Harsh Weather Offshore LNG Terminal Firm Crown to Merge with Catcha

Crown LNG Holdings AS, a provider of LNG liquefaction and regasification terminal technologies for harsh weather locations, has agreed to merge with Catcha Investment Corp, a publicly traded special purpose acquisition company, that would result in Crown becoming a U.S. publicly listed company. The combined company, named Crown LNG Holdings Limited (“PubCo”), intends to apply to list its shares on the New York Stock Exchange under the new ticker symbol “CGBS”.Crown designs and…

Celsius Orders Four LNG Carriers

Shipowner Celsius Tankers announced it has ordered four new liquefied natural gas (LNG) carriers from shipbuilder China Merchants Heavy Industry (Jiangsu) (CMHI) for scheduled delivery in 2026 and 2027.Celsius has formed a joint venture with an affiliate of ArcLight Capital Partners (ArcLight), a middle-market infrastructure investor, to fund two of the LNG carriers. Commodities trading house Gunvor Group Ltd will have a significant equity interest in the other two newbuildings, the first for any independent LNG trading company, demonstrating the strength of Gunvor's global position in the LNG market. All four vessels will enter long…

Wave of New LNG Export Plants Threatens to Knock Gas Prices

A flood of liquefied natural gas (LNG) export projects due online worldwide in mid-decade will vie against lower-cost renewable energy and a revived nuclear power sector, which could rock gas prices and hurt some proposed projects, analysts say.Proposed and approved new LNG plants would boost LNG supply by 67% increase to 636 million tonnes per annum (mtpa) by 2030 from 2021 levels, potentially saturating the gas market."There's over a trillion dollars of natural gas infrastructure being built in the world today.

Italy's Snam Buys Golar Tundra FSRU for $350M

Italian gas group Snam has agreed to buy Golar LNG's floating storage regasification unit (FSRU) Golar Tundra for $350 million.The Golar Tundra can operate both as an LNG carrier and as an FSRU. The vessel, built in 2015, has a storage capacity of around 170,000 cubic meters of LNG and a continuous regasification capacity of 5 billion cubic meters per year.In order to maximise its regasification capacity, the vessel will be located in central-northern Italy, close to the areas with the greatest gas consumption. The Golar Tundra is expected to start operations as an FSRU during the spring of 2023, subject to the completion of authorization…

Vopak, Gasunie Team Up to Build Hydrogen Import Infrastructure in Dutch, German Ports

Vopak, a Dutch natural gas infrastructure and transportation company operating in the Netherlands and Germany, has teamed up with the tank storage firm Gasunie to jointly develop future terminal infrastructure projects for hydrogen import into Northwest Europe via Dutch and German ports. The two companies have collaborated in the Gate LNG terminal in the Port of Rotterdam that came into operation in 2011."Alongside domestic production of hydrogen, large-scale import of green hydrogen will become essential for reaching the European Green Deal and the Fit for 55 targets.

Seaspan Ferries to Run Its Vessels on Renewable Natural Gas

This week, Seaspan Ferries Corporation became the first Canadian marine company to pilot the use of renewable natural gas (RNG) to reduce greenhouse gas emissions produced by its roll-on, roll-off liquefied natural gas (LNG) powered marine fleet. Seaspan expects that data from the pilot will confirm that, by using RNG, greenhouse gas emissions can be reduced by upwards of 85% versus traditional diesel fuel.Seaspan has worked closely with FortisBC Energy Inc. (FortisBC) to secure a source of certified carbon neutral RNG.“Renewable natural gas…

JAX LNG and TOTE Complete US' First Renewable LNG Bunkering

JAX LNG, a small-scale LNG facility located along the St. Johns River in Jacksonville, Fla., recently completed the first fueling of a marine vessel in the United States with a blend of liquefied natural gas (LNG) and renewable LNG (RLNG).JAX LNG loaded the RLNG/LNG blend into the Clean Jacksonville bunker barge to fuel the Isla Bella. The Isla Bella is the world’s first LNG-powered container ship and was put into service by TOTE Maritime Puerto Rico in 2015. Element Markets supplied the renewable natural gas (RNG) used to produce the RLNG via renewable thermal certificates (RTCs).

Cyprus Gets EBRD Loan to Buy FSRU

The European Bank for Reconstruction and Development (EBRD) will provide an €80 million loan ($94,7 million), alongside EU and EIB financing, for a floating storage and regasification unit in CyprusThe EBRD is providing an €80 million loan to the Natural Gas Infrastructure Company of Cyprus (ETYFA) for the acquisition of an FSRU and the development of related infrastructure.The FSRU will be permanently anchored about 1.3 km off the coast of Limassol in Vasilikos Bay and will connect directly to the adjacent Vasilikos power station, the largest power plant in Cyprus. The EU is extending a €101 million grant for the project under the Connecting Europe Facility.

ICE Reports Milestone Trading of LNG Contracts

Intercontinental Exchange, operator of global exchanges and clearing houses and provider of data and listings services, reported new milestones in the trading of the TTF natural gas and JKM LNG (Platts) contracts.In September, TTF Futures and Options hit an all-time monthly volume record of more than two million lots (2,023,848), equivalent to 1,484 TWh. TTF Futures set a new daily volume record on September 10 of 193,695 lots, equivalent to 142.1 TWh.TTF is the most liquid European natural gas benchmark, followed by ICE’s UK Natural Gas Futures (NBP).Europe’s interconnected natural gas infrastructure allows it to absorb LNG arriving…

China-led Consortium Bids for Cyprus LNG

The Natural Gas Public Company of Cyprus (DEFA) announced that a Chinese-led consortium has been chosen as the preferred bidder for the construction of a EUR 250 million liquified natural gas (LNG) import terminal and related infrastructure.The authorities announced that the consortium of JV China Petroleum Pipeline Engineering Co Ltd, AKTOR S.A. and METRON S.A., with Hudong-Zhonghua Shipbuilding Co. Ltd and Wilhelmsen Ship Management Limited has emerged as the preferred bidder in a tender for the construction of infrastructure required for the introduction of natural gas.According to government sources, the successful tenderer will…

Piedmont Awards EPC Gig to Matrix

Oklahoma-based Matrix Service Company has secured an engineering, procurement and construction (EPC) contract for the Piedmont Natural Gas LNG facility in North Carolina.The contract was awarded to Matrix’s subsidiary, Matrix Service Inc, to build its liquefied natural gas (LNG) facility in Robeson County, North Carolina.The facility will help Piedmont Natural Gas continue providing customers with a reliable supply of natural gas during peak usage days, when extremely low temperatures create a higher-than-normal demand for natural gas.The 1 billion-cubic-foot (Bcf) storage facility will cover approximately 60 acres of a 685- acre piece of Piedmont-owned property.

Porthos CCUS Project Getting Ready

Port of Rotterdam Authority, Dutch natural gas infrastructure and transportation company Gasunie and Energie Beheer Nederland (EBN) are preparing a CCUS (Carbon Capture Usage and Storage) project, in which CO₂ from industry will be transported to storage sites in depleted gas fields deep beneath the North Sea seabed.The three companies are working together on the preparation of this project under the name Porthos: Port of Rotterdam CO₂ Transport Hub & Offshore Storage.The Porthos project is being developed as an open access transport and storage infrastructure which can be used by multiple parties to store CO₂. A so-called Expression of Interest process has been launched in order to obtain a clear picture of which companies are interested to become a customer…

ATCO Buys 40% Stake in South American Port

Calgary-based natural gas, electrical and real estate giant ATCO is getting into the transportation business after buying a 40-per-cent stake in a South American port operator Neltume Ports for about CAD$450 million (USD$340 million).Neltume Ports, a subsidiary of Ultramar, operates in 16 port facilities and three stevedoring businesses primarily located in Chile and Uruguay. “This acquisition represents an important milestone in the execution of ATCO’s long-term strategy to diversify and complement our portfolio of existing businesses and geographies in industries that are fundamental to global growth and prosperity: housing, real estate, energy, water, transportation and agriculture,” said Nancy Southern, Chair & Chief Executive Officer with ATCO.

Louisiana Cat Expands in New Iberia

Louisiana Gov. John Bel Edwards and General Product Support Manager Troy Matherne of Louisiana Machinery Company announced the company will add 60 jobs and expand its New Iberia operations. Known as Louisiana Cat, the company rebuilds and services engines and related equipment for marine, oil and gas, industrial and utility companies at the Port of Iberia. Louisiana Cat’s expansion calls for the addition of 60 new direct jobs over the next five years, with the jobs carrying an average annual salary of $60,000, plus benefits. Louisiana Economic Development estimates the project also will result in 28 new indirect jobs, for a total of 88 new jobs in Iberia Parish, Acadiana and the surrounding regions. A total of 130 existing jobs at the Iberia Parish company will be retained.

Petrobangla Signs $950mln Deal with Petronet for LNG Terminal

Bangladesh Oil, Gas and Mineral Corporation (Petrobangla) signed an initial agreement with India's energy company Petronet LNG Limited to set up an LNG re-gasification terminal on Kutubdia Island and a pipeline at an estimated cost of $950 million. Prabhat Singh, managing director and chief executive officer, Petonet and Syed Ashfaquzzaman, secretary, Petrobangla, sign an agreement at Petrobangla Bhaban in Dakka. The agreement aims to set up liquefied natural gas infrastructure, which includes a land-based LNG terminal and a pipeline to carry the re-gasified LNG. The capacity of the terminal is expected to be 7.5 MMTPA (1,000 MMSCFD) at an expected project cost of $950 million.

Flogas Britain and Stolt-Nielsen announce LNG project for Rosyth

Flogas Britain, the UK’s leading liquefied natural gas (LNG) provider, and Stolt-Nielsen LNG Holdings Limited, a subsidiary of Stolt-Nielsen Limited (Oslo Børs: SNI), a leading global provider of bulk liquid transportation and storage solutions, announced a joint project to explore bringing LNG to areas of Scotland not served by the existing natural-gas grid. The initiative is a step towards reducing the cost of energy for homes and businesses located off the national gas network. LNG will be shipped by Stolt-Nielsen LNG via small-scale LNG carriers and stored in bulk at the Port of Rosyth, before being distributed by Flogas across Scotland by road tanker, mainly to industrial customers. At present, Scotland’s off-grid natural gas is delivered by road tanker from Kent, South East England.

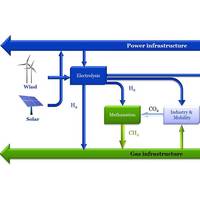

Eleven Companies Connect for Power to Gas Platform

Eleven companies in Europe joined forces in the newly established North Sea Power to Gas Platform to further develop the concept of Power-to-Gas (P2G): the conversion of renewable power into gas. P2G will play an increasingly important role in our future energy system, as it reduces temporal surpluses of renewable power by converting these surpluses into gases. As these gases can be used for different purposes such as transportation, domestic heating, as feedstock for the chemical industry and power generation, the potential value of P2G is considerable.