ABB Controls Production Systems Aboard Giant FPSO

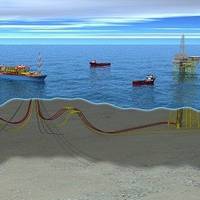

Floating Production Storage & Offloading ship uses ABB systems to control entire production from reservoir to wellhead to vessel. FPSO Peregrino, one of the biggest, most technologically advanced oil production ships in the world, was converted at a cost of more than US$1-billion from a VLCC tankship to function as a FPSO having been acquired by Statoil and permanently moored off the coast of Brazil. This FPSO vessel has a daily production capacity of 100,000 barrels of oil, 350,000 barrels of liquid and 7.3 million standard cubic feet of gas.

A.P. Moller Maersk Reports Interim Results

Revenue for the period increased by 9% to $29.9bn $27.4bn), primarily due to higher oil prices and container volumes. Profit for the period was 8% higher at $2.7bn $2.5bn), positively affected by divestment gain from sale of Netto Foodstores Limited, UK of $0.7bn. The Group’s ROIC was 12.8% (12.8%).. "Thanks to the good performance of our terminals and oil related businesses, the Group has delivered a satisfactory result for the first half-year. As we anticipated at the start of the year, the shipping market has been difficult, due to growing capacity, and we expect the slow economic growth and market volatility to continue for the coming quarters.

Lloyd's Register to support Maersk FPSO

Lloyd’s Register EMEA has been awarded the global contract to provide Maersk FPSOs with a comprehensive suite of technical services to assure the reliable operation of its fleet of floating oil and gas production units which serves some of the world's biggest offshore fields. The multi-year agreement will require the combined expertise of the energy and marine teams at Lloyd's Register to deliver a suite of technical services -- including integrity and inspection management, classification, verification and engineering support -- to help ensure safe and sustainable operations. There is an option to extend beyond the original contract period.

Aker Solutions Enters Brazilian Installation Market

Aker Solutions has signed a contract with Maersk FPSOs to perform mooring installation work at the offshore Brazil Peregrino field. The contract is the first marine installation job for Aker Solutions in Brazil and marks the start-up of the company's marine operations unit in the country. The work involves planning and installation of an APL submerged turret production (STP) buoy, which will be moored in approximately 100-m water depth using ten mooring lines with 90-ton piles, heavy chain and wire. Mooring components will be delivered by Maersk FPSOs. The operations are scheduled to be conducted during Q4 2009.