Top Threats for the Marine Industry in 2023

Allianz just released its 12th Risk Barometer, an annual corporate risk survey incorporating the views of 2,712 risk management experts in 94 countries and territories, including CEOs, risk managers, brokers and insurance experts. The overall global results reveal Cyber incidents and Business interruption as the biggest company concerns for the second year in succession. Macroeconomic developments such as inflation, financial market volatility and a looming recession rose to the third spot followed by the impact of the Energy crisis, a new entry in the fourth spot globally.

Fire and explosions

For the marine and shipping industries, Fire and Explosions lead the rankings of threats keeping management up at night with 29% of responses, up from the third spot last year. While fire risks are often well understood and typically well risk managed, they remain a significant cause of business interruption and supply chain disruption. Commercial insurance claims analysis by Allianz shows that fire is the largest single cause of corporate insurance losses, accounting for 21% of the value of 500,000+ insurance industry claims over the past five years (equivalent to $19.5B).

Although shipping losses have more than halved over the past decade, fires on board vessels remain among the biggest safety issues for the maritime industry. AGCS analysis of over 240,000 marine insurance industry claims between January 1, 2017, and December 31, 2021, worth approximately $10B in value, shows that these are the most expensive cause of loss, accounting for 18% of the value of all claims.

As recent events have demonstrated, roll-on roll-off (ro-ro) car carriers, the largest of which can hold as many as 8,000 vehicles, can be susceptible to fire risks, while there have also been a number of blazes on container ships and in warehouses.

For shipping companies, the transport and storage of lithium-ion batteries are an increasing cause of concern. Insurers have long warned clients about the potential dangers that lithium-ion batteries can pose for the shipping and wider logistics industries, whether they are being transported inside electric vehicles or as standalone cargo, if they are not handled, stored or transported correctly, with fire being a significant hazard.

With the incessant increase in global demand for lithium-ion batteries, this risk is only going to escalate for the industry. Regularly assessing and updating prudent fire mitigation practices, including preventative measures, fire extinguishing methods and contingency planning, remain essential for all maritime businesses and their partners to lower the risk of loss from an incident.

Changes in legislation and regulation

A new entry hit the Risk Barometer’s second spot for marine and shipping companies this year. Changes in legislation and regulation received 25% of industry responses. These include trade wars and tariffs, economic sanctions, protectionism and Euro-zone disintegration. Given the global nature of the shipping industry, it is no wonder this risk is top of mind with our clients.

Within this category is the rapidly changing and evolving regulatory landscape on decarbonization of the shipping industry and the subsequent challenges this poses to shipping companies. The International Maritime Organization’s (IMO) new regulation for global shipping fleets to measure and improve the carbon intensity indicators is a recent example. It is widely expected that the IMO is likely to revise the overall emission’s target for the shipping industry in the near future. The Net Zero Insurance Alliance (NZIA) has also released the target-setting protocol under its commitment to achieve net zero by 2050.

Cyber incidents remain a major concern. Copyright Arrow/AdobeStockCyber incidents

Cyber incidents remain a major concern. Copyright Arrow/AdobeStockCyber incidents

Digital and disruption dangers continue to impact marine and shipping companies with Cyber incidents, such as IT outages, ransomware attacks or data breaches, ranking the third most feared threat for the industry in 2023. According to the Allianz Cyber Center of Competence, the frequency of ransomware attacks remains elevated in 2023, while the average cost of a data breach is at an all-time high at $4.35mn and expected to surpass $5mn in 2023.

The conflict in Ukraine and wider geopolitical tensions are heightening the risk of a large-scale cyber-attack by state-sponsored actors. In addition, there is also a growing shortage of cyber security professionals, which brings challenges when it comes to improving security for all industries, including marine and shipping.

According to Allianz Risk Barometer respondents, a data breach is the exposure which concerns companies most (53%), given data privacy and protection is one of the key cyber risks and related legislation has toughened globally in recent years. Such incidents can result in significant notification costs, fines and penalties, and also lead to litigation or demands for compensation from affected customers, suppliers and data breach victims, notwithstanding any reputational damage to the impacted company.

Business interruption

For maritime businesses, 2023 is likely to be another year of heightened risks for business interruption, which ranked as number four for the industry, down from the top spot last year. Despite positive moves to diversify business models and supply chains since the pandemic, businesses continue to experience significant disruption around the world. Covid-19 came as a massive shock, creating global shortages, delays and higher prices, while the war in Ukraine triggered an energy crisis, turbocharging inflation.

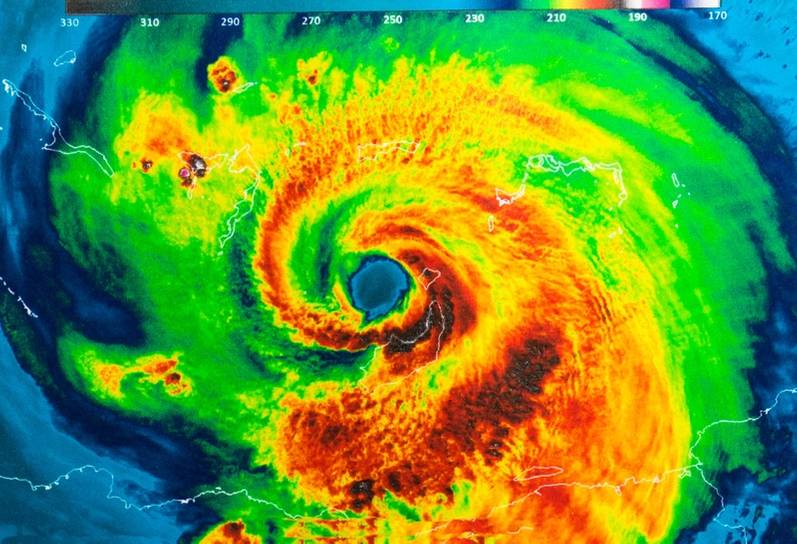

Natural catastrophes

Rounding out the top five risks for marine and shipping companies is natural catastrophes, down from the number two spot last year. Perhaps the drop in rankings for nat cat is no surprise – war in Ukraine, an energy crisis, and the fallout from the Covid-19 pandemic, including inflation and supply chain disruptions, have tested business resources and commanded attention.

There is no room for complacency, however, as we witnessed in 2022 a single event can cause losses in the billions of dollars. Although, the Atlantic hurricane season for 2022 was near average after six years of above-average activity, estimates show insured losses from natural catastrophes continue to be above the 10-year average of $81bn, at $115bn. Hurricane Ian, which struck Florida in September, was the year’s costliest nat cat event, with an estimated insured loss of $50-$65bn, which would rank as the second costliest hurricane of all-time. Rounding out the top five risks for marine and shipping companies is natural catastrophes/ Copyright trongnguyen/AdobeStockDeveloping de-risking actions

Rounding out the top five risks for marine and shipping companies is natural catastrophes/ Copyright trongnguyen/AdobeStockDeveloping de-risking actions

There is little doubt that recent disruptions have increased awareness around BI and supply chain risk and that companies and governments are taking action to build resilience and de-risk. The Allianz Risk Barometer results show that companies have begun to diversify their businesses and supply chains, as well as stepping up risk management. More time and money are being invested into looking into and documenting the supply chain strategies of businesses. Companies that have suffered disruption are now improving transparency and data on supply chain risks.

According to respondents, the most common action taken by companies to de-risk supply chains and make them more resilient is to develop alternative and/or multiple suppliers – although this can be a lengthy process and is not without its own pitfalls – while broadening geographical diversification of supplier networks in response to geopolitical trends is the third most common action. The war in Ukraine has been an eye opener for many, demonstrating how a conflict can result in shortages and price increases for raw materials, raising awareness of the need to be more sophisticated in understanding which components and materials are critical, where they are sourced, as well as how to secure them.

Another positive development is an enhanced focus on business continuity management. Initiating and/ or improving this is the second most common action companies are taking to de-risk, according to the Allianz Risk Barometer. Whether it is planning for the fallout from a cyber-attack or a natural catastrophe, business leaders increasingly see the value in investing more time and money in understanding what business continuity planning can achieve. Companies need to constantly review this across the whole organization, given BI risk is not typically fixed on a particular trigger, location or product but can originate from various areas, crossing sites and continents.

Despite such progress, many companies have yet to improve supply chain transparency or are not able to provide good quality data or willing to engage with the relevant stakeholders to obtain it. This is usually due to a lack of awareness among companies that have not experienced disruption and still see this as a remote possibility. But when disruption happens, it can have catastrophic consequences, which is why insurers must continue to bring knowledge and raise awareness for their marine and shipping clients, given the growing connectivity between many organizations. About the Author: Rich Soja is North American Head of Marine and Global Head of Inland Marine for commercial insurer Allianz Global Corporate & Specialty. Based in New York, Rich has over three decades of marine insurance experience and holds the Chartered Property & Casualty Underwriter (CPCU) designation as well as an Associate in Marine Insurance Management (AMIM) and Associate in Reinsurance (ARe) degrees. He is a Past Chairman of the Inland Marine Underwriters Association and remains a board member. He is also a Past Chairman of the National Cargo Bureau, and currently functions as the chair of the Investment Committee. He is also a member of the American Bureau of Shipping. Rich is actively engaged in the marine insurance industry, including having taught marine insurance classes at St. John’s University, speaking at industry events worldwide, and mentoring industry professionals through the CPCU Mentorship Program.

About the Author: Rich Soja is North American Head of Marine and Global Head of Inland Marine for commercial insurer Allianz Global Corporate & Specialty. Based in New York, Rich has over three decades of marine insurance experience and holds the Chartered Property & Casualty Underwriter (CPCU) designation as well as an Associate in Marine Insurance Management (AMIM) and Associate in Reinsurance (ARe) degrees. He is a Past Chairman of the Inland Marine Underwriters Association and remains a board member. He is also a Past Chairman of the National Cargo Bureau, and currently functions as the chair of the Investment Committee. He is also a member of the American Bureau of Shipping. Rich is actively engaged in the marine insurance industry, including having taught marine insurance classes at St. John’s University, speaking at industry events worldwide, and mentoring industry professionals through the CPCU Mentorship Program.