The History of Offshore Energy

Offshore exploration is a history of man v. nature, with ever bigger technology and investment

Prospecting for oil is a dynamic art. The greatest single element in all prospecting, past, present and future, is the man willing to take a chance,” said Petroleum geologist Everett DeGolyer, ‘the father of American geophysics.’

From a lake in Ohio, to piers off the California coast in the early 1900s, to the salt marshes of Louisiana in the 1930s, to the first “out-of-sight- of-land” tower in 1947 in the Gulf of Mexico, the modern offshore petroleum industry has inched its way over the last roughly 75 years from 100 ft. of water ever farther into the briny deep, where the biggest platform today, Shell’s Perdido spar, sits in 8,000 ft. of water.

As a planet, we have two unquenchable thirsts – for water and for oil. Everybody knows oil and water don’t mix. Not so obvious is the fact that whether via oily swamps, gassy lakes or blubber-laden whales, the link between oil and water is historical and undeniable. And today, more than ever, to get to more of one, we’re going to have to go deep down into more of another. To get there, it’s going to require the same “can-do,” pioneering spirit that grew the industry into the geopolitical force it is today, along with much more – more billions of dollars, more revolutionary technology, more layers of safety, more collaboration and more upsizing of every piece of equipment and vessel involved.

Black Gold

Long before the first well was ever struck on land, the value of oil, and it’s location near and under water (typically in marshy or swampy areas) was noted and utilized. For example, bitumen, the sticky oily tar that leaches up into the ground, was put to use by fishermen 6,000 years ago to seal their boats, an innovation that became a standard waterproofing method practiced throughout the history of wooden vessels, and which gave sailors the nickname of “tars.”

As uses for oil expanded down through the centuries, so did the process of refinement, culminating in the mid-1800s, when the first two oil refineries for making kerosene were launched. One in 1851 in near Edinburgh to distill oil from early shale fields mined in Scotland, and another in 1856 when a scientist figured out how to manufacture kerosene on a large scale and launched a crude oil refinery in Ulaszowice, Poland. Kerosene soon overtook whale oil as the fuel of choice for lamps, and the rising need to keep those lamps filled lit a fire under the hunt for fuel.

Wildcatters and the early beginnings of some of today’s mightiest oil companies were already drilling for oil on land in the second half of the 1800s. The world’s first oil well is generally credited to Baku (Azerbaijan) on the Caspian Sea. First opened in 1847, by the 1860s it was producing most of the world’s oil, and continues to produce oil today. A little more than a decade later, the Seneca Oil Co. struck black gold in Titusville, Pa., the first well in the U.S. A year earlier, Canadian James Williams beat Seneca to the punch, digging the first well in North America in oil-rich swamps in Ontario. But the wild speculating for oil and gas took on new dimensions once mass production unleashed the automobile and its attendant service stations across America in the first quarter of the 1900s.

The Move from Land

From the swamps, oil men followed the black gold, venturing out off piers into lakes, first in Ohio, in the 1890s, where wells were built on piles in Grand Lake, St. Mary’s, and then in 1897 and beyond off piers on the California coast, as far out as 35 ft. in Summerland, near Santa Barbara, where production peaked in 1902 at 75 barrels a day. In 1932, the Indian Oil Co. placed what is possibly the first stand-alone platform in shallow waters off Rincon, Calif.

Still, the southeast – Texas and Louisiana specifically – is generally considered to be the place where offshore drilling first began to percolate. The nascent industry first dipped its toe in lake waters when Gulf Oil Corp. bought drilling rights to what it hoped was a large oil and gas field under Caddo Lake, which straddles Texas and Louisiana. In 1910, using a floating pile driver, the company built a series of wooden platforms on pilings spaced out in the lake, each topped by a derrick and a generator. The platforms were connected to each other by pipelines so that some pumped fuel, directing it to other platforms for collection.

“Over the next four decades, Gulf drilled 278 wells and produced 13 million barrels of oil from under Lake Caddo, creating in the process a commercially successful prototype for water-based operations, the platform on piles,” according to “Deepwater Petroleum Exploration & Production: A Nontechnical Guide,” by William L. Leffler, Richard Pattarozzi and Gordon Sterling.

In 1938, in a joint venture, Pure Oil Co. and Superior Oil Co. built a 320-by 180 ft. free-standing, wooden drilling platform using steel strapping and redundant piling in deference to hurricane winds, near Creole, La. Located a mile offshore, the platform stood 15 ft. above the waterline in just 14 ft. of water in the gently sloping Gulf of Mexico. Shrimp boats were drafted to tow barges, haul supplies and equipment and to ferry the crews. The 33,000-acre lease eventually yielded close to 4 million barrels of oil.

Swamps, lakes and a few piddling feet offshore aside, the formal birth of the offshore industry is generally said to be the Kermac 16, universally recognized as the first “out-of-sight-of land” well, built 10 miles offshore by Brown & Root for Kerr-McGee, Phillips Petroleum and Stanolind Oil & Gas in 1947. The site, which was located on a salt dome and stood in about 20 ft. of water, was touted by the Oil & Gas Journal at the time as a “Spectacular Gulf of Mexico Discovery. Possible 100-Million Barrel Field.” Indeed, Kermac 16 eventually produced 1.4 million barrels of oil and 307 million cubic feet of natural gas by 1984. Not bad for a $450,000 investment.

Following a brief lull in the early ‘50s while the states and the federal government hashed out offshore ownership boundaries, Gulf activity started to heat up considerably mid-decade, and the industry hasn’t looked back since.

It was a gradual creep – foot by hard-won foot – out into the Gulf, according to University of Houston Professor, offshore historian and author Joseph A. Pratt.

Interest in prospecting for energy offshore was also gaining steam outside of North America. In the mid-1920s, wooden structures were placed in Lake Maracaibo in Venezuela, but were laid to waste by worms in less than a year. A government project to build a seawall on the lake lead to experimentation with cement pilings, which were eventually married to steel heads and connected together with steel cable for stability and integrity. By the 1950s, wells on the lake had progressed to hollow, cylindrical cement piles supporting 900-ft platforms.

In 1960s came a series of big discoveries of oil and gas deposits out into the rougher, but still relatively shallow North Sea, primarily in British and Norwegian waters. According to U.K. energy analyst Jeremy Cresswell, one of the most important findings almost didn’t happen.

The Ekofisk field was discovered in 1969 by Phillips Petroleum Co., and remains strategic for the Norwegians. But Phillips, facing bad weather and unsuccessful drills, “only drilled the well because they had bought the rig time – there was still time on the clock,” marveled Cresswell. Other participants in the North Sea are Germany, Denmark, France and the Netherlands. Beyond the Gulf of Mexico and the North Sea, the most productive offshore drilling areas today include coastal areas off Brazil and West Africa, the Southeast Asian seas and the Arabian Gulf.

What stands out about the early pioneers of offshore, according to petroleum historians like Pratt and F. Jay Schempf, author of “Pioneering Offshore: The Early Years,” is the upbeat, optimistic spirit of this tough, ambitious group. In the early days, no one really knew what they doing in the water, except that onshore drilling tools and techniques did not necessarily translate to offshore. Pratt, who is involved in the Offshore Hall of Fame oral history project, quotes one participant as saying, “We were less afraid of failure then.” Problems arose; they were tackled and solved. Most pressed on, perhaps in keeping with the adage, “Omnia bona quoad perfora,” which essentially means “All prospects look good until drilled,” – a motto used decades later by future Kerr-McGee parent Anadarko Petroleum in 1994 as it drilled in the Gulf of Mexico.

In the early offshore years, prospectors had little more than hunches to go on when deciding where to drill. “These guys were brash and arrogant,” said Robert Gramling, emeritus professor of sociology at the University of Houston and the author of several books on offshore drilling. Former President George H.W. Bush, who was a partner in an early offshore company, Zapata, which specialized in jack ups, has been quoted summing up the infancy of offshore drilling as “Low technology, huge risks.”

Risk Meets Technology

The risk has never gone away, but gradually technological advancements came along that were so impactful, they transformed the industry many times over, bringing it to the point today where it’s not a stretch to say that the petroleum industry deploys close to space-age level technology in its bid to go deeper, colder and safer, where no drill, platform or ROV has gone before.

What really opened up offshore drilling initially, was the advent of mobile drilling technology by the Texas (Texaco) Co. While the South Americans were testing concrete piles, Texas Co. in the early 1930s had the idea of using a moveable, submersible barge as a drilling platform, a boon in the days when drilling was more apt than not to come up dry, and the building and abandoning of multiple wells could quickly bleed investors dry. Dubbed the Giliasso, Texaco Co.’s mobile rig initially plied its trade in Lake Pelto, La., and cut the time between drilling new wells from 17 days to 2.

In 1946, Kerr-McGee advanced the idea of mobility by converting an old naval barge into a towable, drilling tender, with conceived a way to bring portability to offshore drilling by converting a 327-ft surplus naval materials barge into a towable drilling “tender” that, in conjunction with a small fixed platform, could drill wells relatively quickly. The tender also housed a crew and galley, setting the stage for manned, 24-hour operations that continue to this day.

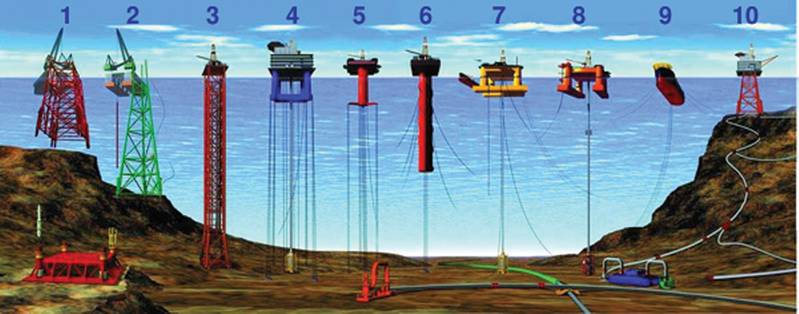

Stability and depth were other issues addressed by a steady advancement in fixed and mobile platform types and size that helped to drive the march out into the sea (see image above) from shallow and calm, to deeper and more turbulent waters. Mobile drilling platforms evolved from fixed wood or concrete platforms placed on piles driven into the seafloor out to 1,500 ft., to “jack-ups,” which while similar to a drilling barge, has legs that are lowered down to the ocean bottom, lifting the platform out of the water, but which can only be used in moderate depths. Somewhat similar are “submersible” rigs, which are elevated on stilts above barges that are flooded until they sink to the floor as an anchor, pushing the platform out of the sea. The “semisubmersible” rig improved upon the submersible via its ability to anchor a platform in deeper, rougher water. BP’s ill-fated Deepwater Horizon well was a semisubmersible.

More recent is the emergence of drilling ships. Dynamic positioning is used to talk to the sensors on the template and communicate with thrusters on the underside of the ship to keep the vessel stabilized and anchored in position. The farther out to sea, the bigger the vessels. Currently scheduled for launch in June, the Chinese-built Dalian Developer will be the world’s largest ultra-deep water drillship rated to a water depth of 10,000 ft. and capable of drilling to 35,000 ft. It reportedly will store 1 million barrels of crude.

Production platforms have also evolved to enable the push into ever deeper waters. After “fixed” platforms that rival skyscrapers in height and are kept in place by their sheer weight, “compliant towers’’ kicked the early design up a few notches and finto deeper waters, from 1,500 to 3,000 ft. Similar in construction and height, they are narrower and built to “comply” or sway with the elements, making them more resistant to damage from wind, water and weather, major threats in the hurricane-prone gulf. Sea Star platforms are deployable from 500 to 3,500 ft., and are essentially a sturdier version of a semisubmersible that uses rigid tension legs instead of anchors to hold the platform in place.

To get beyond 3,500 ft. requires any of the following: a floating production and offloading facility (1,500 to 6,000 ft.), vertically moored Tension- and min-Tension leg platforms (1,500 to 7,000 feet) or a spar platform, (2,000 to 10,000 feett). Oil companies and governments want to get beyond not just 3,500 ft., but even the current depth stop of 8,000 ft. In 2007 alone, about 37% of annual oil production was credited to offshore production, and about 26%, or 41 billion tons, of the then perceived conventional oil reserves lay offshore in ultra-deep (3,500+ ft) waters, including up-and-coming anticipated well fields off India, in the South China Sea, the Caspian Sea off Kazakhstan and even the Arctic and Antarctica.

A FPS, which can be a floating semisubmersible or a drillship, places much of the production equipment on the ocean bed, pumping oil or gas into storage facilities on the platform, using dynamic positioning to stay in place.

Tension leg platforms are bigger versions of sea stars that have tension legs stretching to the ocean floor. It is more susceptible to horizontal and some vertical motion, but can store oil temporarily and permits drilling to almost 7,000 ft.

Subsea systems take the floor-mounted wellhead to significantly deeper depths, 7,000 ft and beyond. Once extracted, oil and gas are pumped into production facilities via pipelines or risers.

But to go really deep, the limit today is the SPAR platform, which can drill to a depth of 10,000 ft, and temporarily store oil. It consists of a hollow, tubular hull, the bottom of which drops 700 ft. into the ocean waters. A combination of the system’s weight and a network of cables and lines hanging from the cylinder stabilize the platform and keep it in place. The mooring line scan be manipulated to move the spar from one well to the next.

Going Deeper

The deepest wells drilled to date are both dual oil and gas and are located in the Gulf of Mexico. The most remote and deepest is Shell’s spar Perdido, which was deployed in 2010, stands 9,600 ft., and sits in just under 8,000 ft. of water 220 miles off the Texas coast. Perdido functions as a common processing and exporting hub supporting a 30-mile radius of wells.

Second in depth is the physically bigger Atlantis complex, located 190 miles south of New Orleans, covering an area with water depths ranging from almost 4,500 to just over 7,000 ft. of water. It started producing oil in late 2007.

Shell hopes to take drilling to the next depth level in 2016, when it plans to deploy a floating production, storage and offloading (FPSO) vessel to tap into subsea facilities 9,500 ft. below, in its ultra-deep Stones field, located in the Gulf’s largely uncharted lower tertiary region.

To go deeper will require more than a new generation of platforms and systems to anchor and stabilize it. Ultra deep water exploration comes with particularly harsh conditions requiring what Shell calls “feats of engineering”– extreme temperature differences between the frigid waters of the deep and the boiling oil being extracted, wild weather, uneven ocean beds, rough seas and currents and intense pressure capable of cracking drill casings and in all likelihood some ROVs.

As the the depths get larger, the risks do too, and the probability of accidents is exponentially higher here than in more hospitable and shallow seas. Along with technological advancements to surmount these issues will come even more layers of environmental and safety requirements in an industry that is already hidebound in regulation.

Enabling Technologies

“First look at the size of the prize and then the risk involved - geology first, economics second” R.E.Mcgill

Seismology and geology have always been the divining rod of petroleum prospecting, onshore and off. At one time, oil companies employed armies of so-degreed workers, taking surveys and deciphering and analyzing acres of the resulting data. Then came desktop computing, with its enormous databases and software capable of crunching all that data and spitting out heavily detailed maps in a fraction of the time at a fraction of the cost, followed by 2D and 3D seismology. The technology shrank seismology and geology departments at oil companies as third parties sprang up and mapped, offering off-the-shelf maps galore at affordable prices.

More recently, in 2011, Shell and Hewlett-Packard Co. announced a breakthrough in the capability of its jointly developed inertial sensing technology to shoot and record seismic data at much higher sensitivity and at ultra-low frequencies down to 10 nano-g per square root Hertz (ng/rtHz), which is equal to the noise created by the earth’s ocean waves at the quietest locations on earth as defined by the Peterson Low Noise Model. The wireless seismic system sits onshore and “talks” to seismic sensor networks in order to provide a more clear picture of the earth‘s subsurface.

Advances in drilling equipment, processes and techniques have also helped to pave the way down. Among the earliest innovations were the use of drilling mud to lubricate the process and to also extract drilled debris, ever increasing layers and strengths of casings, cement liners, diamond-tipped drill bits and very key, the ability to drill directionally. Directional or vertical drilling enables companies to explore not just straight down, but to look for pockets in the areas around a well. It saves time and money by eliminating the need to sink and man new wells.

Satellite communications, dynamic positioning and remotely operated vehicles (ROVs) have also done their bit to surmount the unreachable and the inhospitable, enabling isolated platforms to be monitored from ship, shore and space, and enabling research, maintenance and production work to take place beyond the endurance of human divers. For instance, advanced ROV technology figured prominently in Shell’s Perdido project, which needed to find a way to get oil extracted by the most remote and deepest situated well on the planet back to shore. The solution was to build a connection to existing pipelines 4,500 feet down and 80 miles away, a tricky endeavor even under the best conditions. Shell tackled the job with several 300hp ROVs capable of diving to 10,000 feet and equipped with articulated arms able to turn valves, program control panels, make cuts, install pumps and other systems.

Over the decades, the fortunes of offshore oil and its financiers have risen and fallen on the restraints of conservation, the agitation of environmentalism, the scrum of politics and the winds of war. Throw in leasing, royalty and taxes, along with the ups and downs of the worldwide and national economies, and it’s been anything but steady ride for the industry.

The People Factor

One of the lingering offshoots of the down years, particularly the period in between the mid-‘80s and ‘90s, is the shortage of experienced personnel. The oil companies went through periods where they slashed headcounts whenever things got tight, and in one point, even stopped hiring. As it looks baby boomer retirements square in the eye, the industry is seeing the payout for what some might call short-sighted hiring practices. Sure, some boomers can be enticed to stay on, and work can be done with universities and vocational schools to direct more graduates into entry-level positions, but there’s a whole tier of mid-level experienced people who should be ready to move into the boomer jobs, that just aren’t there right now, says Tyler Priest, an associate professor of history and geography at the University of Iowa and a member of the presidential commission on the Deepwater Horizon spill. Consequently, there’s hardly an industry conference or seminar today that doesn’t bemoan the labor shortage and brainstorm about how to address it.

Another issue is the impact of geopolitics. Decisions made today are as much about ease of access, cooperation and taxation, as they are about the probable number of barrels and projected lifespan of a particular field or basin. Oil companies have learned painful lessons about dealing with unstable and impetuous governments, said Cresswell.

Hence when looking at probable untapped oil and gas reserves today, it’s not hard to figure out which areas are likely to be drilled first. “The major obstacle to the development of new supplies is not geology, but what happens above ground: international affairs, politics, investment and technology,” said Dr. Daniel Yergin, Vice Chairman of IHS and founder of Cambridge Energy Research Associates, as well as the author of books about the oil industry, including, “The Prize: The Epic Quest for Oil, Money & Power.”

Location is something, but money is everything, according to numerous speakers at this year’s 2014 CERAWeek conference. Yes, the oil and gas industry contains some of the most profitable and well capitalized companies in the world, but the cost of building deep water platforms, never mind supplying all the rest of the equipment and vessels and hauling everything out to essentially the middle of nowhere – sometimes in hostile seas – is as close to prohibitively expensive as oil companies can get. And more than ever, they want to hew to budget, and will hold off on a project in order to make their numbers.

Moreover it can take up to 20 years and billions of dollars to develop a project to the point where it starts producing, and U.S. demand for oil is down. It’s expected then that offshore oil will lose some projects to gas. Jim McCaul of IMA told attendees at the 2013 Emerging FPSO Forum conference that shale oil and gas are a threat to deep water because they could drag investment away.

Ditto LNG. Plentiful resources of both could turn the U.S into a major exporter, while moving the country closer to energy independence say many observers. Already, the abundance of cheap gas is said to be sparking a renaissance in manufacturing on American shores. And, adds McCaul, plans to build onshore facilities to handle imported gas are being scrapped in favor of readying the market for export to the rest of the world.

There are significant shale deposits the world over, notes John Westwood, chairman of Douglas-Westwood, but only North America seems to be serious about it. That could be in part because the Green River Formation shale deposit that stretches across parts of Colorado, Wyoming and Utah, is said to be the largest shale reserve in the world.

LNG is attracting a lot of attention, and a lot of investment. Shell, once again, is at the forefront here, with plans to launch Prelude, one of four super-sized Floating Liquid Natural Gas (FLNG) production facilities currently under construction around the world.

Prelude will be 488m long and 74m wide; fully loaded it will weigh about 600,000 tons. Once towed in 2017 to its destination off the coast of Western Australia, it will be moored in 250m deep water, where it will stay for the next 25 years, designed to produce 3.6 million tons of LNG a year as well as LPG and condensate for export. After processing the gas, it will be offloaded to other vessels for export.

Prelude will be the first of its kind, and is designed to help develop “stranded” gas reserves at a lower capital cost. There’s a lot of untapped gas in the deep, in part because gas is tricky to transport and store. FLNGs are the solution, and just in time too. World demand for gas is soaring while consumption of oil have been flat to dropping.

Even so, environmental, geographical and monetary constraints involved aside, more of the world needs even more oil and gas, in every form possible, from anywhere probable, and demand is only going to rise. Offshore production of oil and gas, which the International Energy Association (IEA) says accounts for just 6% of world’s energy mix, has obviously never surpassed onshore output, but then it’s a lot harder to find, develop and extract.

Still, the IEA is predicting an increase in deep water production from 4.8 billion barrels of oil equivalent (boe) a day in 2011 to 8.7 million boe by 2035. Moreover, the agency estimates that there are more than 300 billion boe beneath the ocean, which it says comprises at least 10% of the word’s remaining recoverable conventional oil and gas, resources we have barely begun to tap.

With recent history of technological development in the offshore energy sector as a guide, it can be assumed that with considerably more black gold out there, the industry will gear up to go get it.

(As published in the April 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)