Ship Recycling Market Remains Jittery

As threats of trade wars loom, global shipping already seems to be reacting in kind with the Baltic Dry Exchange falling to its lowest since February 2023, says cash buyer GMS. This marks a clear shift towards easing freight rates as a gradually increasing number of over-aged assets have been making their way towards the bidding tables since the start of 2025.

“Incoming Chinese New Year holidays has predictably seen an accelerated purging of older assets from Far Eastern waters including all those coming off charter amidst declining rates. Even oil futures that rapidly rose on the back of recent U.S. sanctions, saw a minor cooling this week as levels fell to $74 / barrel and President Trump urges Saudi Arabia to lower the price of oil whilst America’s “drill baby drill” motto trudges on.”

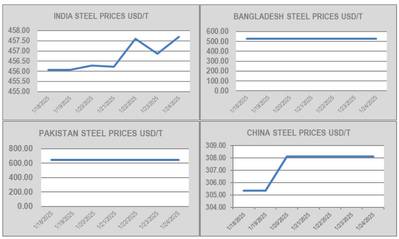

In the meantime, fundamentals continue to remain jittery amidst a likely interest rate cut by the U.S. Feds and the U.S. Dollar continues to shake global ship recycling currencies as some impressive gains against the Dollar were registered while others continue to shatter records, says GMS.

The Indian sub-continent ship recycling market continues to feel the strain of an increasing number of candidates for a recycling sale, particularly from Panamax bulkers and now, likely container ships in the near future.

The imminent easing / reopening of traffic through the Red Sea shipping lanes following the truce in Gaza is likely to be bad news for many container operators who have been raking in 2024 charter highs. “This is certain to eventually see a slew of container ships head for recycling after an extraordinary last few years of earnings – although experience tell us that the effects from this should take 3-4 months to filter through to recycling markets, at least with most vessels still on time charters.

“Overall, sentiments remain of an eagerness that is shackled by economic uncertainty and despite an increasing supply of tonnage earmarking the present, unraveling indications have simply failed to fuel the expected volume of sales, as disappointed ship owners and cash buyers of expensive inventory reevaluate further moves as the (residual) values on their assets are just not what they were hoping to see in 2025, especially since USD 600/Ton is only a dream from a year ago.”

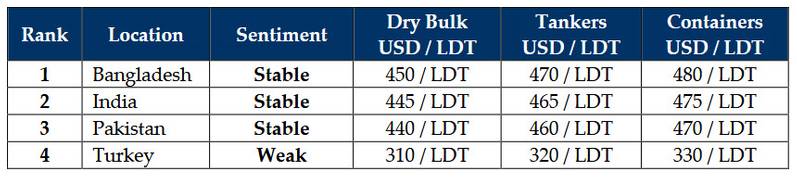

GMS demo rankings / pricing for week 4 of 2025 are: