new deep-water, open access marine terminal in Ingleside, Texas. The South Texas Gateway Terminal will be constructed on a 212 acre waterfront parcel at the mouth of Corpus Christi Bay. The facility is positioned to serve as the primary outlet for crude oil and condensate volumes delivered off of the planned Gray Oak pipeline from the Permian Basin. The terminal, to be constructed and operated by Buckeye, will offer 3.4 million barrels of crude oil storage capacity, connectivity to the Gray Oak pipeline and two deep-water vessel docks capable of berthing Very Large Crude Carrier (VLCC) petroleum tankers as part of the initial scope of construction.

Buckeye, Trafigura Load Suezmax Tanker in U.S. Port

U.S. midstream oil firm Buckeye Partners and commodities trader Trafigura said on Thursday that modifications to their terminal in Texas to accommodate large tankers were completed and the first shipment of crude on a Suezmax tanker took place. The Buckeye Texas Hub terminal located in Corpus Christi shipping channel is 80 percent owned and operated by Buckeye while Trafigura holds a 20 percent stake. "North American supplies have launched the U.S. on to the world stage as a new crude provider. Upgrading the terminal's deep-water docks at Corpus Christi will help us to meet the growing demand for this product from European refineries and Far East refineries and petrochemical plants," said Corey Prologo, Trafigura's head of oil trading in North America.

Fuel Imports, Distribution in Puerto Rico Starts to Unclog

Shipments of gasoline and diesel into Puerto Rico have resumed after Hurricane Maria, with ports restarting operations, though there were still long fuel lines around the island on Thursday, according to traders and Thomson Reuters tracking data. Residents lined up for diesel for power generators and to fill cars with gasoline, while at least one tanker discharged at the port of San Juan as oil terminals reopened some facilities. The territory still faces logistical hurdles to distribute food, fuel and water. Critics called for more resources and a single authority to oversee relief efforts. Most of the Caribbean island's 3.4 million people still lacked electricity. Gasoline stations have been unable to remain open for more than a few hours at a time, the U.S.

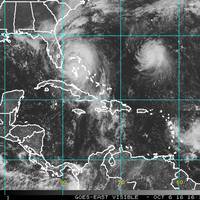

Dominican Republic Shuts Most Ports ahead of Hurricane Maria

Dominican Republic closed most of its ports ahead of Hurricane Maria, but the country's 34,000-barrel-per-day refinery was still running, the government said on Wednesday. Ports that suspended operations under the "red alert" declared for extreme weather conditions are La Romana, Samana, Arroyo Barril, Puerto Plata and Manzanillo, the Dominican Port Authority said in a statement. Maria was a Category 4 hurricane when it hit Puerto Rico earlier on Wednesday. The ports of San Souci and Haina…

Caribbean Oil Terminals Prepare for Hurricane Maria

Several Caribbean oil storage terminals that temporarily closed ahead of Hurricane Irma earlier this month have started making preparations in case they have to shut again due to Hurricane Maria, which was a rare Category 5 storm on Tuesday. Shippers and traders in the Atlantic basin are struggling amid this year's very active storm season, which has seen seven hurricanes so far, four of them major hurricanes, defined as at least a Category 3 on the five-step Saffir-Simpson scale. Hurricane Harvey hit the U.S.

Statoil's Bahamas Oil Terminal to Shut ahead of Irma

Norway's state-run oil company Statoil began making preparations on Thursday to shut its South Riding Point storage and transshipment terminal in the Bahamas ahead of Hurricane Irma, traders close to the facility told Reuters. South Riding Point in Grand Bahama has the capacity to store up to 6.75 million barrels of oil. A neighboring terminal in the Bahamas, Buckeye Partners' BORCO, was also expected to halt all operations on Thursday, the company said. (Reporting by Marianna Parraga)

Irma forces Bahamas Borco Terminal to Close

Buckeye Partners LP's Bahamas terminal, also known as Borco, has been closed for vessel traffic and will shut all operations by the end of the day due to Hurricane Irma, a source familiar with operations said on Thursday. That terminal, located in Freeport, on Grand Bahama Island, has more than 26 million barrels of storage capacity for crude, fuel oil, gasoline and other products. Hurricane Irma has already killed several people after hammering the Caribbean as a category 5 storm, with winds up to 180 mph (285 km/h). It was most recently located off the northern coast of Dominican Republic, about 760 miles (1220 km) southeast of Freeport, according to the National Weather Service. Reporting By Jessica Resnick Ault

The Evolving ATB Jones Act Business Model

Today’s ATB play seemingly has legs for the long haul, as operators build and market needs fluctuate. The refined product trades are always in flux. Similarly, the supply patterns for products (and for chemicals derived from oil refining) are subject to constant change. At the same time, the distribution of refined petroleum products sees great benefit from the efficiency of Articulated Tug Barges (ATBs), which have the flexibility to adjust to dynamic supply programs between refineries and myriad distribution facilities dotting the coastline. It wasn’t always like that.

PA Pipeline Spat Could Upend International Oil Flows

Refiners from the Midwest United States are fighting for access to a vital Pennsylvania pipeline – a move that could cripple their East Coast competitors and redraw the map for international flows of crude and fuel into coveted coastal markets. The regulatory dispute centers on a proposal by pipeline operator Buckeye Partners’ to that state's Public Utilities Commission. The plan would reverse the flow of fuels on a section of Buckeye’s 350-mile Laurel Pipeline, which currently flows from the East Coast to Pittsburgh. Because pipelines only flow in one direction, the change would effectively block five East Coast refineries from serving Pittsburgh – with Midwest refiners picking up their market share.

Hurricane Matthew Strengthens as it Heads for US

Hurricane Matthew, the fiercest Caribbean storm in nearly a decade, strengthened as it barreled toward the southeastern United States on Thursday after killing at least 140 people, mostly in Haiti, on its deadly northward march. As Matthew blew through the northwestern Bahamas on Thursday en route to Florida's Atlantic coast, it became an "extremely dangerous" hurricane carrying winds of 140 miles per hour (220 kph), the U.S. National Hurricane Center said. That made it a Category 4 hurricane and it was likely to remain so as it approached the United States…

Traders Scramble for Caribbean Crude Storage

Demand for crude storage in the Caribbean, one of the world's most important oil hubs, is rising as producers and traders try to ride out the worst price crash in six years by holding onto more barrels or making blends that can be sold for premiums. The last time tanks in the logistically-important islands were this full, during the price collapse of 2009, companies started leasing vessels to use as floating storage. That is not yet happening now, but the only way to get tank space at the moment is to sublease it, said one tank broker with decades of experience. Since June, his firm alone has received requests to lease up to 7.5 million barrels of tankage in a region with some 100 million barrels of capacity.

Buckeye Pipeline Quietly Makes Key Acquisition

Houston-based logistic firm Buckeye Partners has spent more than $3.5 billion buying assets since 2010, transforming itself from a quiet regional pipeline utility into an emerging energy powerhouse. But the acquisition that may best symbolize its evolution is one the company didn't tout to investors this summer: a Washington lobbyist. After spending most of the past century pumping fuel from one place to another, the 128-year-old company has become a key player in the import and export of North American oil, with an unrivalled network of East Coast and Caribbean fuel depots and an expanding business loading crude oil from trains to tankers.

Buckeye Buys Trafigura's Texas Assets

Oil logistics specialist Buckeye Partners LP will pay $860 million for control of Trafigura's prized oil facilities in the Texas shale hub amid expectations Washington will relax its crude oil export ban. U.S. firm Buckeye will buy 80 percent of the global commodities trader's South Stream assets which include a deep-water tanker loading terminal in Corpus Christi, liquefied petroleum gas (LPG) storage and a small refining unit known as a condensate splitter. Trafigura will hold on to the remaining 20 percent in the Corpus Christi facility, described in Trafigura's 2013 annual report as "one of the company's most important strategic assets ... at the center of the action in the world's largest, most dynamic, energy market". The deal comes at a time of increased pressure on the U.S.

Refiners Seek Jones Act Workarounds as Crude Export Debate Heats Up

As the first U.S. oil condensate exports head to Asia from the Gulf Coast, crude producers and refiners are exploring ways to get around a century-old law that makes it three times more expensive to ship by water between U.S. ports than to sail to a foreign port. The Jones Act, originally passed to protect the U.S. maritime industry, restricts passage between U.S. ports to ships that are U.S.-built, U.S.-flagged and U.S.-crewed. If oil exports pick up pace while the Jones Act is left in place, U.S.

Marathon Traders Gain E.Coast foothold with Hess Deal

Marathon Petroleum Corp is poised to expand its growing Midwest and Gulf Coast fuel trading operation to the East Coast with Thursday's deal to buy Hess Corp's retail network and transport contracts. The purchase will give Marathon control of Hess's gasoline stations and access to pipelines, including the capacity to ship approximately 40,000 barrels per day on the sought-after Colonial Pipeline from the Gulf Coast to the East Coast, according to the companies. The $2.9 billion deal is expected to close late in the third quarter. That likely means opening up new trading opportunities. Marathon's nearest refinery is nearly 500 miles east of New York City in Canton, Ohio, with few major pipelines in between.