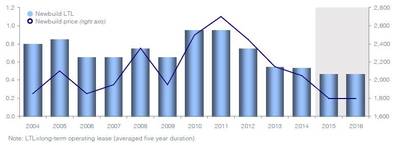

Container equipment rental rates came under renewed pressure in 2014 and by mid-2015 new dry freight pricing was at a 10-year low, while lease rates had fallen to an all-time low, according to the latest edition of the Container Leasing report published by global shipping consultancy Drewry. Similarly, used dry freight container prices have also reached a five-year low, largely in line with the decline in new equipment costs and also because of increased resale volumes.

“The outlook for 2015 is for the annualized average rental price of container equipment to drop further and reach its lowest point in more than a decade, with no improvement predicted for 2016”, noted Andrew Foxcroft, Drewry’s lead analyst for container equipment.

The leased container equipment fleet increased in size by 9 percent during 2014, a faster pace than 2013 and well above the growth trend recorded for transport operators. Shipping lines’ owned fleet increased by less than 4 percent in 2014, which compared with less than 2 percent per annum for 2012-13 combined and thus remains at an historic low.

The lines’ continued weak fleet growth is attributable to their enduring financial weakness, with this improving only slightly during 2014-15 when the impact of lower operational costs brought some much needed fiscal relief. By comparison, the box lease industry has still been able to access competitive funding.

All of the current top 15 container leasing companies have changed ownership, been started-up or undergone some major financial restructuring during the past decade, with one large fleet merger due for completion in 2015. The entire lease industry is also facing up to a tougher market climate in 2015. Cash returns from new equipment lease stayed flat through 2014, and into 2015, and per diem rates have continued to slide in step with the recent decline in new box pricing.