War Insurers Shrug off Rubymar Sinking in Red Sea, Rates Stable

The cost of war risk insurance through the Red Sea remained stable on Monday despite the sinking of the Rubymar cargo ship as underwriters had already factored in the casualty after it was first hit by a missile last month, industry sources said.

The cost of insuring a seven-day voyage through the Red Sea has risen by hundreds of thousands of dollars since Yemen's Iran-aligned Houthis began attacking shipping in the area in November in a show of solidarity with Palestinians in Gaza.

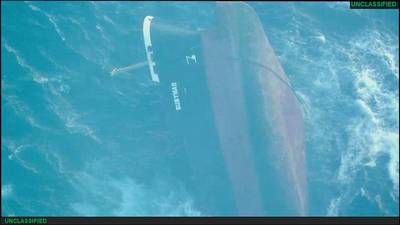

The UK-owned and Belize-flagged Rubymar was abandoned after the Houthis fired a missile at the ship in the southern Red Sea on Feb. 18, leading to a fuel leak and it taking on water.

The U.S. military confirmed on Saturday that the vessel had sunk, the first total loss from the attacks in the Red Sea and Bab al-Mandab Strait. Yemen's internationally recognised government pointed out the risk to marine life due to its cargo of hazardous fertiliser.

Insurance industry sources said the Rubymar, built in 1997, was an ageing vessel with a low value, which was not believed to have been covered through the major London marine insurance market.

"The Rubymar is worth scrap and is not hitting the London market," one source said.

The vessel was valued at $4.82 million, according to analysis from valuation company VesselsValue.

"Rubymar was factored into the existing rates given the small value of the vessel. The waters around the ship were also flagged as a risk area to be avoided before it sank," another industry source said.

Other insurance industry sources said that war risk premiums being quoted for Red Sea voyages had remained around 1% of the value of a ship for some weeks - compared with around 0.5% before the attacks started - with various discounts applied by underwriters.

Ships are commercially required to have protection & indemnity (P&I) insurance, which covers third party liability claims including environmental damage and injury. Separate hull and machinery policies cover physical damage.

The vessel's previous known P&I provider British Marine ceased cover in 2023, industry sources said, and it is not known who took on arrangements after that.

QBE Insurance Group, which owns British Marine, declined to comment.

"The recent sinking of the vessel Rubymar represents an additional risk for the environment and maritime security," Arsenio Dominguez, Secretary-General of the UN’s International Maritime Organization (IMO) agency, said on Monday, adding that the IMO was in contact with other UN organisations and Yemen's government "to provide necessary assistance".

In a fresh incident on Tuesday, the UKMTO agency said it received a report of a vessel damaged 91 nautical miles southeast of Aden as a result of two explosions, although there were no casualties.

(Reuters - Reporting by Jonathan Saul; Editing by Kirsten Donovan)