Evaluating the Floating Production Market 2010-2015

Introduction & market overview

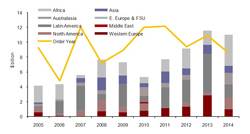

Over the next few years, Douglas-Westwood forecasts a strong increase in FPS expenditure, driven by a surge in installations. Findings from the latest edition of our World Floating Production Market Report indicate that more than 100 Floating Production Systems (FPSs) will be installed worldwide over the next five years. This represents a total global value of approximately $45 billion and around a 20% increase on the previous five years.

It is worth noting upfront that, following the Deepwater Horizon explosion and oil spill, President Obama has announced a ban on drilling in deepwaters (in depths greater 500 feet) by floating semi-submersible drilling rigs and drillships currently operating in the region. This will ultimately lead to a delay in the development of current and future offshore reserves. However, at this time we do not believe that the ban will affect any of the North American FPS projects forecast to come onstream during the 2010-2014 period.

To date, Latin America has seen the greatest number of FPS installations and its forecast market share is equivalent to almost a third of global FPS Capex over the period. The region’s importance is almost entirely due to the wave of deepwater projects in the Santos and Campos Basins off Brazil moving forward development in the next five years. Together, Africa, Asia and Latin America account for almost two-thirds of the units forecast for installation over the next five years. Asia is forecast for 23 installations, but only accounts for 12% of the expenditure as a number of the planned installations are redeployments which only require minimal Capex for upgrades. The relatively benign environments and shallow waters in which most of the FPS prospects in the region are located also allow cheaper FPS solutions to be adopted. In the Western Europe region, despite the fact that many of the producing areas are now considered mature and significant new finds are becoming less frequent, there are still considerable development opportunities – with 18 planned installations.

Global FPS fleet

In terms of vessel type, FPSOs dominate the global floating production scene. As of year-end 2009, there had been more than 220 FPSO deployments worldwide – almost double all the other floating production systems (semi-submersible FPSs, TLPs and Spars) put together. There are currently more than 150 FPSOs in operation. Africa and Asia have the largest fleets, followed by Latin America. It’s not surprising, therefore, that FPSOs represent by far the largest segment of the market, accounting for close to four-fifths of the total FPS forecast Capex. TLPs and semi-submersible FPSs form the next-largest segments around 10% of the market each (with Spars make up the remainder).

FPSSs have a long history and have proved particularly popular off Brazil where the national operator, Petrobras, has embraced FPS technology as a means of developing the country’s extensive deepwater reserves. There have been more than 80 FPSS installations worldwide; many of these were short-term deployments for early production or well testing purposes.

TLPs, and more recently Spars, have proved the production system of choice in the US Gulf of Mexico. More than half the TLP installations to date and all but one of the spars have been associated with deepwater developments in the US Gulf. Recent years have seen the introduction of smaller, less expensive designs to enable the exploitation of marginal fields. However, the progression into ultra-deep waters in this region is now working in favour of FPSO solutions (with operators such as Petrobras bringing extensive FPSO experience) and against TLP designs, which are less feasible in ultra-deep waters.

Market Drivers

Growing emphasis on ‘fast-track’ and/or phased developments.

The fast-track approach is designed to ensure a swift start to a project’s revenue stream, but the scope of these projects and consequently the work load associated with them tends to be greater than for more traditional Early Production Schemes (EPSs). In contrast to EPSs early production schemes, which are usually hosted by redeployed floaters that have undergone minor upgrades to adapt them for the project in question, fast-track projects typically feature a vessel conversion with a relatively large topsides capacity allowing a more extensive field development than envisaged under the EPS approach. Once the fast-track project is up and running, production capacity can be augmented in subsequent phases by expanding the topsides equipment on the original vessel, or by deploying a larger replacement vessel and/or additional FPSs in support.

Subsea Production Technologies

It can be said without exaggeration that the emergence of subsea production technology has revolutionised the oil and gas industry’s offshore activities. The subsea sector has developed at a remarkable pace in recent years enabling the economic development not just of fields on the continental shelf but also in the deeper waters further offshore. The growing adoption of subsea production technology runs very much in parallel with the expansion of the global FPS fleet and the growth in deepwater production and the trends are in many ways mutually reinforcing.

The move into Deepwater

For obvious practical reasons, the hydrocarbon potential of deep waters has historically received relatively little attention compared to that in continental shelf areas. However, as shallow-water opportunities become increasingly scarce, the development of deepwater reserves will accelerate rapidly. For fields in deepwater, floating production systems are the development method of choice since the use of fixed platforms will tend not to be feasible on technical and/or economic grounds. The costs of the jacket structure that supports the deck of a fixed platform are strongly correlated with water depth, so as water depths increase, greater production rates are required to ensure economic viability. Once the WD 400m mark is passed, conventional fixed platforms become technically impractical and unstable. Although a compliant tower platform – with a jacket designed to sway slightly under wave action – may be used, fabrication costs remain high and installation becomes increasingly complex.

Exploitation of marginal fields

Floating production systems have long been used to develop marginal fields. FPSO vessels and semi-submersible FPS platforms are the candidates of choice for marginal projects. An example of a marginal project made viable through the use of an FPS is Statoil’s Glitne project in the Norwegian sector of the North Sea. The field, in WD 109m, was thought to have reserves of just 32 mmbbl oil and 10 Bcf gas. A leased FPSO – the Petrojarl I – was selected for the project. Developed via four subsea production wells and one injector, Glitne is the smallest field on the Norwegian shelf ever brought into production on a stand-alone basis.

Innovations

Given the high financial stakes involved in FPS-led projects, there is a natural tendency for operators to play it safe and stick with proven FPS designs rather than investing in a promising but untried concept. Unfortunately – from the point of view of the concept originators, at least – this tendency may actually be reinforced in these key areas of deepwater and marginal projects where, because of their relatively high risks and/or limited rewards, there is even less room for error. Hence, it is usually the smaller, independent operators (who are by default risk-taking entrepreneurs) that select an innovative design rather than the larger multi-national operators.

To date, the majority of FPS developments worldwide have been either semi-submersible FPSs, based on converted semi-submersible drilling rigs, or oil tankers converted into FPSOs. In technical terms this is more evolutionary than innovative, and evolution generally carries less business risk than innovation. It is only relatively recently that other more innovative concepts – notably TLPs and spars – have become more common. Once a new design gets accepted and successfully deployed, uptake of the idea can be fairly swift – as evidenced by the wave of spar projects currently moving forward in the GoM. The danger for concept originators is that the acceptance and deployment of a rival FPS solution may result in the exclusion of other concepts targeting the same niche market (e.g. marginal fields off West Africa) on account of operators’ understandable preference for field-proven technology.

More detailed analysis of the global Floating Production market is available in Douglas-Westwood’s, ‘World Floating Production Market Report 2010-2014’

The Authors

Established in 1990, Douglas-Westwood is an independent employee-owned company and the leading provider of business research & analysis, strategy and commercial due diligence on the global energy services sectors. We have offices in Canterbury England, Aberdeen Scotland and New York USA and to date has completed more than 600 projects and provided products & services to 400 clients in 70 countries. Further information is available at www.dw-1.com. The authors can be contacted via [email protected] or +44 (0) 1227 780999.

Lucy Miller

Lucy is an analyst with Douglas-Westwood and has conducted market analysis on a variety of the company’s commissioned research projects for clients in the oil and gas sector, as part of commercial due-diligence and published market studies. She has contributed to studies including ‘The World LNG Market Report’ and ‘The World FLNG Market Report’. Recently she has carried out studies of offshore and onshore LNG markets as a part of a major commissioned research project. Lucy has a background in the offshore oil and gas sector and previous worked for FoundOcean Ltd. She has a degree in Economics and Geography from the University of Leicester.

As published in the August 2010 edition of Maritime Reporter & Engineering News - www.MarineLink.com