Capesize Index Turns Negative for the First Time Ever

Capesize index plummets to -133, the first time ever in negative territory – is it all up from here?

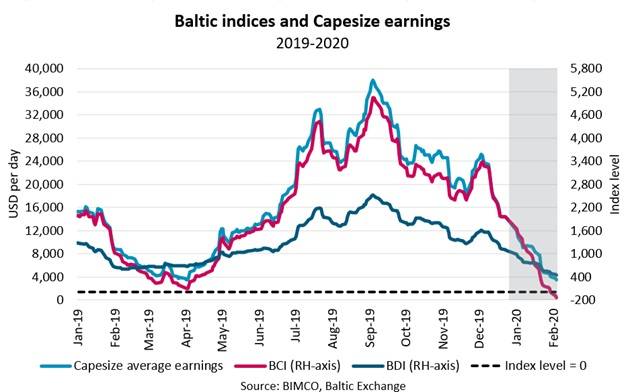

The Baltic Exchange Capesize Index (BCI) dropped to -133 index points on February 4, 2020, turning negative for the first time ever on January 31, 2020. The composite BDI index (BDI), which has excluded the more stable handysize segment since March 2018, also dropped on February 4, 2020 to settle at 453 index points.

The BCI has been on a freefall through the entirety of December, but the descent started to pick up more steam during the past couple of weeks. A streak of negative developments has been at the root of this downturn, including seasonality, the Ineternational Maritime Organization's low sulpher emissions regulations (IMO 2020), Chinese New Year, flooding in Brazil and the outbreak of the coronavirus.

A market brought to its knees by externalities

The first quarter of the year typically marks the downturn in the Capesize markets, partly due to the Chinese New Year. However, with the recent outbreak of coronavirus in China, large parts of the country have extended the holiday and remained closed to contain the spread.

The shutdown of China is set to negatively affect industrial production and protract the slump of the dry bulk market. If the spread continues at the current pace, it could certainly bring more dire consequences to the Chinese, Asian and global economies than just a slowdown of industrial production.

The virus outbreak comes at a time when the dry bulk market is extraordinarily fragile. IMO 2020 has sent fuel oil costs soaring for shipowners. The very-low sulpher fuel oil (VLSFO)-high sulpher fuel oil (HSFO) spread is currently at $233 per metric ton in Singapore on February 4, 2020. Given the current spread, ships operating without exhaust-gas cleaning systems (scrubber) have seen an uptick of roughly 75% in fuel oil costs. But the BCI index is based on non-scrubber fitted ships, which partly skews the index to the negative side.

One could hope that this is only a temporary index dip below zero, yet for as long as China remains closed, the Capesize segment is bound to remain shackled in the doldrums. One could also wonder what useful information a negative index provides?

| Peter Sand is Chief Shipping Analyst at BIMCO. He has worked for Statistics Denmark, compiling public accounts and doing international statistical work in relation to the European Union and United Nations. He then joined D/S NORDEN and during the rise and fall of the dry bulk markets, Peter gained experience in the fields of executive assistance, caretaking of investors and the art of transforming financial data and shipping statistics into analyses, presentations and reports. Later on he worked with CSR with a focus on sustainable shipping. Peter left D/S NORDEN as Senior Analyst and member of the Corporate Social Responsibility Board and joined BIMCO in 2009. He holds an MSc in Economics from the University of Copenhagen. |