Sharp Uptick Seen in Crude Tanker Ordering

Contracting activity for for crude tanker newbuilding has risen sharply to start 2024, driven by a steep rise in orders for very large crude carriers (VLCC), according to shipping organization BIMCO.In the first two months of 2024, crude tanker newbuild contracting surged to 7.4 m DWT, a 490% leap y/y. Notably, the 19 VLCCs ordered in January and February is more than was ordered for the entirety of 2023.Freight rates for crude tankers spiked at the start of the war in Ukraine, and they have largely stayed strong since, said Filipe Gouveia, shipping analyst at BIMCO.

BIMCO: Tanker Supply/Demand Balance will Tighten

The BIMCO Tanker Shipping Market Overview & Outlook February 2024 by Niels Rasmussen, BIMCO’s Chief Shipping Analyst, forecasts that the supply/demand balance will tighten further during both 2024 and 2025.Low fleet growth, along with increasing sailing distances, create the foundation for the improvement despite a slowing of growth in oil demand. The product tanker supply/demand balance is also expected to tighten in 2024 but weaken in 2025. Like the crude tanker market, longer sailing distances support demand growth despite slowing oil demand.

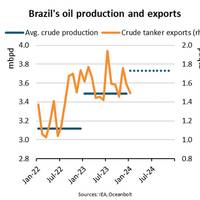

Oil Production, Chinese Buying Buoys Brazil Crude Exports 19%

“The reshaping of global crude tanker markets continued in 2023. In 2022, sanctions shifted Russia’s exports from Europe to Asia while OPEC production cuts in 2023 increased the Americas’ share of exports. Brazil’s oil production increased by 12% year-on-year in 2023 while crude tanker exports rose 19%,” said Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the International Energy Agency (IEA), Brazil’s oil production reached 3.49 million barrels per day (mbpd) in 2023, up from 3.12 mbpd the year before.

Hunter Group Signs Charter for Eco-Design VLCC

Norwegian shipowner Hunter Group has entered into a three-year back-to-back charterparty for an eco-design and scrubber fitted Very Large Crude Carrier (VLCC) with an internationally renowned counterparty.Delivery of the 2016-built vessel is expected to take place during March/April 2024.The company will charter the vessel in at a fixed rate of $51,000 per day, before subsequently chartering the vessel out on a floating index-linked spot rate contract."This agreement is yet another…

OPEC+ Prepares for 2024 Demand Uncertainty

Speaking after the November 30 OPEC+ meeting, Ann-Louise Hittle, vice president, Macro Oils, at Wood Mackenzie, said: “The decision by OPEC+ to continue with its previously announced production cuts and Saudi/Russia to extend their voluntary production cuts to the end of Q1 2024 is not a surprise, given current pricing and the uncertainty in the market over the strength of the global economy and oil demand growth. What is new is the additional voluntary cuts for Q1 2024 and announced by several OPEC+ producers.” The full tally of the additional cuts has not yet been announced…

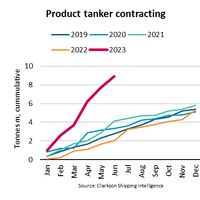

Contracting of Product Tankers Jumps

The product tanker orderbook to fleet ratio has surged from 5.4% in December 2022 to 9.3% in June 2023, driven by a remarkable 337% y/y rise in contracting during the first half of this year.“A spike in freight rates and product tanker demand is likely behind the surge in contracting,” says Filipe Gouveia, Shipping Analyst at BIMCO.By June 2023, product tanker contracting reached 8.9 million DWT. This means that more product tankers were already ordered in the first half of 2023 than during all of 2022.While the contracting of MR and LR1 ships saw notable growth…

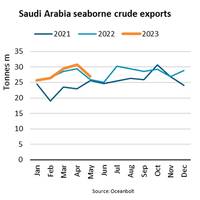

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

ADNOC Eyes June Listing of Marine & Logistics Unit

State oil giant Abu Dhabi National Oil Co (ADNOC) plans to float its marine and logistics subsidiary in the coming months, two sources said, the second initial public offering of one of its businesses this year.ADNOC, which raised $2.5 billion from listing its gas business in March, is gearing up for a June listing of ADNOC Logistics & Services (ADNOC L&S), said the sources, declining to be named as the matter is not public.HSBC was appointed as joint global coordinator on the syndicate this week…

US Oil Exports to Europe Hit Record in March

U.S. crude exports to Europe have hit a record 2.1 million barrels per day on average so far this month, spurred by wide discounts to the global benchmark and weaker oil demand by U.S. refineries.Record exports to Europe and China this month reflect the rise of United States in crude oil trade and solidifies its role supplying Europe following Russia's invasion of Ukraine.A holiday freeze knocked out operations at a dozen U.S. refineries, increasing scheduled plant maintenance and reducing crude oil demand that widened U.S.

Euronav Beats Q4 Revenue Estimate on Crude Tanker Recovery

Belgian oil tanker and storage operator Euronav EUAV.BR reported better-than-expected fourth-quarter revenue and profit on Thursday, driven by large crude tanker recovery and seasonal demand for crude oil.The tanker market, which has battled low earnings since the pandemic first hit oil demand, got a boost last year as Russia diverted oil exports from Europe, mainly to Asia, after many Western buyers turned to other suppliers in retaliation for Moscow's invasion of Ukraine last February."The EU embargo on Russian oil ...

Core Profit Surges Tenfold at Oil Tanker Firm Euronav

Euronav's core profit was more than ten times higher in the third quarter than in the same period last year as the recovery in large crude tanker freight rates accelerated, the Belgian oil tanker and storage operator said on Thursday. The crude shipping market, which has battled with low earnings since the pandemic first hit oil demand, is now seeing freight rates recover, while this year's trade flow disruptions due to sanctions on Russia have driven shipping activity. Chief…

This Decade's Oil Boom is Moving Offshore - Way Offshore

Global oil companies are pumping billions of dollars into offshore drilling, reversing a long decline in spending on the decades-long projects, including some in the remote iceberg waters far off Canada's Atlantic coast.Surging oil prices are encouraging the investments, along with Europe's mounting energy demand as the Ukraine-Russia war drags on. Offshore production sites are more expensive to build than onshore shale, the last decade's investment darling. But once they are up and running…

Euronav's Earnings Rise Offset by Low Rates for Large Vessel

Belgian oil tanker and storage operator Euronav on Thursday reported sharply higher quarterly earnings, but despite a freight market recovery, rates for very large crude carriers (VLCCs) remained low, sending its shares down more than 4%."Management has good reason to be more optimistic on the winter season," ING's analyst Quirijn Mulder said after the group, which provides crude oil shipping and storage services, said freight rates had improved substantially since March.Chief Executive Officer Hugo De Stoop said in a statement that recent trading data…

IEA Says World Oil Demand to Rise 2% in '23

World oil demand will rise more than 2% to a record high of 101.6 million barrels per day (bpd) in 2023, the International Energy Agency said on Wednesday, although sky-high oil prices and weakening economic forecasts dimmed the future outlook.The Paris-based IEA also said in its monthly report supply was being constrained because of sanctions on Russia over its invasion of Ukraine."Economic fears persist, as various international institutions have recently released downbeat outlooks…

2021 in Review: The Dry Bulk and Tanker Markets

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE.Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC…

ADNOC Weighs IPO of Logistics, Marine Services, and Shipping Unit

State oil firm Abu Dhabi National Oil Company (ADNOC) is weighing an initial public offering (IPO) of its marine services, logistics and shipping arm next year, two sources familiar with the matter told Reuters.ADNOC Logistics & Services (ADNOC L&S) has been selected for a potential float in Abu Dhabi in 2022, said the sources, declining to be named as the matter is not public.A deal could follow after testing investor appetite and market conditions, they said.ADNOC declined to comment when contacted by Reuters on Sunday.Gulf oil producers are looking at sales of stakes in energy assets…

Record Number of Floating Production System Awards Expected Over the Next 18 Months

Around 30 production floater contracts are now queued up for award over the next 18 months, assuming no major market disruption occurs and the supply chain can absorb the orders within this time frame. That’s the conclusion of an in-depth market analysis just completed by IMA/WER.The market surge is being driven by crude prices that have climbed to the mid-$80s on fast rebounding oil demand growth, supply constraints by OPEC+ and inadequate investment by upstream players to replace production.

LNG Demand to Rise 25-50% By 2030 - Morgan Stanley

Demand for liquefied natural gas (LNG) is expected to rise by 25 to 50% by 2030, making it the fastest growing hydrocarbon over the next decade, analysts from Morgan Stanley Research said in a note on Monday.Morgan Stanley has raised its long-term LNG price outlook to $10 per million British thermal units (mmBtu), expecting spot prices of the super-chilled fuel to average 40% higher over the next decade, versus the past five years.Asian spot LNG prices hit a record above $56 mmBtu…

Oil Tanker Market Set to Endure Low Earnings for Another Year -BIMCO

The global oil tanker market faces another year of low earnings as the coronavirus pandemic and vaccine inequalities disrupt demand and producers limit output of crude, a shipping analyst said on Wednesday.The earnings of very large crude carriers (VLCCs) that carry the bulk of crude stand at about $10,000 a day, down from 2020 record highs of more than $240,000, after the pandemic battered demand, creating an oil surplus and a scramble for storage.Despite a patchy recovery in global oil demand and some easing of output cuts…

Oil Holds Above $75 on Big U.S. Inventories Drop With Gulf Output Still Recovering from Ida

Oil held above $75 a barrel on Thursday, within sight of a multi-week high hit a day earlier, supported by a big drop in U.S. crude inventories and surging European natural gas prices.U.S. crude inventories fell by 6.4 million barrels last week, more than the 3.5 million-barrel drop analysts expected, with offshore oil facilities still recovering from the impact of Hurricane Ida last month.Brent crude was down 15 cents, or 0.2%, at $75.31 a barrel by 1128 GMT. On Wednesday, Brent touched $76.13, its highest since July 30. U.S.

Profitability Still a Way Off for Tanker Shipping -BIMCO

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

Near-term Outlook for Deepwater Floating Production Systems is Excellent

Near-term prospects for the deepwater sector are excellent. That’s the conclusion of an in-depth market analysis of the floating production market just completed by IMA/WER in the August 2021 Floating Production Systems Report.Asked what is driving the positive sentiment, WER’s Chairman Jim McCaul explains that, “Oil demand growth is expected to continue at a strong pace, OPEC+ appears to be able to successfully keep oil supply under control, and crude inventory has been falling…

Oil Slides 4% on China Virus Curbs, Climate Warning

Oil prices fell by 4% on Monday, extending last week's steep losses on the back of a rising U.S. dollar and concerns that new coronavirus-related restrictions in Asia, especially China, could slow a global recovery in fuel demand.A United Nations panel's dire warning on climate change also added to the gloomy mood after fires in Greece have razed homes and forests and parts of Europe suffered deadly floods last month.Brent crude futures fell by $2.82, or 4.2%, to $67.88 a barrel by 0930 GMT after a 6% slump last week for their biggest weekly loss in four months.U.S.