Brent Oil Hits Highest Price This Year on Fresh Supply Threats

Global oil benchmark Brent on Tuesday rose above $89 a barrel for the first time since October, albeit briefly, as oil supplies faced fresh threats from Ukrainian attacks on Russian energy facilities and escalating conflict in the Middle East.Brent futures for June delivery were up $1.35, or 1.5%, at $88.76 a barrel by 11:40 a.m. EDT (1540 GMT) after touching a peak of $89.08.U.S. West Texas Intermediate (WTI) crude futures for May rose $1.27, or about 1.5%, to $84.98 after touching a peak of $85.46…

US Gulf Coast Fuel Oil Imports Hit Five-year Low

Imports of fuel oil bound for the U.S. Gulf Coast fell to a five-year low last month as refiners ran more cheap, heavy Canadian crude and geopolitical tensions in the Middle East pressured fuel oil flows.Fuel oil deliveries to the Gulf Coast dwindled in February to just 318,000 barrels per day (bpd), a 20% drop from the prior month and marking their lowest level since February 2019, data from tanker tracking firm, Kpler showed.Heavy fuel oil feedstocks like high sulfur fuel oil…

How Could Red Sea Attacks Affect Oil and Gas Shipping?

Several shipping companies and a few liquefied natural gas (LNG) tankers have decided to avoid the world's main East-West trade route, following attacks launched by Yemen's Houthi group on commercial ships at the southern end of the Red Sea.The attacks raised the specter of another bout of disruption to international commerce following the upheaval of the COVID pandemic, and prompted a U.S.-led international force to patrol waters near Yemen.IS THE RED SEA ROUTE IMPORTANT FOR…

BP Pauses All Shipments Through Red Sea Amid Houthi Attacks

Oil prices were little changed on Tuesday as investors eyed the impact on oil supply after attacks by Yemen's Iran-aligned Houthi militants on ships in the Red Sea disrupted maritime trade and forced companies to reroute vessels.Brent crude futures rose 6 cents to $78.01 a barrel at 0726 GMT. The front-month U.S. West Texas Intermediate crude futures contract , which expires on Tuesday, fell 18 cents to $72.29 a barrel. The more active second-month contract dropped 10 cents, or 0.1%…

Russian Warship Damaged in Ukrainian Attack on Novorossiysk Naval Base

A Russian warship was seriously damaged in an overnight Ukrainian naval drone attack on Russia's Black Sea navy base at Novorossiysk, two sources said on Friday, after Russia said it had fended off the attack.The civilian port, which handles 2% of the world's oil supply and also exports grain, temporarily halted all ship movement before resuming normal operations, according to the Caspian Pipeline Consortium which operates an oil terminal there. Russia's Defence Ministry said…

Wrong Size Bearing Led to Engine Failure and Fire on Supply Vessel

An incorrectly sized bearing led to an engine failure and fire last year onboard the offshore supply vessel Ocean Guardian, reports the National Transportation Safety Board (NTSB).On May 27, 2022, the vessel was conducting a sea trial in Shilshole Bay when its no. 3 diesel generator engine suffered a mechanical failure, resulting in an engine room fire that caused $1.1 million in damages.After maintenance was completed on all four main diesel generator engines in January and February 2022, full-function tests of vessel systems were conducted in open waters.

Valero Seeks US Approval to Import Venezuelan Oil

Valero Energy Corp, the second-largest U.S. oil refiner, is seeking Washington's permission to import Venezuelan crude, according to four people close to the matter, hoping for a repeat of the approval granted to Chevron Corp in November after a four-year ban.President Joe Biden's administration has eased some U.S. sanctions on the OPEC-member nation in an effort to encourage a political dialogue with the country's opposition. That has led to further pressure from U.S., European and Asian energy firms…

Iranian Oil Exports End 2022 at a High, Despite No Nuclear Deal

Iranian oil exports hit new highs in the last two months of 2022 and are making a strong start to 2023 despite U.S. sanctions, according to companies that track the flows, on higher shipments to China and Venezuela.Tehran's oil exports have been limited since former U.S. President Donald Trump in 2018 exited a 2015 nuclear accord and reimposed sanctions aimed at curbing oil exports and the associated revenue to Iran's government.Exports have risen during the term of his successor President Joe Biden, who had sought to revive the nuclear deal, and hit the highest since 2019 on some estimates.

EU Tentatively Agrees $60 Price Cap on Russian Seaborne Oil

European Union governments tentatively agreed on Thursday on a $60 a barrel price cap on Russian seaborne oil - an idea of the Group of Seven (G7) nations - with an adjustment mechanism to keep the cap at 5% below the market price, according to diplomats and a document seen by Reuters.The agreement still needs approval from all EU governments in a written procedure by Friday. Poland, which had pushed for the cap to be as low as possible, had as of Thursday evening not confirmed if it would support the deal…

Russian, Kazakh Crude Oil Exports Hit by SPM Repairs

Russian and Kazakh oil exports via the Caspian Pipeline Consortium's (CPC) Black Sea terminal face at least one month's disruption each once repairs begin on two of its three single point moorins (SPMs), CPC confirmed on Tuesday.Oil exports via the two SPMs have been suspended due to equipment damaged by bad winter weather, CPC said on Monday, confirming a Reuters report on Saturday.CPC added that a planned inspection of the third SPM at the Yuzhnaya Ozereyevka terminal would require it to be temporarily shut for a matter of hours.

Euronav's Earnings Rise Offset by Low Rates for Large Vessel

Belgian oil tanker and storage operator Euronav on Thursday reported sharply higher quarterly earnings, but despite a freight market recovery, rates for very large crude carriers (VLCCs) remained low, sending its shares down more than 4%."Management has good reason to be more optimistic on the winter season," ING's analyst Quirijn Mulder said after the group, which provides crude oil shipping and storage services, said freight rates had improved substantially since March.Chief Executive Officer Hugo De Stoop said in a statement that recent trading data…

IEA Says World Oil Demand to Rise 2% in '23

World oil demand will rise more than 2% to a record high of 101.6 million barrels per day (bpd) in 2023, the International Energy Agency said on Wednesday, although sky-high oil prices and weakening economic forecasts dimmed the future outlook.The Paris-based IEA also said in its monthly report supply was being constrained because of sanctions on Russia over its invasion of Ukraine."Economic fears persist, as various international institutions have recently released downbeat outlooks…

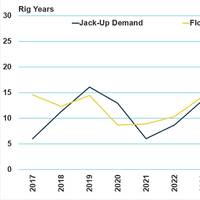

West Africa Market Harbors Positive Potential for MODU Operators

The region could be a key growth market for the oil and gas industry going forward, writes Joshua Belo-Osagie, Maritime Strategies International (MSI).Improving sentiment surrounds energy market prospects offshore West Africa, the positive mood underpinned by higher oil prices, reformed regulatory frameworks in key markets including Angola and Nigeria and the discovery of major prospects off the Ivory Coast and Namibia.In addition, the implications of Russia’s invasion of Ukraine have only reinforced some of these pre-existing dynamics…

Seaborne Oil a Lifeline as German, Polish Refiners Swerve Russian Supply

Seaborne oil has thrown a lifeline to refiners in eastern Germany and Poland, with non-Russian deliveries into the Polish port of Gdansk hitting at least seven-year highs this month as they switch away from Russian supply.Imports booked for May into Gdansk from Egypt, the United States, Norway, Britain and West Africa had hit 8.4 million barrels by May 16, their highest level according to Refinitiv Eikon ship tracking data that goes back to 2015.At the same time, Russian crude booked for May into Gdansk and the port of Rostock stood at 700…

Freight Rates, Ukraine War Boost Euronav's Q1 Core Profit

Belgian oil tanker and storage operator Euronav on Thursday reported a 30% increase in its quarterly core profit, helped by recovering freight rates and a positive impact from the war in Ukraine."The conflict in Ukraine has driven considerable dislocation in tanker market freight patterns as sanctions and so-called self-sanctioning by market participants has driven ton-mile growth," Chief Executive Officer Hugo De Stoop said in a statement.Ton mile is an industry measure incorporating volumes and distance.Euronav…

Iran's Oil Exports On the Rise

Iranian oil exports have risen to more than 1 million barrels per day for the first time in almost three years, based on estimates from companies that track the flows, reflecting increased shipments to China.Tehran's oil exports have been limited since former U.S. President Donald Trump in 2018 exited a 2015 nuclear accord and reimposed sanctions aimed at curbing oil exports and the associated revenue to Iran's government.Iran has kept some exports flowing despite sanctions as intermediaries find ways to disguise the origin of the imports.

Euronav's Loss Deepens as Omicron Hits Tanker Market Recovery

Euronav deepened its quarterly net loss as the spread of the highly contagious Omicron variant of the coronavirus dragged on the recovery of the crude tanker market, the Belgian shipping group said on Thursday."We believe this is a temporary pause," Chief Executive Hugo De Stoop said in a statement, predicting a rebound in oil supply, restocking requirements of global crude inventory and consumption to pre-pandemic levels in 2022.Output cuts by the OPEC+ group of oil-producing countries have constrained global crude oil exports during the pandemic…

Shell Restarts Production from Hurricane-hit Platforms in Gulf of Mexico

Shell said on Friday it had restarted production at its offshore Mars and Ursa in the Gulf of Mexico and began exporting oil and gas through a transfer facility, which was shut due to damage from Hurricane Ida.The oil major was the hardest-hit producer from Ida, which tore through the Gulf of Mexico in August and removed 28 million barrels from the market.Shell's West Delta-143 offshore facility, which transfers oil and gas from three major fields for processing at onshore terminals…

Shell Expects Ida-hit Offshore Platform to Restart in November

Shell said on Friday it expects an offshore transfer facility, which was shut due to damage from Hurricane Ida, to be operational in the first half of November, restarting production of a popular Gulf of Mexico crude grade earlier than expected.The oil major was the hardest-hit producer from Ida, which tore through the Gulf of Mexico in August and removed 28 million barrels from the market.Shell previously said it expected its West Delta-143 offshore facility, which transfers oil and gas from three major fields for processing at onshore terminals…

US National Towing Safety Advisory Committee Appoints New Members

The U.S. Coast Guard announced 18 individuals have been appointed to serve as members of the National Towing Safety Advisory Committee (N-TSAC).The National Towing Safety Advisory Committee was established in December 2018 to advise the Secretary of Homeland Security on matters relating to shallow-draft inland navigation, coastal waterway navigation and towing safety. This advice also assists the Coast Guard in formulating regulations and policies as well as the position of the U.S.

Near-term Outlook for Deepwater Floating Production Systems is Excellent

Near-term prospects for the deepwater sector are excellent. That’s the conclusion of an in-depth market analysis of the floating production market just completed by IMA/WER in the August 2021 Floating Production Systems Report.Asked what is driving the positive sentiment, WER’s Chairman Jim McCaul explains that, “Oil demand growth is expected to continue at a strong pace, OPEC+ appears to be able to successfully keep oil supply under control, and crude inventory has been falling…

Belgium's Euronav Posts 2Q Loss on Low Oil Tanker Demand

Belgium's Euronav, which provides shipping and storage services for crude oil, swung to a second-quarter loss, it said on Thursday, as recovering demand for oil and easing production cuts had yet to lead to better shipping rates.The Antwerp-based group posted a loss of $89.7 million for the period compared to a $259.6 million profit a year earlier."Improving crude demand and the tapering of OPEC+ production cuts have yet to translate into freight rate recovery," Chief Executive…

Saudi Arabia's Oil Exports at Four-Month High

Saudi Arabia's crude oil exports rose in May to 5.649 million barrels per day (bpd), their highest level in four months, Joint Organisations Data Initiative (JODI) said on its website on Monday.Crude oil exports rose from 5.408 million bpd in April, while the country's total oil (crude oil and total oil products) exports stood at 6.94 million bpd in May compared with 6.62 million bpd the previous month.The world's largest oil exporter's crude output rose by 0.410 million bpd month-on-month to 8.544 mln bpd in May…