MR Tankship Market Analysis: Second-Hand Price-Rise Outstrips Newbuild

In their latest analysis, shipbrokers & marine transport consultants, McQuilling Services, in their latest analysis discuss observations, current and historical, for the clean tanker market, specifically MR tankers. The report concludes that they believe the current MR secondhand asset market will adjust to reflect the weak TCE (Time Charter Equivalent) environment over the longer term. Excerpts as follows:

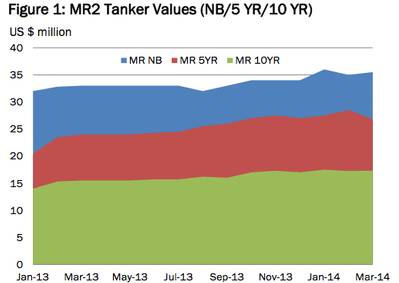

" In Figure 1 [shown here] we display the price movements over the last 15 months for MR2 newbuildings, five-year and 10-year old vessels. During this period, we witnessed a sharp increase in five-year old prices (31%) and ten-year old prices (24%) while newbuilding values increased by a modest 11%.

As discussed in our previous industry note, we would expect prices for secondhand tonnage to closely follow movements in TCE levels with newbuilding prices being dictated by the market’s future expectations. However, the five-year old asset price trend line increased throughout the year. We believe the conviction displayed by market participants promoting the long-term growth potential in clean products may have led to an impulsive desire to buy up secondhand tonnage despite TCE rates coming under pressure. Reality may however be trickling through as five-year old values have been falling recently.

If we conclude that the secondhand asset market is correcting to reflect the weaker TCE results, the question is then whether the future looks any brighter. Is it likely that there will be an asset contango in the MR sector on the horizon?

The long-term CPP tanker demand growth story is in part based on additional refining capacity coming online in Asia and the Middle East coupled with the potential for further refinery closures in Europe. The expectation is that this combination may lead to significant ton-mile demand growth in the coming years and the prospect has propelled owners to build-up their clean tanker fleet via newbuildings.

One of the main challenges to a recovery for MRs in the longer term is the alarming amount of orders placed in the last couple years along with the subsequent delivery profile moving forward.

In conclusion, we believe the current MR secondhand asset market will adjust to reflect the weak TCE environment and pressure from a strong delivery profile will strain the optimistic expectations that have been promoted by owners and investors over the longer term."

Source: McQuilling Services