US, UK Ship Investors Hit by Soaring Red Sea Insurance

War underwriters have raised the premiums they charge to U.S., British and Israeli firms by as high as 50% for ships transiting the Red Sea and some providers are avoiding such business due to targeting of the vessels by Yemen's Houthis, sources said.Attacks by the Iran-aligned Houthis since November have slowed trade between Asia and Europe and alarmed major powers. The Houthis say they are acting in solidarity with Palestinians as Israel's war against Hamas militants in Gaza…

Russian Oil Flows Through Red Sea Face Lower Risks

Tankers carrying Russian oil have continued sailing through the Red Sea largely uninterrupted by Houthi attacks on shipping and face lower risks than competitors, according to shipping executives, analysts and flows data.Russia has become more dependent on trade through the Suez Canal and the Red Sea since it invaded Ukraine, which led to Europe imposing sanctions on Russian imports and forced Moscow to export most of its crude to China and India. Before the war, Russia exported…

Trafigura Assesses Red Sea Risks after Tanker Attack by Houthis

Commodities trader Trafigura said on Saturday it was assessing the security risks of further Red Sea voyages after firefighters put out a blaze on a tanker attacked by Yemen's Houthi group a day earlier.The U.S. military said a U.S. Navy ship and other vessels provided assistance after the Marlin Luanda was hit by a Houthi anti-ship missile."No further vessels operating on behalf of Trafigura are currently transiting the Gulf of Aden and we continue to assess carefully the risks involved in any voyage…

Supertanker Chartered by Polish Firm to Load Venezuelan Oil for China

Polish oil and gas firm Orlen has provisionally chartered a supertanker to load Venezuelan oil for China, according to a shipbroker and tracking data, following a temporary easing of U.S. sanctions on the South American country.The Very Large Crude Carrier (VLCC) Olympic Trophy, chartered for $13 million, is scheduled to load in early December, according to a source and ship tracking data on Kpler.Vitol, the world's largest independent oil trader, chartered a supertanker earlier this month to load Venezuelan crude for China.

Berge Bulk Retrofits Bulk Carrier with WindWings

Singapore-based Berge Bulk has launched a ship fitted with steel-and-composite sails to cut fuel consumption and carbon dioxide emissions, with an eye to converting more vessels that ply routes with favourable wind conditions.The dry bulk carrier Berge Olympus, equipped with four sails known as WindWings, is chartered by mining giant Vale and will sail between Brazil and China, Berge said on Tuesday.The sails will save up to 20% fuel or six tons per day on an average worldwide…

Black Sea Grain Deal Could Hinge on Ammonia Pipeline

A possible extension next month of a deal allowing the safe wartime export of grains and fertilizers from three Ukrainian Black Sea ports could hinge on the reopening of a pipeline that delivers Russian ammonia to one of those Ukrainian ports.The dealsThe United Nations and Turkey brokered the Black Sea Grain Initiative for an initial 120 days last July to help tackle a global food crisis worsened by Moscow’s invasion of Ukraine, one of the world’s leading grain exporters. It has been extended three times since…

TFG Marine Targets 20% Bunker Sales Rise through Expansion

TFG Marine, majority owned by commodities trader Trafigura, aims to increase its marine fuel sales volume by up to 20% this year through expansion in Africa, the UK and the Mediterranean, a senior company executive said.The fuel supplier is looking to expand its volumes to 11-12 million tonnes, up from about 10 million tonnes in 2022, its head of bunkering Kenneth Dam told Reuters on the sidelines of the Fujairah Bunkering and Fuel Oil Forum (FUJCON) 2023.It plans to expand operations in several existing and new markets…

Cargill Seeks to Boost Ships' Use of Biofuel, Methanol to Cut Emissions

Cargill seeks to boost its use of biofuels in a bunkering trial and plans to order methanol-fuelled ships as part of its plans to cut emissions, a senior executive of the global commodities trader said on Wednesday.One of the world's biggest ship charterers, Cargill has been testing the operational performance of biofuels in its vessels since the start of the year as it steps up efforts to go green. The trial aims to boost vessels' use of biofuels to 50,000 tonnes by mid- or end-2023…

U.S. EPA Revokes Permit for Phillips-Trafigura Bluewater Offshore Terminal

The U.S. Environmental Protection Agency has revoked the pollution control permit of Bluewater Texas Terminal, according to a letter sent by the EPA to the offshore oil terminal, following objections from environmental groups.The terminal, jointly developed by refiner Phillips 66 and commodities trader Trafigura, had applied for a Clean Air Act permit in 2019 and received an EPA pollution control license in November 2020 that allowed it to emit almost 19,000 tons of pollutants…

US Receiving Last Russian Oil Cargoes Before Wind-down

Nine tankers carrying Russian-origin crude and fuel oil have discharged in the United States in April, likely the last ones to deliver before a wind-down set by Washington expires this week, customs and tanker tracking data showed.The United States last month set an April 22 ban on imports of Russian crude and refined products. The United States gave importers of Russian petroleum, liquefied natural gas and coal 45 days to take en route and under-contract cargoes.Tanker Seamagic, which loaded fuel oil at Russia’s Taman port, discharged at Valero Energy’s St. Charles, Louisiana, refinery last week, the last of the nine tracked to discharge.

Asyad Looking to Sell Stake in Oman Shipping Company

Oman's state-owned transport group Asyad is weighing the sale of a strategic stake in its subsidiary Oman Shipping Company (OSC), three sources familiar with the matter said.Asyad has asked banks to pitch for a mandate to help it review a potential deal in which Asyad could divest up to 40% of its ownership, said two sources, who declined to be named as the matter was not public.Asyad, owned by the Oman Investment Authority, the country's sovereign fund, did not immediately respond to a request for comment on Monday. Oman Shipping Company also did not respond to a request for comment.OSC focuses on transportation of liquefied natural gas (LNG) cargoes to the international market…

Trafigura Posts Highest-ever First Half Profit

Global commodities trader Trafigura on Thursday posted its highest-ever first-half net profit and core earnings, largely driven by the economic recovery.The Geneva-based trader's net profit rose to $2.1 billion for the period ending March 31, from 500 million the previous year. The company's financial year ends on Sept. 30.Revenue rose 19% to $98 billion while core earnings were $3.7 billion, up over 50% from a year before. Gross profit rose similarly to $4.3 billion from $2.8 billion…

Trafigura, Yara Sign Deal on Ammonia for Shipping Fuel

Global commodities trader Trafigura and Norway's Yara said on Monday they had signed a memorandum of understanding (MoU) aiming to supply the marine industry with carbon emissions-free ammonia for fuel.Yara will supply Trafigura with clean ammonia and together the two firms will jointly conduct research and develop marine fuel infrastructure and market opportunities for both "green" and "blue" ammonia, they said.Ammonia, a hydrogen-carrying chemical used as a fertilizer but also in other applications such as explosives, is one of several candidates to become the shipping industry's preferred z

Shipping Groups Press EU to Advance 'Fuels of the Future'

Shipping and trade groups are calling on the European Union to advance the development of ammonia and green hydrogen as the best marine fuel options to enable the industry to accelerate decarbonization.With about 90% of world trade transported by sea, global shipping accounts for nearly 3% of the world’s CO2 emissions.To reach goals for shipping set by the United Nations, industry leaders say the first net-zero ships must enter the global fleet by 2030, with vessels powered by green hydrogen and its derivative compound ammonia among the options.The coalition of groups…

Shipping Groups Tap Algorithms to Cut Carbon Emissions

Leading shipping group Maersk Tankers is investing tens of millions of dollars in digital technology to speed up cuts in carbon emissions across the industry, its chief executive told Reuters.Global shipping accounts for nearly 3% of the world’s CO2 emissions, putting the sector under pressure to clean up. About 90% of world trade is transported by sea.Maersk Tankers, which commercially manages the world’s largest fleet of more than 220 product tankers, has invested $19 million…

Glencore to Send First Spot LNG Cargo to Zhoushan

Swiss-based global mining and commodities trader Glencore is set to send its first spot liquefied natural gas cargo to Zhoushan in eastern China in a trading joint venture with Zhejiang Energy Group, a top company trader said on Friday.Glencore's joint venture with Zhejiang, which is backed by the provincial government, dates from 2018, making it one of the few Western traders with such tie-ups in China, the world's top crude oil buyer and second-largest importer of LNG.Alex Sanna…

Trafigura Proposes Carbon Levy on Marine Fuels

Commodities trader Trafigura on Friday proposed a carbon levy of $250-$300 per tonne of carbon-dioxide (CO2) equivalent on shipping fuels to make zero and low carbon fuels more economically viable and competitive.The International Maritime Organization (IMO) wants to halve the sector's greenhouse gas output by 2050 against 2008 levels.

Trafigura Offers COVID-19 Premium

Commodities trader Trafigura Beheer has become the first company to offer a defined Covid premium on an Asian syndicated loan, paying up to an extra 20bp all-in on its latest US$1bn-equivalent financing.The novel pricing structure is a first for Asia, if not globally, and could set a precedent for other price-sensitive borrowers looking to limit the long-term effects of the pandemic on their funding costs.Without the Covid premiums, the terms of Trafigura's new deal are little…

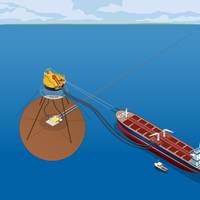

Trafigura, Phillips 66 to Build Deepwater Texas Oil Port

Global commodities trader Trafigura said on Friday it had formed a joint venture with U.S. refiner Phillips 66 to build a major deepwater port in Texas capable of handling supertankers, ditching its own competing project.The Bluewater Texas Terminal, which will be located 21 nautical miles east of the entrance to Corpus Christi port, will consist of two single point mooring buoys that can load Very Large Crude Carriers (VLCCs) capable of carrying around 2 million barrels of oil.Geneva…

China Stocks up on VLSFO Ahead of IMO2020 Deadline

Chinese marine fuel suppliers have signed up short-term deals to buy very low-sulphur fuel oil from companies like oil major Shell, Germany's Uniper and U.S. commodities trader Freepoint ahead of a new standard on emissions for the global shipping industry that kicks in on Jan. 1.While China's state refiners have pledged to produce a combined 14 million tonnes of the fuel for 2020 that complies with the tighter rules set by the International Maritime Organization (IMO), Beijing…

Hudson Shipping Joins Trident Alliance

United States based commodities trader Hudson Shipping Lines (HSL) became a member of the Trident Alliance as part of the company’s ongoing ‘green’ initiatives.The shipping company is increasing its commitment to cleaning up the shipping industry in conjunction with two environmental organizations. Hudson has recently joined the Trident Alliance as a member.“The shipping industry has a tremendous opportunity to improve its impact upon the world with the IMO 2020 sulfur cap. Hudson believes it has a responsibility to encourage companies and countries to comply with both the letter and also the spirit of the sulfur rules,” said company President, Avi Eilon.

Cargill, Maersk Tankers to Run Joint Pool

Commodities trader Cargill and shipowner Maersk Tankers aim to build a joint Medium Range (MR) tanker pool with more vessels as they seek to cut emissions."The strategic partnership will improve flexibility for customers and reduce fuel consumption and emissions, whilst having a positive impact on time-charter-equivalent earnings for partners," claimed Maersk Tankers which operates 164 product tanker vessels.Cargill will enter its MR fleet into the existing Maersk Tankers MR pool, creating a new joint pool that will significantly increase the scope of their Medium Range (MR) spot tanker business, combining Maersk Tankers' digital expertise with Cargill's experience in trading.The pool will be managed by Maersk Tankers…

Baltic Index at 2-week High on Capesize, Panamax Strength

The Baltic Exchange's main sea freight index climbed to a near two week high on Tuesday propelled by strong demand across capesize and panamax vessel segments.The Baltic index, which tracks rates for ships ferrying dry bulk commodities, gained 90 points, or 5.1%, to 1,864 points, a high since July 31.The capesize index added 188 points, or 5.8%, to 3,454 points, its highest in more than a week. Average daily earnings for capesizes, which typically transport 170,000 tonne-180,000 tonne cargoes such as iron ore and coal…