Ship Recycling Fundamentals Remain Shaky

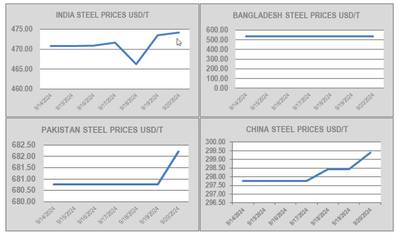

Global ship recycling fundamentals remain shaky, reports cash buyer GMS, as Indian and Pakistani steel plate prices reported unexpected moves bought on by the 30% tariffs levied on a variety of goods being imported from China.

In addition, the U.S. Dollar continues to “belly dance” around the various recycling nation currencies reporting the (comparatively) worst week for the Bangladeshi Taka as the interim government continues struggling to control the currency since May.

“The free flow of turmoil since the start of the year has therefore seen vessel offers fall firmly by over $90/ton since the highs of +USD 600/LDT, down to firmly below USD 500/LDT even on favored container units in India,” says GMS. This is in light of MSC’s strictly India only HKC pre-approved yard list policy, which certainly (yet briefly) perked not only the mood in Alang, but even the incoming volume of tonnage at Alang’s waterfront amidst a bevy of prompt MSC sales that were truly the recycling highlight of the week.

“Limited and even laughable offers continue emanating from the various sub-continent shores as recyclers remain nervous about current ongoings and even about the immediate future, as the industry would logically prefer to see a few weeks of global and currency stability, before putting down firm offers on any viable units.

“Whilst the inertia remains staggered and dire ship owners are abstaining from introducing any fresh vessels into the market, unwilling to accept the lowly ongoing prices, these remain concerning times for global ship recycling markets even though the general feeling is that a bottom may have been reached and the only way is up from here.”

GMS demo rankings / pricing for week 38 of 2024 are: