Thousands Rally in Australia Against Potential Submarine Base

Thousands of people rallied on Saturday against a future nuclear-powered submarine base at Port Kembla in eastern Australia as part of the A$368 billion ($244.1 billion) AUKUS defense pact with the United States and Britain.The second-largest coal export port in New South Wales state is the Defense Department’s preferred site for a new east-coast submarine base, according to state broadcaster ABC.Protesters carrying trade union banners and flags marched down the main street to voice their opposition to a base in the town of around 5…

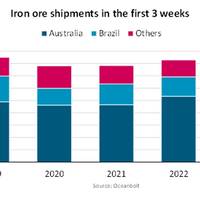

Iron Ore Shipments Drop 13.1% to Start 2023

2023 has so far been a disappointment for the dry bulk shipping sector, despite hopes that a quick economic recovery in China would boost iron ore demand,. During the first three weeks of the year, iron ore shipments fell 13.1% year on year, the lowest volume since at least 2019, worsening conditions for capesizes. In this period, the Baltic Dry Index (BDI) declined by almost 500 points to 763 on 20 January, its lowest point since June 2020.It is not unusual for the bulk market to cool during the first quarter when demand weakens during the Lunar New Year celebrations.

Australia's First LNG Import Terminal Seen Ready by Late-2023

Squadron Energy, the private company building Australia's first LNG import terminal, expects its Port Kembla facility in New South Wales to be ready to take its first gas shipment by the end of 2023, its commercial director said on Tuesday.Squadron Energy, owned by Australian mining billionaire Andrew Forrest, is vying against four other proposed LNG import projects looking to fill a shortfall in gas supplies expected in southeastern Australia from as early as 2024, and across eastern Australia from 2027.Earthworks at the Port Kembla site about 90 kilometers (56 miles) south of Sydney have bee

Australia Set to be the King of LNG Exports

Australia is on track to surpass Qatar as the world’s largest LNG exporter, according to Australia’s Department of Industry, Innovation, and Science (DIIS).Australia already surpasses Qatar in LNG export capacity and exported more LNG than Qatar in November 2018 and April 2019, said a release from U.S. Energy Information Administration (EIA).Within the next year, as Australia’s newly commissioned projects ramp up and operate at full capacity, EIA expects Australia to consistently export more LNG than Qatar, it said.Australia’s LNG export capacity increased from 2.6 billion cubic feet per day (Bcf/d) in 2011 to more than 11.4 Bcf/d in 2019.

Australia Plans to Limit LNG Exports

Australia's conservative government unveiled a radical plan on Thursday to restrict exports of liquefied natural gas (LNG) at times when domestic shortages push up local prices, aiming to ease soaring energy costs for local manufacturers. The plan would allow Australia's resources minister to impose controls on LNG exports on advice from the market operator and regulator, as the government seeks to cap domestic gas prices, which have become a political hot potato. "It's not a threat. This will be export controls.

Baltic Index Rises as Panamax Rates Hits High

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Wednesday as panamax rates surged to their highest in over three years and capesize activity firmed up. The overall index, which factors in rates for capesize, panamax, supramax and handysize shipping vessels, rose for the fourth straight session. The index was up 20 points, or 1.58 percent, at 1,282 points. The panamax index hit its highest since January 2014. The index was up 50 points, or 3.26 percent, at 1,583 points.

Capesize Rates Further Impacted by Cyclone Debbie

Coal shipments from eastern Australia could stop for 3-4 weeks. Freight rates for large capesize dry cargo vessels on key Asian routes, which fell to multi-week lows this week, are likely to remain depressed in the absence of Australian coal cargoes and iron ore and coal from South Africa, brokers said. Coal shipments from ports including Hay Point have been badly disrupted after Cyclone Debbie struck eastern Australia last week, causing extensive flooding and resulted in mine closures with BHP Billiton declaring force majeure on coal shipments. "The market is saying nothing will come out of the east coast of Australia for three or four weeks. If that's the case, shipments will be cancelled and vessels will need to find fresh cargoes," a Singapore-based capesize broker said on Friday.

Baltic Index Drops as Cyclone Dampens Demand

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, fell on Friday as closure of mines and ports in Australia due to a cyclone weighed on demand for capesize vessels. Cyclone Debbie, which struck Queensland this week, caused extensive flooding and social disruption and dampened chartering activity after coal mines were closed. The overall index, which factors in rates for capesize, panamax, supramax and handysize shipping vessels, fell 27 points, or 2 percent, to 1,297 points. The index on Wednesday hit its highest level since Nov. 11, 2014.

Asia Dry Bulk-Capesize Rates Set to Climb Again

Capesize rates hit new multi-month highs this week; BHP and FMG likely to renew chartering activity next week. Freight rates for large capesize dry cargo vessels on key Asian routes, which hit multi-month highs on Tuesday, could climb further on increased chartered activity by miners and operators, brokers said. "Only Rio Tinto has been active this week - it picked off the injured animals - fixing ships for less than the last fixture, dampening the market by 50 cents a tonne," a Singapore capesize dry cargo broker said on Friday. "There's been no competition - no BHP Billiton, no Fortescue Metals Group and no operators," the broker added.

Asia Dry Bulk-Capesize Rates Firm as Weather Delays Weigh

Brazil-China rates climb to a 15-month high; about 80 capesize, panamax ships waiting to unload around Tianjin. Freight rates for large capesize dry cargo ships on key Asian routes are likely to remain firm for at least two more weeks as bad weather conditions in China and Australia help tighten the supply of ships available for charter, ship brokers said. That came as capesize charter rates from Brazil to China climbed to a 15-month high on Thursday. The surge in freight rates on the Brazil-China and Australia-China routes have surprised ship owners and brokers who were anticipating a lacklustre market during the holiday season, brokers said. "The market is still looking firm.

Brokers Optimistic on Asia Dry Bulk-Capesize Rates

More activity from Australian miners buoy capesize rates; dry cargo market remains over-tonnaged as fleet growth outpaces demand. Freight rates for large capesize dry cargo ships on key Asian routes should stay largely unchanged next week on static cargo volumes though shipowners remain confident about prospects in the fourth quarter, ship brokers said. "I feel it's another boring week. People still have confidence in quarter four," a Shanghai-based capesize broker said on Thursday. That came as Rio Tinto fixed the 178,623 deadweight tonne (dwt) capesize ship Mount Austin on Thursday to haul iron ore from Western Australia to China at a rate of $4.40 per tonne, brokers said. The rate was about 10 cents higher than the Baltic dry bulk index rate for the route on Wednesday.

Demand, Bunker Pricing Spurs Asia Dry Bulk-Capesize Rates

Owners asking $1 per tonne more on Australia-China rates; Panamax rates climb to two-month high, but remain under pressure. Freight rates for large capesize dry cargo ships on key Asian routes could continue to firm next week on higher cargo volumes and bunker prices, while upbeat shipowner sentiment will also support the market, ship brokers said. "The market is pushing up a little bit. Owners' ideas though are even higher - they are indicating about $1 per tonne more on rates from eastern Australia," a Shanghai-based capesize ship broker said on Thursday. "Sentiment is more positive now than at the beginning of the week," the broker said.

Charting the Shift of Oceanic Boundary Currents

Global warming results in fundamental changes to important ocean currents. As scientists from the Alfred-Wegener-Institute show in a new study, wind-driven subtropical boundary currents in the northern and southern hemisphere are not only going to increase in strength by the end of this century. The Kuroshio Current, the Agulhas Current and other oceanic currents are shifting their paths towards the pole and thus carry higher temperatures and thus the risk of storms to temperate latitudes. For this study, researchers evaluated a wealth of independent observational data and climate simulations. They showed the same pattern for all boundary currents, with the Gulf Stream as the only exception. According to the data, the latter will weaken over the next decades.

APLNG Ships First LNG Cargo from Australian Megaproject

The first cargo of liquefied natural gas has sailed from the mammoth Australia Pacific LNG (APLNG) facility in Queensland, following a delay of at least two weeks with another carrier waiting to be loaded. The startup of the APLNG project comes after a slight delay. APLNG had earlier announced that it expected the first cargo to be exported by the end of 2015. The shipment, carried on the 935-foot tanker Methane Spirit and bound for customers in Asia, is among the first in a wave of liquefied natural gas projects that are coming online even as low oil prices have dragged down the value of natural gas on international markets. APLNG facility takes natural gas from Eastern Australia, liquefies it and then ships it on specialized tankers.

Shell, BG Merger Faces Roadblock

The Australian Competition and Consumer Commission (ACCC) has raised concerns that Royal Dutch Shell's proposed $70 billion takeover of BG Group may lessen gas supply competition in eastern Australia and delayed a final decision on the bid to November. The competition watchdog said, after preliminary investigations, the proposed takeover could damage the interests of east coast and Queensland gas users and force up prices. ACCC said a large number of market participants had expressed concerns that the proposed takeover may lead Shell's Arrow Energy to sell its gas into BG's Queensland Curtis liquefied natural gas plant (QCLNG) for export.