Maersk Drilling Bags Contract with Tullow Ghana

Maersk Drilling has been awarded a four year contract for the deep-water drillship Maersk Venturer by Tullow Ghana Ltd. The contract, which was signed December 2017, is expected to commence in February 2018 and covers development drilling on the Jubilee and TEN fields offshore Ghana. Maersk Venturer is currently in transit for the job offshore Ghana thereby further strengthening Maersk Drilling’s presence in the region. ”I am very pleased that Maersk Drilling will be mobilising another deepwater rig for this significant job in a strategically important region. It is our first contract with Tullow Ghana and it is a testament to our successful operational track record in Ghana.

China, Vietnam to Look Beyond Sea Disputes

Vietnamese Communist leader Nguyen Phu Trong and Chinese President Xi Jinping agreed to make joint efforts to manage the South China Sea row. Both countries agreed to friendly negotiations, and the possibility of joint development projects to settle their differences over the resource rich South China Sea. Among the proposals put forward by Li Keqiang include joint inspections with Vietnam in the waters at the mouth of the Beibu Gulf. The waters of the Beibu Gulf, which borders Guangxi and northern Vietnam, have not been completely delineated. The leaders stated that they would “proactively look for transitional resolution methods which do not affect both side’s position, including looking at and discussing joint development” said a joint communiqué.

China, Vietnam Pledge Peaceful Resolution of S.China Sea Spat

China and Vietnam have pledged to look for a peaceful resolution to their dispute in the South China Sea via talks, following a meeting between China's president and the head of Vietnam's Communist Party, state news agency Xinhua said on Wednesday. A joint communique carried by Xinhua said that both countries had a "candid" exchange of views on their maritime spat. But the two countries agreed to "use well the Sino-Vietnam government border negotiation mechanism, uphold friendly consultations and negotiations to look for a basic and lasting resolution both countries can accept", the statement said. China and Vietnam should also "proactively look for transitional resolution methods which do not affect either side's position, including looking at and discussing joint development".

Ensco plc Declares Cash Dividend

Ensco plc announced today that its Board of Directors has declared a regular quarterly cash dividend of US$0.75 per Class A ordinary share payable on 19 December 2014. The ex-dividend date for this payment is expected to be 4 December 2014, with a record date of 8 December 2014. Ensco uses its website to disclose material and non-material information to investors, customers, employees and others interested in the Company. To receive regular updates on Ensco news or SEC filings, please sign-up for Email Alerts on the Company’s website. Ensco plc brings energy to the world as a global provider of offshore drilling services to the petroleum industry. For more than 25 years, the Company has focused on operating safely and exceeding customer expectations.

Maersk Drilling CEO: Slow Deepwater Rig Market Coming

Maersk Drilling Chief Executive Claus Hemmingsen talked to Reuters on the sidelines of A.P. Moller-Maersk's annual capital markets day. Maersk Drilling has focused on two areas - harsh environment rigs primarily in Norway and deepwater rigs in the Gulf of Mexico and off West Africa. "The deepwater market will be slow, for the rest of 2014 and in 2015. We do believe however it will come up in the mid-term and long-term. "If you go back one and a half years ago, you would say (the day rates would reach) $500,000-600,000, a few above that, but that would be in Angola. "Currently, we're probably talking about $400,000-$500,000 for day rates. "We have actually six rigs out of eight coming out (of shipyards) with very strong contracts.

Maersk Drilling Wins 2-Year Angolan Extension

The head of Maersk Drilling said on Wednesday the A.P. Moller-Maersk unit has won a two-year extension for its Maersk Deliverer deepwater rig worth $387 million. Maersk Venturer, a new rig set to be delivered this year, had also won a letter of award for a short-term contract in South East Asia, Maersk Drilling Chief Executive Claus Hemmingsen told Reuters during a capital markets day. Such an award means the parties have agreed to a deal but are yet to hammer out details such as day rates. Reporting by Sabina Zawadzki

Ensco to Present at Barclays & Pareto Securities Conferences

Ensco will present at the Barclays Energy-Power Conference in New York City on Wednesday, 3 September 2014 at 11:05 a.m. EDT. The presentation will be available live over the Internet at www.enscoplc.com by selecting Investors/Presentations and Webcasts. Please go to the website at least 15 minutes before the presentation to register, download and install any necessary audio software. A replay of the presentation will be available on Ensco’s website within twenty-four hours of the live presentation and remain available for 30 days. Ensco will present at the Pareto Securities 21st Annual Oil & Offshore Conference in Oslo on Wednesday, 10 September 2014 at 11:05 a.m. CEST (5:05 a.m. EDT). A presentation will be available at the link noted above. There will be no webcast.

China Sending 4 Rigs To S China Sea Amid Tensions

China is sending four oil rigs into the South China Sea in a sign that Beijing its stepping up its exploration for oil and gas in the tense region, less than two months after it positioned a giant drilling platform in waters claimed by Vietnam. Coordinates posted on the website of China's Maritime Safety Administration showed the Nanhai number 2 and 5 rigs would be deployed roughly between southern China and the Pratas islands, which are occupied by Taiwan. The Nanhai 4 rig would be towed close to the Chinese coast. The agency, which did not say who owns the rigs, said all three would be in place by Aug. 12. Earlier this week, it gave coordinates for a fourth rig, the Nanhai 9, which would be positioned just outside Vietnam's exclusive economic zone by Friday.

China Optimistic of Finding Gas Offshore Vietnam

A Chinese oil rig whose deployment to waters claimed by Vietnam early this month triggered a rupture in ties has a good chance of finding enough gas to put the area into production, Chinese industry experts said. That would give China its first viable energy field in the disputed South China Sea, as well as make it a source of friction with Hanoi for years to come. For now, China has said nothing about the potential of the area. The first round of drilling had been completed, the rig operator said on Tuesday, without giving any results from the tapped wells. The $1 billion deepwater rig owned by state-run China National Offshore Oil Company Group (CNOOC Group), parent of flagship unit CNOOC Ltd, is scheduled to explore until mid-August.

Streamlined Service for the Offshore Sector

In a business where time is money, Signal Ship Repair’s niche ‘high blocking’ repair methods have significantly reduced repair times and increased shipyard efficiencies. If Signal Ship Repair’s (SSR) primary business can generically be described simply as ship repair and conversion, then it can also be said that its practice of ‘high blocking’ to facilitate faster, and more efficient in-house Z drive repairs is its signature service. Utilizing a simple but highly effective shipyard technique, SSR has taken a routine practice originally used to facilitate naval ship drydockings, and turned it into a signature service that helps offshore clients with drop down thrusters, z-drives, pods and keel coolers get repairs done rapidly.

China Warns Japan, Philippines Chastises China

China warned Japan on Friday to stay out of a growing dispute with its neighbors over the South China Sea, as the Philippines implicitly accused Beijing of delaying talks aimed at a solution. China claims almost the entire South China Sea, rejecting rival claims to parts of it from Vietnam, the Philippines, Taiwan, Malaysia and Brunei in one of Asia's most intractable disputes and a possible flashpoint. It also has a separate maritime dispute with Japan over islands in the East Sea. Japanese Prime Minister Shinzo Abe on Thursday expressed concern about regional tensions that he said were stoked by China's "unilateral drilling" after China moved a giant oil rig into disputed waters, a moved denounced by the Philippines, Vietnam and the United States.

Vietnam Considers Legal Action Against China

Vietnam says will "resolutely defend its sovereignty." China says Vietnam making "irresponsible accusations" against it; Philippines submitted arbitration case against China in March. Vietnamese Prime Minister Nguyen Tan Dung said his government was considering various "defence options" against China, including legal action, following the deployment of a Chinese oil rig to waters in the South China Sea that Hanoi also claims. Dung's comments, given in a written response to questions from Reuters, were the first time he has suggested Vietnam would take legal measures, and drew an angry response from China, which insisted the rig was in its sovereign waters.

Ensco plc Announces Cash Dividend

Ensco plc (NYSE: ESV) announced today that its Board of Directors has declared a regular quarterly cash dividend of US$0.75 per Class A ordinary share payable on 20 June 2014. The ex-dividend date for this payment is expected to be 5 June 2014, with a record date of 9 June 2014. Ensco’s dividend yield is among the top five percent of S&P 500® companies. Ensco uses its website to disclose material and non-material information to investors, customers, employees and others interested in the Company. To receive regular updates on Ensco news or SEC filings, please sign-up for Email Alerts on the Company’s website. Ensco plc (NYSE: ESV) brings energy to the world as a global provider of offshore drilling services to the petroleum industry.

Ultra Deepwater Rig Towed 11,500 Miles

Tug Fairmount Sherpa towed rig Sevan Louisiana safely from Singapore to Curaçao. During the 11,500 miles voyage via Cape of Good Hope, stops were made in Port Louis (Mauritius), Walvis Bay (Namibia) and Port of Spain (Trinidad) to take bunkers and for crew changes. Sevan Louisiana is a so called Ultra Deep Water rig (UDW), built in 2013 at the Cosco shipyard in Nantong, China, for UK-based Seadrill Ltd. The self-propelled rig, equipped with eight thrusters, can accommodate up to 150 crew members.

Maersk Deepwater Rig's Incident Free Year

The crew of the 'Maersk Deliverer' has achieved a ‘One-Year Free of Accidents’ award during operations offshore West Africa. Maersk Deliverer has been operating in six different countries in West Africa for eight different clients over the past two years and is currently on a two year contract with Chevron, Angola. Maersk Offshore say that the crew received the award due to a relentless pursuit of keeping a safe and incident-free environment on-board the rig. “On Maersk Deliverer, we believe that the crew is the cornerstone of all our operations.

Guarded Optimism for 2013 from U.S. Gulf Boatbuilders

Caveats and some doubts remain. Marine companies along the Gulf of Mexico will be busy in 2013 producing offshore vessels to meet expected growth in the region’s deepwater drilling sector over the next several years. Vessel repairs will be active too. Worker training will be stepped up to address a skilled labor shortage. And nearly three years after BP’s spill off coastal Louisiana, safety will remain a priority. But with the nation teetering on a fiscal cliff – which may spur tax increases and government spending cuts – demand for official and military vessels could be affected…

Seadrill Buys Ultra-Deepwater Rig 'Songa Eclipse'

A subsidiary of Seadrill to buy the ultra-deepwater semi-submersible rig 'Songa Eclipse' for a price of US$ 590-million. The rig was delivered from the Jurong Shipyard in Singapore in 2011, and is currently operating for Total offshore Angola on a fixed contract ending in December 2013. In addition Total has three one-year options to further extend the contract. Seadrill intends to take delivery of the rig during December 2012 after which it will have an immediate impact on Seadrill's cash flow and financial results.

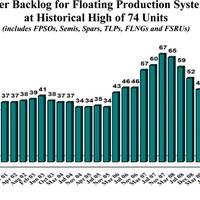

Planned Floating Production Projects at An All-Time High

IMA has just completed an in-depth analysis of the floating production sector. The 175 page report Floating Production Systems: Assessment of the Outlook for FPSOs, Semis, TLPs, Spars, FLNGs, FSRUs and FSOs is the 47th in a series of IMA reports on the deepwater production sector that began in 1996. Some highlights from the new report are below. Order backlog for production floaters at all-time high – 74 production floaters are currently on order. This number is 40% higher than the backlog a year ago – and more than double the backlog in mid-2009.

Ultra-deepwater Drillship Arrives Brazil From Korea

QGOG Constellation announces the arrival in Brazil waters of the ultra-deepwater drillship, 'Amaralina Star'. 'Amaralina Star' is to be operated by its subsidiary, Queiroz Galvão Óleo e Gás (QGOG). The unit was built to operate in ultra-deepwaters to water depths of up to 10,000 feet and to drill wells depths of up to 40,000 feet. It will be able to operate in the Brazilian pre-salt area. The Amaralina Star was built by the Samsung Heavy Industries shipyard, in South Korea. The shipyard is also currently building the Laguna Star drillship, which belongs to QGOG Constellation and will be operated by QGOG. The two units have been chartered to Petrobras under a six-year contract, with options to renew for six additional years. Drilling services will be provided by QGOG.

Planned Floating Production Projects Hits All-Time High

IMA has just completed an in-depth analysis of the floating production sector. The 175 page report Floating Production Systems: Assessment of the Outlook for FPSOs, Semis, TLPs, Spars, FLNGs, FSRUs and FSOs is the 47th in a series of IMA reports on the deepwater production sector that began in 1996. Some highlights from the new report are below. Order backlog for production floaters at all-time high – 74 production floaters are currently on order. This number is 40% higher than the backlog a year ago – and more than double the backlog in mid-2009.

Korean Shipyard to Construct Ultra-deepwater Rig for Seadrill

To benefit from the current strong demand for high specification drilling units Seadrill announced that it has entered into a turnkey construction contract with Hyundai Samho Shipyard for the construction of a new harsh environment semisubmersible drilling rig. The new rig will be a sister rig of the harsh environment semi-submersible unit Seadrill's subsidiary North Atlantic Drilling currently have under construction at Jurong Shipyard in Singapore. The new rig will be of a Moss CS60 design, N class compliant and be fully winterized to meet the harsh and demanding weather conditions in the North Atlantic areas. In addition, the new rig will have premium ultra deepwater capabilities including water depth of up to 10,000 feet.

Singapore Shipyard Contracted for Ultra-deepwater Drill Rig

Sembcorp Marine, Jurong Shipyard gets US$ 568-million contract for semi-submersible deepwater rig for North Atlantic Drilling Ltd. The new rig will be constructed based on the Moss Maritime CS60 design – an enhancement of the Moss Maritime CS50E MKII harsh-environment ultra-deepwater semi-submersible rigs West Pegasus and West Leo which were delivered by Jurong Shipyard to Seadrill in March 2011 and January 2012 respectively. Delivery is scheduled no later than the first quarter of 2015.

Keppel Completes Saipem Ultra Deepwater Rig

Keppel FELS Limited (Keppel FELS) is on track to deliver Scarabeo 9, a 6th generation ultra-deepwater semisubmersible drilling rig, to Saipem S.p.A (Saipem) on time and with no lost time incidents. A significant part of Keppel FELS' workscope on Scarabeo 9 involved the completion and commissioning of marine and drilling systems onboard. The rig was named by Lady Sponsor, Mrs Anna Tatka, spouse of Mr Pietro Franco Tali, CEO of Saipem. Speaking at the ceremony, Mr Tali said, "With Keppel's proven track record, we were confident of receiving a rig of the highest quality delivered on time and in a safe manner. The Frigstad D90 semisubmersible rig is equipped with a Dynamic Positioning 3 system and will be capable of operating in water depths of up to 3,600 meters.