120 To 175 Floating Production Systems Forecast Over The Next Five Years

The number of floating production systems in service continues to grow. There are now more than double the number of units ten years ago – 250 units now vs. 120 units in 2001. Order backlog, which now stands at 47 units, will increase the inventory by another 20 percent over the next several years.

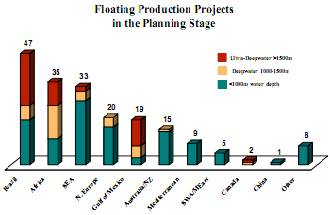

Planned projects – In a new in-depth analysis of the floating production sector, IMA identifies 194 projects in the planning stage that are likely to require a floating production system for development. Fifty-five of these projects are at the bidding/final design stage, with equipment orders likely over the next 12 to 18 months. Another 139 projects are in the planning/study stage, with orders likely in the 2013 to 2019 timeframe.

Floater order forecast – Overall, IMA expects orders for production floaters to average 24 to 35 units annually over the next five years. Around 80 percent of the units will be FPSOs. Capex thrown off by floater orders is expected to total $80 to 115 billion between 2011 and 2016. The forecast range reflects three potential crude pricing scenarios. The base scenario assumes oil stays in the $90-110 range, a price range IMA sees most likely over the foreseeable future.

Long term outlook – There is no indication of future slowdown in this sector. Deepwater fields are among the major sources of hydrocarbons yet to be found or developed. While no one knows the full extent of deepwater potential, the magnitude is undoubtedly huge. In Brazil alone, deepwater pre-salt resources are estimated at 70 billion barrels of oil equivalent, a figure that is likely to grow as more finds are confirmed. Some estimates see deepwater resources offshore Brazil, West Africa, elsewhere providing almost 14 million barrels of oil equivalent per day by 2030 – more than double the current contribution to global supply.

According to Jim McCaul, head of IMA, “future growth indicators in the floating production sector are hugely positive. Global demand for oil continues to grow, the market is again threatened by MENA supply disruptions, oil prices have pierced $100 and virtually every major field operator has announced plans to increase offshore E&D expenditures. Deepwater drilling rigs now being built will add 38 percent to available drilling capacity, removing constraints on deepwater exploration.”

McCaul adds “if there is another business sector more strategically positioned for future growth, I’d like to know about it.”

Source:INTERNATIONAL MARITIME ASSOCIATES, INC.