Yemen's Houthis Warn They Will Target All Ships Headed to Israel

Yemen's Houthi movement said on Saturday they would target all ships heading to Israel, regardless of their nationality, and warned all international shipping companies against dealing with Israeli ports.The Iran-aligned group is escalating the risks of a regional conflict amid a brutal war between Israel and the Palestinian militant group Hamas.The Houthis have attacked and seized several Israeli-linked ships in the Red Sea and its Bab al-Mandab strait, a sea lane through which much of the world's oil is shipped…

French Warship Shoots Down Two Drones Coming from Yemen

A French warship operating in the Red Sea has shot down two drones that were launched at it from the Yemen coast, the defence ministry said on Sunday.It said the multipurpose frigate Languedoc had intercepted and destroyed a first drone at around 9:30 p.m. local French time on Saturday, and a second one around 11:30 p.m.

Saudi Arabia Urges US Restraint as Houthis Attack Ships in Red Sea

Saudi Arabia has asked the United States to show restraint in responding to attacks by Yemen's Houthis against ships in the Red Sea, two sources familiar with Saudi thinking said, as Riyadh seeks to contain spillover from the Hamas-Israel war.The Iran-aligned Houthis have waded into the conflict that has spread around the Middle East since war erupted on Oct. 7, attacking vessels in vital shipping lanes and firing drones and missiles at Israel itself.The group which rules much…

Russian Warship Damaged in Ukrainian Attack on Novorossiysk Naval Base

A Russian warship was seriously damaged in an overnight Ukrainian naval drone attack on Russia's Black Sea navy base at Novorossiysk, two sources said on Friday, after Russia said it had fended off the attack.The civilian port, which handles 2% of the world's oil supply and also exports grain, temporarily halted all ship movement before resuming normal operations, according to the Caspian Pipeline Consortium which operates an oil terminal there. Russia's Defence Ministry said…

Saudi Arabia Urges Improved Maritime Security in Gulf

Saudi Arabia wants enhanced maritime security in the crucial Gulf region as part of its rapprochement with long-timerival Iran, Foreign Minister Prince Faisal bin Farhan said on Saturday.Iran and Saudi Arabia agreed in March, in a deal brokered by China, to end a diplomatic rift and reestablish relations following years of hostility that had endangered regional stability including in the Gulf, Yemen, Syria and Lebanon."I would like to refer to the importance of cooperation between the two countries on regional security, especially the security of maritime navigation...

Report: US Gulf of Mexico Oil Production Leads on GHG Intensity

The US National Ocean Industries Association (NOIA) has released a study on global oil production emissions that finds that the greenhouse gas intensity of US oil production, particularly in the U.S. Gulf of Mexico, is significantly lower than most other regions around the world.Prepared by ICF, the GHG Emission Intensity of Crude Oil and Condensate Production report, calculates that total US oil production has a carbon intensity 23% lower than the international average outside of the US and Canada.

Russian Oil Sanctions Fuel Demand for Old Tankers

The market for old oil tankers is booming, and it's all down to efforts by Western nations to curb trade in Russian crude.As Western shipping and maritime services firms steer clear of Russian oil to avoid falling foul of sanctions or harming their reputations, new companies have leapt into the void, and they're snapping up old tankers that might normally be scrapped.The European Union banned all seaborne Russian crude imports from Dec. 5, with a fuel import ban to follow in February.

EU Tentatively Agrees $60 Price Cap on Russian Seaborne Oil

European Union governments tentatively agreed on Thursday on a $60 a barrel price cap on Russian seaborne oil - an idea of the Group of Seven (G7) nations - with an adjustment mechanism to keep the cap at 5% below the market price, according to diplomats and a document seen by Reuters.The agreement still needs approval from all EU governments in a written procedure by Friday. Poland, which had pushed for the cap to be as low as possible, had as of Thursday evening not confirmed if it would support the deal…

Five Iran-related Oil Tankers Lose Their Flags Following US Sanctions

The international ship registries of Djibouti and the Cook Islands suspended the flags on five oil tankers, following sanctions by the United States this month for having facilitated oil trade for Hezbollah and Iran’s Quds Force, nongovernment organization United Against Nuclear Iran (UANI) said on Monday.The U.S. Treasury Department in early November imposed sanctions on a wide network of companies, people and vessels accused of concealing the Iranian origins of shipments and exporting them around the world.Oil tankers Bueno…

This Decade's Oil Boom is Moving Offshore - Way Offshore

Global oil companies are pumping billions of dollars into offshore drilling, reversing a long decline in spending on the decades-long projects, including some in the remote iceberg waters far off Canada's Atlantic coast.Surging oil prices are encouraging the investments, along with Europe's mounting energy demand as the Ukraine-Russia war drags on. Offshore production sites are more expensive to build than onshore shale, the last decade's investment darling. But once they are up and running…

IEA Says World Oil Demand to Rise 2% in '23

World oil demand will rise more than 2% to a record high of 101.6 million barrels per day (bpd) in 2023, the International Energy Agency said on Wednesday, although sky-high oil prices and weakening economic forecasts dimmed the future outlook.The Paris-based IEA also said in its monthly report supply was being constrained because of sanctions on Russia over its invasion of Ukraine."Economic fears persist, as various international institutions have recently released downbeat outlooks…

First of Four FPSOs Deployed at Petrobras' Mero Field

The Guanabara FPSO has arrived at the Mero field in the Santos Basin, offshore Brazil, the Brazilian state-run oil company Petrobras has informed.The FPSO, also known as Mero 1, will be the first 'definitive' oil production system at the Mero field, the third largest pre-salt field behind Búzios and Tupi. MODEC is responsible for the engineering, procurement, construction, mobilization, installation and operation of the FPSO, including topsides processing equipment as well as hull and marine systems.

International Seaways, Diamond S Shipping Merge. Become 2nd Largest U.S.-listed Tanker Firm

International Seaways, one of the world's oil largest tanker operators, petroleum products, has completed the previously announced merger with Diamond S Shipping Inc. The combined company will continue to operate as International Seaways and trade on the New York Stock Exchange under the symbol INSW. International Seaways expects to achieve cost synergies in excess of $23 million and revenue synergies of $9 million, which are expected to be fully realizable within 2022."Following the completion of the merger…

Iran's Largest Navy Ship Catches Fire and Sinks in Gulf of Oman

Iran's largest navy ship the Kharg sank on Wednesday after catching fire in the Gulf of Oman, but the crew was safely rescued, Iranian media reported.No further explanation was given for the latest incident in a region of sensitive waterways, where there have been accusations of attacks on ships owned by arch-enemies Iran and Israel.State TV said the fire on Iran's highest-tonnage naval vessel started around 2:25 a.m.on Wednesday (21:55 GMT) near the Iranian port of Jask, where…

Nigerian Court Jails Seven for Stealing Oil

A Nigerian court has sentenced six foreigners and one Nigerian to seven years in prison for oil theft, the Economic and Financial Crimes Commission (EFCC) said on Tuesday, three years after the navy arrested 10 suspects with a vessel carrying crude oil off the Niger Delta.The suspects - a Nigerian, two Pakistanis, three Ghanaians, one Indonesian, one Beninois and two Ukrainians - had siphoned about two thousand metric tonnes of crude oil from a loading facility belonging to Shell Petroleum…

Iran Deploys Mock-up U.S. Aircraft Carrier for Target Practice

Iran has moved a mock-up U.S. aircraft carrier to the strategic Strait of Hormuz, satellite images show, suggesting it will use the look-alike vessel for target practice in war games in a Gulf shipping channel vital to world oil exports.The use of dummy American warships has become an occasional feature of training by Iran's Revolutionary Guards and its naval forces, including in 2015 when Iranian missiles hit a mock-up resembling a Nimitz-class aircraft carrier.Tehran, which opposes the presence of U.S.

Guyana's First-Ever Oil Cargo Sets Sail for the U.S

A vessel carrying about 1 million barrels crude oil from Guyana set sail on Monday for the United States, according to vessel tracking service TankerTrackers.com, ushering the tiny South American nation into ranks of the world's oil exporters.The first cargo of Liza crude departed from the floating platform Liza Destiny off Guyana, operated by U.S. companies Exxon Mobil, Hess Corp, and China's CNOOC . (Reporting by Marianna Parraga; editing by Diane Craft)

Russia, China, Iran start IO Naval Drills

Iran, China and Russia began joint naval drills on Friday in the Indian Ocean and Gulf of Oman, in what Moscow said was an unprecedented exercise in naval cooperation and training.Waters around Iran have become a focus for international tensions, with the United States exerting pressure for Iranian crude oil sales and other trade ties to be cut off."The message of this exercise is peace, friendship and lasting security through cooperation and unity... and its result will be to show that Iran cannot be isolated…

China, Russia, Iran to Hold Naval Drills

China, Iran and Russia will hold joint naval drills starting on Friday in the Indian Ocean and Gulf of Oman, China's defence ministry said on Thursday, amid heightened tension in the region between Iran and the United States.China will send the Xining, a guided missile destroyer, to the drills, which will last until Monday, and are meant to deepen cooperation between the three countries' navies, ministry spokesman Wu Qian told a monthly news briefing.The drill was a "normal military exchange" between the three armed forces and was in line with international law and practices…

BIMCO: Tanker Shipping and Macroeconomics Outlook

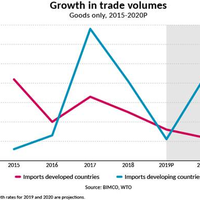

World growth and trade volumes under pressure, but still positive. A continued slowdown in global growth, as well as a lower trade multiplier will reduce overall demand for shipping for the rest of this year and through 2020.Expectations for global trade growth have also been lowered for 2020; this is now forecast at 2.7%, down from 3%. The WTO cautions that risks to these forecasts are weighted to the downside, with these risks including a potential deepening of trade tensions…

U.S. Aircraft Carrier Group sails through Strait of Hormuz

The U.S. aircraft carrier strike group Abraham Lincoln sailed through the vital Strait of Hormuz on Tuesday, U.S. officials told Reuters, amid simmering tensions between Iran and the United States.Tensions in the Gulf have risen since attacks on oil tankers this summer, including off the UAE coast, and a major assault on energy facilities in Saudi Arabia.Washington has blamed Iran, which has denied being behind the attacks on global energy infrastructure.The commander overseeing U.S.

Iran: Waterways Won't be Safe if its Oil Exports

If Iran's oil exports are cut to zero, international waterways will not have the same security as before, its president said on Wednesday, cautioning Washington against upping pressure on Tehran in an angry confrontation between the longtime foes.The comment by President Hassan Rouhani coincided with a remark by Iranian Foreign Minister Mohammad Javad Zarif that Tehran might act "unpredictably" in response to "unpredictable" U.S. policies under President Donald Trump."World powers know that in the case that oil is completely sanctioned and Iran's oil exports are brought down to zero…

Marad: Send Gulf Transit Plans in Advance

The U.S. maritime agency has told U.S.-flagged commercial vessels they should send transit plans in advance to American and British naval authorities if they intend to sail in Gulf waters following several incidents over tankers involving Iran.The seizure of commercial vessels and attacks on tankers near the Strait of Hormuz have unsettled shipping lanes that link Middle Eastern oil producers to global markets.The United States, which has increased its military forces in the region…