2021 in Review: The Dry Bulk and Tanker Markets

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE.Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC…

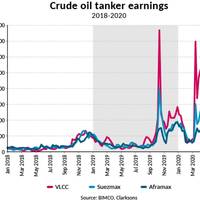

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

Iranian Tanker Hit by Missiles, Oil Rises

Oil prices jumped more than 2% on Friday, October 11, 2019, after Iranian media said a state-owned oil tanker had been struck by missiles in the Red Sea near Saudi Arabia, raising the prospect of supply disruptions weeks after attacks on Saudi oil plants.The Suezmax crude tanker Sabiti was ablaze and suffered heavy damage after being hit by two missiles, Iranian media reported.Both oil benchmarks recorded their biggest daily rise since Sept. 16, the first trading day after the attacks on Saudi installations pushed oil prices up around 20%.International benchmark Brent crude futures were up$1.39, or around 2.4%, at $60.49 a barrel by 0829 GMT.U.S.

Oil Prices Jump 2% After Tanker Attacks

Oil prices settled 2.2% higher on Thursday after attacks on two oil tankers in the Gulf of Oman stoked concerns of reduced crude trade flows through one of the world's key shipping routes.The attacks near Iran and the Strait of Hormuz reignited worries about an impact to flows from the Middle East if insurance companies begin to reduce coverage for voyages through the region and additional shipping companies suspend new bookings, analysts said.Such a disruption "could further exacerbate the supply problem…

Freight Fuel Market Moves Back Towards Balance: Kemp

The market for freight fuels is moving close to balance, after tightening significantly in 2017 and the first quarter of 2018, contributing to the recent stabilisation in crude oil prices.OECD stocks of middle distillate fuels, including road diesel, marine gasoil and jet fuel, totalled 513 million barrels at the end of June, according to the International Energy Agency (“Oil Market Report”, August 2018).Stocks have fallen compared with the slump years of 2015-2017 (when they…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Force Majeure Declared on Some North Sea Liftings

Pipeline shut on Dec. 11; repair work could last several weeks. Deliveries of crude oil through the Forties pipeline in the North Sea are under force majeure for the first time in decades and operator INEOS said on Thursday there was no timeline yet for repair work that could last several weeks. The 169-km pipeline, which carries around a quarter of all North Sea crude output and around a third of Britain's total offshore gas production, has been closed since Monday, following the discovery of a small crack in part of the system onshore in Scotland. Force majeure, which suspends a company's contractual obligations in the wake of situations that lie beyond its control, is common in oil-producing nations like Nigeria where unrest often disrupts output, but very rare in the North Sea.

d'Amico Bullish on Product Tankers

d'Amico International Shipping believes that the supply-demand balance in the product tanker freight market is improving. The key drivers that should affect the product tanker freight markets are (i) global oil supply (ii) the crude oil price and refinery margins (iii) demand for refined products and (iv) the product tankers fleet growth rate. The International Energy Agency, in its 2017 Oil Market Report (OMR), published in March 2017, forecasted annual global demand growth to average 1.2 million b/d, or 1.2% per annum, from 2016-2022, corresponding to an increase in the period of 7.3 million b/d. From an average of 96.6 million b/d in 2016, global demand is expected to rise to 103.8 million b/d by 2022.

Oil Rally is Not Just About Hedge Funds: Kemp

Oil prices are becoming dangerously overheated as speculators anticipate a rebalancing of supply and demand that has barely started, according to many oil analysts. "Even as oil rallies, analysts have barely nudged up their price forecasts as they worry that crude's recent gains might not be sustainable," notes the Wall Street Journal ("Analysts just aren't buying the oil rally", April 28). Many fear hedge funds are pushing up oil prices prematurely, which will lead to a renewed crash when the bubble bursts, as it did after the last big run-up in prices between January and May 2015. Hedge funds and other money managers have accumulated a record net long position in Brent and WTI futures and options, betting on a further rise in prices equivalent to 656 million barrels of crude.

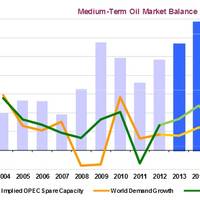

IEA Paints Lukewarm Outlook for Crude Oil Tankers

Every year around this time, the International Energy Agency (IEA) publishes their Medium Term Oil Market Report. The report includes the customary oil supply and demand forecasts and refinery dynamics. "Most interesting for us in the tanker industry is their detailed discussion of the crude oil trade flows. What does the latest IEA outlook have in stock for the tanker market?" asks, Tanker Research & Consulting department at Poten & Partners. The IEA forecasts oil demand to increase from 94.4 Million barrels per day (Mb/d) in 2015 to 101.6 Mb/d in 2021, as NonOECD demand increases by 8.1 Mb/d while OECD demand declines by 1 Mb/d during the same period. Over these six years, oil production in the OECD Americas regains its growth trajectory after an initial decline in 2016.

Offshore Prospects for 2016: Playing the Waiting Game?

This year, the offshore oil and gas industry has had to come to terms with the worst downturn for more than a decade. With commodity prices plummeting to an 11-year low in December, market research and consulting firm Douglas-Westwood (DW) reflects on the year gone by and considers the outlook for the year to come. Offshore rig markets still have a lot to digest before recovery. Rig dayrates have plummeted as a function of significant oversupply. Many of these rigs were ordered in the previous up-cycle, but have only recently entered the fleet at a time when the appetite to drill is poor.

Crude Spreads Remain Firm in face of "Massive Oversupply": Kemp

The oil market was massively oversupplied in the second quarter and remains so today, the International Energy Agency (IEA) wrote in its latest monthly oil market report. "The market's ability to absorb that oversupply is unlikely to last. Onshore storage space is limited. So is the tanker fleet. New refineries do not get built every day. Something has to give," the agency warned starkly. If so, someone forgot to tell the futures markets, where timespreads have remained firm and give no indication storage might be running out (http://link.reuters.com/zyt25w). Brent and WTI futures imply the market is willing to pay less than 45 cents per barrel per month to finance and store crude on average over the next half-year, down from more than $1 at times between January and March.

‘Business as Unusual’ for Oil in the Medium Term

The recent crash in oil prices will cause the oil market to rebalance in ways that challenge traditional thinking about the responsiveness of supply and demand, the International Energy Agency (IEA) said in its annual Medium-Term Oil Market Report (MTOMR). The U.S. light, tight oil (LTO) revolution has made non-OPEC production more responsive to price swings than during previous market selloffs, the report said, adding that this would likely set the stage for a relatively swift recovery.

IEA: Unconventional Oil Revolution to Spread by End of Decade

The IEA’s Medium-Term Oil Market Report 2014 will be officially launched during a Press webinar on Tuesday, June 17, 2014, 11 a.m. Paris time. In addition, a web-based technical briefing will take place on June 17, at 16:30 Paris time where journalists will have an opportunity to put questions to the team that produced the Medium-Term Oil Market Report 2014. The unconventional supply revolution that has redrawn the global oil map will likely expand beyond North America before the end of the decade…

Oil Prices Climb Again Amid Escalating Violence In Iraq

Crude oil prices rose to new nine-month highs on Friday as concerns persisted that an insurgency in Iraq could disrupt oil exports from the second-largest OPEC producer. Grand Ayatollah Ali al-Sistani, the highest religious authority for Shi'ites, on Friday urged his followers to take up arms against Sunni militants advancing south toward Baghdad, raising the prospect of further violence. The surge in both Brent and U.S. crude prices, up about $4 this week, lost some momentum on Friday as the market waited to see if the conflict in Iraq would threaten oil refineries south of Baghdad. "Right now the market is looking for a comfort zone," said James Williams, an energy economist at WTRG Economics in London, Arkansas.

North American Oil Supply Shocks Markets

The supply shock created by a surge in North American oil production will be as transformative to the market over the next five years as was the rise of Chinese demand over the last 15, the International Energy Agency (IEA) said in its annual Medium-Term Oil Market Report (MTOMR). The shift will not only cause oil companies to overhaul their global investment strategies, but also reshape the way oil is transported, stored and refined. According to the MTOMR, the effects of continued growth in North American supply – led by U.S.

Wärtsilä Wins Brazil Liftboat Genset & Propulsion Orders

Wärtsilä’s success in Brazilian drill ship programme continues with latest genset and propulsion order for three new liftboats. This latest in a series of contracts won by Wärtsilä is to supply complete mechanical packages, comprising the generating sets and thrusters, for three new drill ships to be built by Brazilian shipyard ECOVIX. The vessels will be employed in Brazil’s pre-salt offshore oil fields. The three new drill ships will each be powered by six Wärtsilä 32 generating sets and will feature six Wärtsilä underwater de-mountable thrusters.

Global Oil Demand Revised Downward

According to the International Energy Agency’s Monthly Oil Market Report, global demand for oil usage has been adjusted slightly downward, as persistent economic uncertainty and sustained high oil prices have simultaneously thwarted demand’s previous trek upward. While global economic growth assumptions remain basically unchanged for 2011 and 2012, weakness in 3Q2011 has sparked concern. IEA estimated global demand in September, albeit based on preliminary data, as flat compared to the same month in 2010. This follows growth of 1.4% in August. If this result holds, it would signal the weakest monthly demand growth since October 2009.

IEA: Oil Outlook Through 2011

According to the International Energy Agency’s July 2010 Oil Market Report, global oil demand through 2011 is projected to rise 1.6% or 1.3 mb/dyear‐on‐year to 87.8 mb/d, driven entirely by non-OECD country consumption, as OECD countries continue to see a gradual decline. This is a slight reduction from 2010’s 1.8 mb/d growth, fueled in part by an early, buoyant global recovery and stimulus funds. The report, released today, is filled with a number of caveats, particularly the current and future direction of the global economic recovery, which has waned in the early summer months. IEA bases its oil demand projection on the IMF’s April World Economic Outlook, with global GDP growth reaching +4.3% in 2011 from +4.1% in 2010 as recovery from the 2008/2009 recession continues apace.

Market Report: Oil Markets in for Bumpy Ride

As winter subsides and warmer weather arrives in the northern hemisphere, the traditional drop in global oil demand should be at hand. But given a number of outside factors, the balance of 2004 should be anything but business as usual. Oil demand is estimated to fall by 2.3 million barrels per day (mb/d) between the first and second quarters of 2004, much of which is projected to take place in OECD Pacific and the FSU. While demand will drop, it traditionally doesn't stay down for long, with the summer driving season creating a sharp spike upward in consumption, particularly in North America, which usually accounts for half of the estimated 2.0 mb/d growth in third quarter global demand. The lull between peak winter and summer demand poses a number of challenges.

World Oil Demand Growth Highest in 16 Years

In its May Oil Market Report the International Energy Agency (IEA) raised its forecast for 2004 world oil demand by 0.27 mbd. Altogether oil demand growth in 2004 amounts to 1.9 mbd or a change over 2003 of 2.5% resulting in a total demand of 80.6 mbd. In absolute terms the 2004 demand increase represents the single largest annual gain since 1988. Previous upward revisions to oil demand growth had centred on China but this time increased growth is estimated for North America and Europe. North America will in 2004 have increased oil demand by 1.6%, Europe by 1.5%, China by 13.6%, other Asia by 5.1%, Middle East by 4.9% Africa and Latin America by 1.7%. Oil demand is set to decline by 2% in the Former Soviet Union and by 1.6% in OECD Pacific.

Unchanged Estimate of 2001 Oil Demand Growth - IEA

The IEA in their Oil Market Report for December 2001 did not alter their previous estimate of only a marginal increase in oil demand in 2001 over 2000, a 0.14 mbd increase only. During November 2001 world oil production increased by 0.29 mbd compared to the previous month. OPEC oil production decreased whereas non-OPEC oil production increased by a total of 0.63 mbd. Total industry oil stocks in the OECD area grew by 0.22 mbd in October 2001. According to the IEA, winter fuels in primary storage continue to remain at comfortable levels. Source: INTERTANKO

China Oil Demand Expected To Rise

Chinese crude oil demand is expected to average 5.03 million barrels per day (bpd) in 2001, or five percent higher than in 2000, the International Energy Agency (IEA) said. The IEA said in its monthly Oil Market Report that demand was likely to rise by 240,000 bpd over last year's average of 4.79 million bpd but warned that the Chinese economy remained a major concern. November crude imports were 187,000 bpd higher than October, essentially all Omani oil. The report said Chinese refiners had cut back on imports of Angolan, Nigerian and North Sea oil and boosted imports of heavier Iranian, Kuwaiti and Saudi crude. - (Reuters)